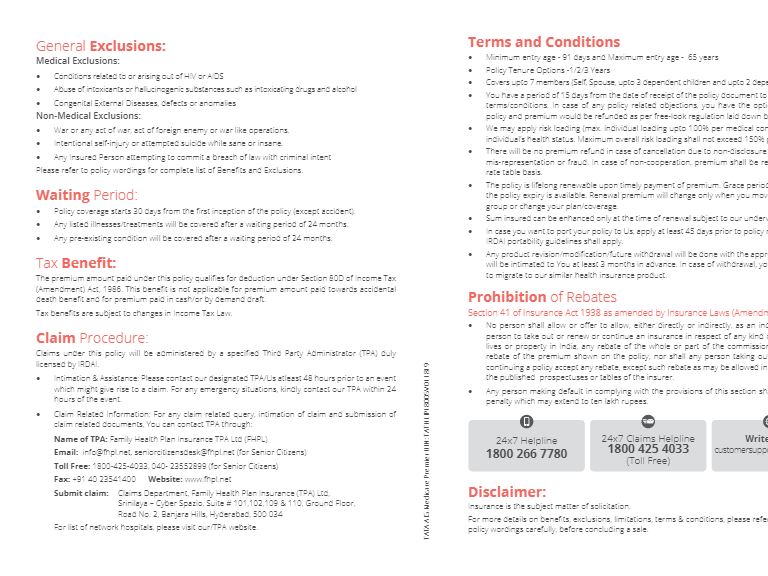

1. Tata AIG General Insurance Company Limited Regd Office: 15th Floor, Tower A, Peninsula Business Park,, G.K. Marg, Lower Parel, Mumbai – 400013 24X7 Toll Free No: 1800 266 7780 or 1800 229966 (For Senior Citizens) | Fax: 022 6693 8170 . | Email: customersupport@tataaig.com Website: www.tataaig.com IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425 | UIN: TATHLIP18004V011819 TAGIC/B/TGMC/Jun 18/141 Ver1 / All | 1339 DON'T Compromise! Call us 24x7 on: 1800 266 7780 Uncompromising Care inside... General Exclusions: Medical Exclusions: Condition s related to or arising out of HIV or AIDS Abuse of intoxicants or hallucinogenic substances such as intox icating drugs and alcohol Congenital External Diseases, defects or anomalies Non-Medical Exclusions: War or any act of war, act of foreign enemy or war like operations. Intentional self-injury or attempted suicide while sane or insane. Any Insured Person attempting to commit a breach of law with criminal intent Please refer to policy wordings for c omplete list of Benefits and Exclusions. Waiting Period: Policy coverage starts 30 days from the first inception of the policy (except accident). Any listed illnesses/treatments will be covered after a waiting period of 24 months. Any pre-existing condition will be covered af ter a waiting period of 36 months. Tax Benefit: The premium amount paid under this policy qualifies for deduction under 80D of Income Tax (Amendment) Act, 1986. This benefit is not applicable for premium amount paid towards accidental death benefit if opted and for premium paid in cash/ or by demand draft. Tax benefits are subject to changes in Income Tax Law. Claim Procedure: Claims under this policy will be administered by a specified Third Party Administrator (TPA) duly licensed by IRDAI. Intimation & Assistance: Please contact our designated TPA/Us atleast 48 hours prior to an event which might give rise to a claim. For any emergency situations, kindly contact our TPA within 24 hours of the event. Claim Related Information: For any claim related query, intimation of claim and submission of claim related documents, You can contact TPA through: Name of TPA: Family Health Plan Insurance TPA Ltd (FHPL) Email: info@fhpl.net, seniorcitizensdesk@fhpl.net (for Senior Citizens) Toll Free: 1800-425-4033, 040- 23552899 (for Senior Citizens) Fax: +91 40 23541400 Website: www.fhpl.net Submit claim: Claims Department, Family Health Plan Insurance (TPA) Ltd, Srinilaya – Cyber Spazio, Suite # 101,102,109 & 110, Ground Floor, Road No. 2, Banjara Hills, Hyderabad, 500 034 For list of network hospitals, please visit our/TPA website. In case if the insured person opts for shared accommodation under the policy, but gets admitted in a room category higher than that, then 10% of admissible claim amount will be borne by the insured person. Terms and Conditions Minimum entry age - 91 days and Maximum entry age - 65 years Policy Tenure Options -1/2/3 Years Covers upto 7 members (Self, Spouse, upto 3 dependent children and upto 2 dependent parents) You have a period of 15 days from the date of receipt of the policy document to review the policy terms/conditions. In case of any policy related objections, you have the option to cancel the policy and premium would be refunded as per free-look regulation laid down by IRDAI. We may apply risk loading (max. individual loading upto 100% per medical condition) based on individual’s health status. Maximum overall risk loading shall not exceed 150% per individual. There will be no premium