1. For more details on risk factors, terms and conditions, please read the sales brochure before concluding a sale. T rade Logo displayed above belongs to HDFC Ltd. and ERGO International AG and used by HDFC ERGO General Insurance Company under license. CIN :U66030MH2007PLC1771 17. IRDAI Reg No. 146. Printing Code: CM/BR/0061/Sept18. UIN: IRDAN125P0005V01200203. UID No. 539 Keeping your business on the move COMMERCIAL VEHICLE Take it easy! HDFC ERGO General Insurance Company Limited st Registered & Corporate Of fice: 1 Floor , HDFC House, 165-166 Backbay Reclamation, H. T . Parekh Marg, Churchgate, Mumbai - 400 020. Customer Service Address: D-301, 3rd Floor , Eastern Business District (Magnet Mall), LBS Marg, Bhandup (W est), Mumbai - 400 078. Fax: 91-22-6638 3699 T oll-free: 1800 2700 700 (Accessible from India only) care@hdfcergo.com www .hdfcergo.com Take it easy!

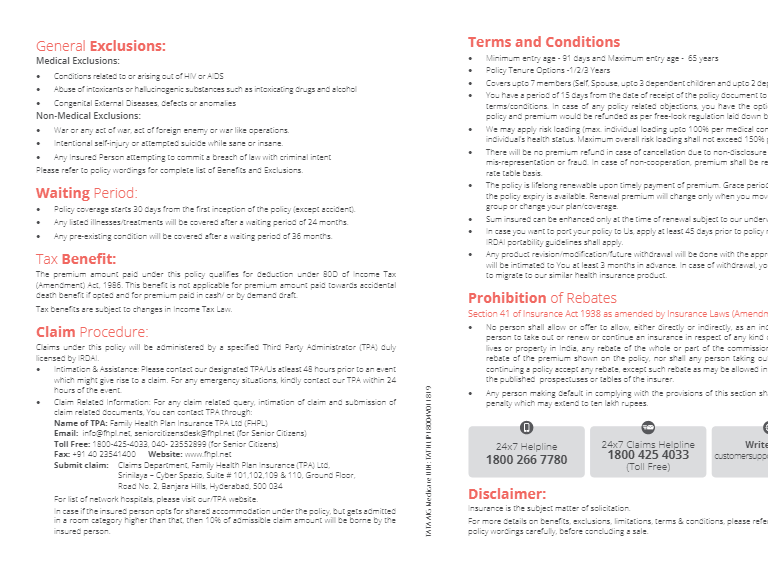

2. In this dynamic age, our business needs to be on the move- AL W A YS! And this should be irrespective of the eventualities that occur in its day to day functioning. At HDFC ERGO it is our endeavour to assure you just that. Our commercial vehicles insurance brings to you specialised tailor-made features to suit your business requirements. With us you can be rest assured of an end-to-end automated process which ensures fast track claim settlement of your claim with minimal documentation. With us, your vehicle’ s insurance is in safe hands. WHA T IS COVERED ¡ Own damage to the vehicle caused by: ¡ Accidental external means ¡ Burglary , housebreaking or theft ¡ Fire, explosion, self ignition, lightning ¡ T errorism, riots, strike or malicious act ¡ T ransit by road, rail, inland waterway , lift ¡ Earthquake, flood, storm, landslide, rockslide ¡ Legal liability for injury and / or damage to third party arising out of the use of the vehicle. ¡ In addition, your policy also includes: ¡ Reimbursement of towing charges upto ` 750, ` 1500 and ` 2,500 varies depending on the vehicle type KEY SER VICE FEA TURES Simple Documentation for hassle free claims settlement ¡ Duly filled and signed claim form ¡ Driving license ¡ Registration book copy ¡ Copy of insurance certificate ¡ Load challan ¡ Route permit ¡ Fitness certificate ¡ FIR ¡ T ax paid receipt P A YMENT ADV ANCES No need to raise money in a hurry to pay for your repairs. Advances upto 80% of insurer liability . Spot Survey : T o be carried within 6 hours, waived after 6 hours. A vail cashless claims at all our associated garages / workshops. T oll-free helpline no. 1800-2-700-700 for any queries/claims assistance (Accessible from India only). WHA T IS NOT COVERED ¡ General ageing, wear and tear ¡ Mechanical or electrical breakdown, failure ¡ Loss / damage attributable to war , mutiny , nuclear risks ¡ Loss / damage outside India ¡ Partial theft KEY HIGHLIGHTS: ¡ Comprehensive policy - provides a host of covers in a single policy ¡ Get your no claim bonus transferred in case you switch from your existing insurer to HDFC ERGO ¡ A team of dedicated relationship managers at all locations to manage our strategic partnership ¡ T oll free helpline No. - For any product or claims queries ¡ Use of state of the art technology for claims and policy processing ¡ Cashless claims service at associated garages / workshops ¡ For non-cashless claims service, reimbursement within 7 working days on full and final receipt of claim documents ¡ Standardized quality service across the country PROHIBITION OF REBA TES - Section 41 of the Insurance Act, 1938 as amended by Insurance Laws (Amendment) Act, 2015: 1. No person shall allow or of fer to allow , either directly or indirectly , as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy , nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer: provided that acceptance by an insurance agent of commission in connection with a policy of life insurance taken out by himself on his own life shall not be deemed to be acceptance of a rebate of premium within the meaning of this sub-section if at the time of such acceptance the insurance agent satisfies the prescribed conditions establishing that he is a bona fide insurance agent employed by the insurer . 2. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ` 10 Lakhs.