refund in case of cancellation due to non-disclosure of material facts, mis-representation or fraud. In case of non-cooperation, premium shall be refunded on short rate table basis. The policy is lifelong renewable upon timely payment of premium. Grace period of 30 days from the policy expiry is available. Renewal premium will change only when you move into higher age group or change your plan/coverage. Sum insured can be enhanced only at the time of renewal subject to our underwriting guidelines In case you want to port your policy to Us, apply at least 45 days prior to policy renewal date and IRDAI portability guidelines shall apply. Any product revision/modification/future withdrawal will be done with the approval of IRDAI and will be intimated to You at least 3 months in advance. In case of withdrawal, you have an option to migrate to our similar health insurance product. Prohibition of Rebates Section 41 of Insurance Act 1938 as amended by Insurance Laws (Amendment) Act, 2015 No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees. Disclaimer: Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms & conditions, please refer sales brochure/ policy wordings carefully, before concluding a sale. 24x7 Helpline 1800 266 7780 24x7 Claims Helpline 1800 425 4033 (Toll Free) Write to us customersupport@tataaig.com TATA AIG Medicare UIN: TATHLIP18004V011819 H IGHEST claims paying ability i AAA by ICRA

2. Restore Benefits It automatically restores your sum insured to 100% for you and your family members. Global Cover Covers Medical Expenses related to Inpatient & Day Care Hospitalization of the Insured Person incurred outside India, provided that the diagnosis was made in India. Bariatric Surgery Covers expenses incurred for Bariatric Surgery for treatment of Obesity and weight control. Cumulative bonus 50% increase in cumulative bonus for every claim free year, upto a maximum of 100%. In the case a claim is made during the policy year, the cumulative bonus would reduce by 50% in the following year. Global Cover Bariatric Surgery Key features In-Patient Treatment Consumables Benefit Restore Benefit Vaccination Cover Compassionate Travel Optional Accidental Death Rider Others Features Covers expenses for hospitalization due to disease/illness/Injury during the policy period that requires an Insured Person’s admission in a hospital as an inpatient. Medical expenses directly related to the hospitalization would be payable Covers expenses incurred, for consumables, which are consumed during the period of hospitalization directly related to the insured person’s medical or surgical treatment of illness/disease/injur y. Covers expenses related to Human Papilloma Virus (HPV) vaccine & Hepatitis B Vaccine after 2 years of continuous coverage and Anti- rabies vaccine & Typhoid vaccination without any waiting period . Covers expenses upto Rs. 20,000 related to a round trip economy class air ticket, or first-class railway ticket, to allow the Immediate Family Member to be at insured person's bedside during his stay in the hospital. Covers 100% of sum insured in the event of death of insured person due to accident. This benefit is not applicable for dependent children covered in the policy. 100% of PPC charges would be borne by TATA AIG General Insurance Company Ltd. upon acceptance of the proposal. Premium Chart: Premium Chart for Accidental Death Benefit Rider: Age/Sum Insured 3 Lakh 4 Lakh 5 Lakh 7.5 Lakh 10 Lakh 15 Lakh 20 Lakh 0-18 yrs 3,953 4,577 5,253 5,778 6,180 7,146 7,579 19-35 yrs 4,785 5,608 6,724 7,490 8,322 9,719 10,410 36-45 yrs 5,754 6,832 7,931 8,871 9,891 11,324 11,887 46-50 yrs 8,260 10,296 11,963 13,596 15,347 17,219 19,009 51-55 yrs 10,403 13,324 16,251 18,202 19,570 22,629 24,240 56-60 yrs 14,582 17,913 19,986 22,171 23,453 26,851 28,187 61-65 yrs 18,911 20,188 24,720 30,467 35,720 40,895 43,368 66-70 yrs* 25,750 28,768 36,771 43,075 49,440 57,168 61,844 71+ yrs* 30,282 35,720 46,226 54,096 62,418 70,745 76,547 Age/Sum Insured 3 Lakh 4 Lakh 5 Lakh 7.5 Lakh 10 Lakh 15 Lakh 20 Lakh All Ages 167 223 279 418 558 836 1,115 When thinking of health, DON'T Compromise! Being the risk experts, we know there can be no compromise in the matters of health and making sure that starts with a robust insurance plan. Choosing the right mix of features and coverage levels is essential to get everything you would need in an ideal health insurance plan. Tata AIG Medicare is a simplified and comprehensive Health Insurance plan . The product is designed keeping in mind the important role that your health insurance plays considering the cost of medical emergencies. Tata AIG General Insurance has been accredited with iAAA rating by ICRA for highest claims playing ability. With a legacy built on trust be rest assured that we will not compromise on your health insurance and neither should you. Think Ahead! Pre-Policy Check-up (PPC) Premium mentioned is per person in INR (Exclusive of GST) Premium mentioned is per person in INR (Exclusive of GST) *Applicable for renewals only Note : Self is mandatory for Accidental Death Benefit Rider * Not applicable on Accidental Death Premium Premium Calculations: The premium will be charged on the completed age of the Insured Person. The premium for the policy will remain the same for the policy period as mentioned in the policy schedule. For family floater, premium is calculated by adding the premium of respective individual members and applying family floater discount.* 10% discount on premium in case insured opts for shared room category.* Calculate Your Premium You Spouse upto 3 Children upto 2 Dependent Parents T OTAL Individual Premiums Family Floater Discount Long Term Discount Family Floater Discount Long Term Discount Total Premium 20% 28% 32% for 2 members for 3 members for more than 3 5% 10% for 2yrs tenure for 3yrs tenure T OTAL Apply discount T OTAL Apply discount Day Care Procedures Covers expenses for 540+ Day Care Treatment due to disease/ illness/Injury during the policy period taken at a hospital or a Day Care Centre. TATA AIG Medicare UIN: TATHLIP18004V011819 TATA AIG Medicare UIN: TATHLIP18004V011819 TATA AIG Medicare UIN: TATHLIP18004V011819 Pre-Hospitalization expenses Domiciliary Treatment Second Opinion Ambulance Cover Hearing Aid Daily Cash for accompanying an insured child. Post-Hospitalization expenses Organ Donor In-patient Dental Treatment AYUSH Benefit Health Checkup Daily Cash for choosing shared accomodation Age/ Sum Insured 3,4,5 Lacs 7.5 & 10 Lacs >10 Lacs 0-45 Nil Nil Tele-MER 46-50 Tele-MER Tele-MER MER, RUA, FBS, CBC, Lipids, ECG 51-55 MER, RUA, FBS, ECG, CBC, TC MER, RUA, FBS, CBC, Lipids, ECG MER, RUA, FBS, CBC, Lipids, ECG 56-60 MER, RUA, FBS, CBC, Lipids, ECG MER, RUA, FBS, CBC, Lipids, SGOT, TMT, HbA1c, Sr Creat, USG abd MER, RUA, FBS, CBC, Lipids, SGOT, TMT, HbA1c, Sr Creat, USG abd 61-65 MER, RUA, FBS, CBC, Lipids, TMT, LFT, RFT, USG Abd , HbA1C MER, RUA, FBS, CBC, Lipids, TMT, LFT, RFT, USG Abd , HbA1C MER, RUA, FBS, CBC, Lipids, TMT, LFT, RFT, USG Abd , HbA1C The above mentioned benefits are subject to terms and conditions apply. Premium calculated are Exclusive of GST