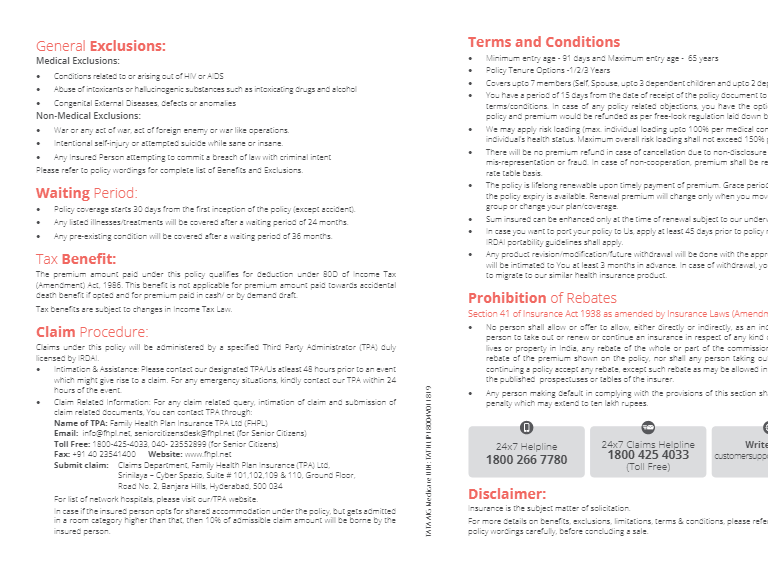

1. DON'T Compromise! Call us 24x7 on: 1800 266 7780 Health Insurance for the Uncompromising Customer Hig H es T claims paying ability i AAA Tata A ig g eneral i nsurance Company Limited Regd Office: 15th Floor, Tower A, Peninsula Business Park,, G.K. Marg, Lower Parel, Mumbai – 400013 24X7 Toll Free No: 1800 266 7780 or 1800 229966 (For Senior Citizens) | Fax: 022 6693 8170 . | Email: customersupport@tataaig.com Website: www.tataaig.com IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425 | UIN: TATHLIP18005V011819 TAGIC/B/TGMCPRE/Jun 18/143 Ver1 / All | 1341 General e xclusions: Medical Exclusions: Condition s related to or arising out of HIV or AIDS Abuse of intoxicants or hallucinogenic substances such as intox icating drugs and alcohol Congenital External Diseases, defects or anomalies Non-Medical Exclusions: War or any act of war, act of foreign enemy or war like operations. Intentional self-injury or attempted suicide while sane or insane. Any Insured Person attempting to commit a breach of law with criminal intent Please refer to policy wordings for c omplete list of Benefits and Exclusions. Waiting Period: Policy coverage starts 30 days from the first inception of the policy (except accident). Any listed illnesses/treatments will be covered after a waiting period of 24 months. Any pre-existing condition will be covered af ter a waiting period of 24 months. Tax Benefit: The premium amount paid under this policy qualifies for deduction under Section 80D of Income Tax (Amendment) Act, 1986. This benefit is not applicable for premium amount paid towards accidental death benefit and for premium paid in cash/or by demand draft. Tax benefits are subject to changes in Income Tax Law. Claim Procedure: Claims under this policy will be administered by a specified Third Party Administrator (TPA) duly licensed by IRDAI. Intimation & Assistance: Please contact our designated TPA/Us atleast 48 hours prior to an event which might give rise to a claim. For any emergency situations, kindly contact our TPA within 24 hours of the event. Claim Related Information: For any claim related query, intimation of claim and submission of claim related documents, You can contact TPA through: Name of TPA: Family Health Plan Insurance TPA Ltd (FHPL) e mail: info@fhpl.net, seniorcitizensdesk@fhpl.net (for Senior Citizens) Toll Free: 1800-425-4033, 040- 23552899 (for Senior Citizens) Fax: +91 40 23541400 Website: www.fhpl.net s ubmit claim: Claims Department, Family Health Plan Insurance (TPA) Ltd, Srinilaya – Cyber Spazio, Suite # 101,102,109 & 110, Ground Floor, Road No. 2, Banjara Hills, Hyderabad, 500 034 For list of network hospitals, please visit our/TPA website. Terms and Conditions Minimum entry age - 91 days and Maximum entry age - 65 years Policy Tenure Options -1/2/3 Years Covers upto 7 members (Self, Spouse, upto 3 dependent children and upto 2 dependent parents). You have a period of 15 days from the date of receipt of the policy document to review the policy terms/conditions. In case of any policy related objections, you have the option to cancel the policy and premium would be refunded as per free-look regulation laid down by IRDAI. We may apply risk loading (max. individual loading upto 100% per medical condition) based on individual’s health status. Maximum overall risk loading shall not exceed 150% per individual. There will be no premium refund in case of cancellation due to non-disclosure of material facts, mis-representation or fraud. In case of non-cooperation, premium shall be refunded on short rate table basis. The policy is lifelong renewable upon timely payment of premium. Grace period of 30 days from the policy expiry is available. Renewal premium will change only when you move into higher age group or change your plan/coverage. Sum insured can be enhanced only at the time of renewal subject to our underwriting guidelines In case you want to port your policy to Us, apply at least 45 days prior to policy renewal date and IRDAI portability guidelines shall apply. Any product revision/modification/future withdrawal will be done with the approval of IRDAI and will be intimated to You at least 3 months in advance. In case of withdrawal, you have an option to migrate to our similar health insurance product. Prohibition of Rebates Section 41 of Insurance Act 1938 as amended by Insurance Laws (Amendment) Act, 2015 No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees. Disclaimer: Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms & conditions, please refer sales brochure/ policy wordings carefully, before concluding a sale. 24x7 Helpline 1800 266 7780 24x7 Claims Helpline 1800 425 4033 (Toll Free) Write to us customersupport@tataaig.com TATA AIG Medicare Premier UIN: TATHLIP18005V011819 by ICRA

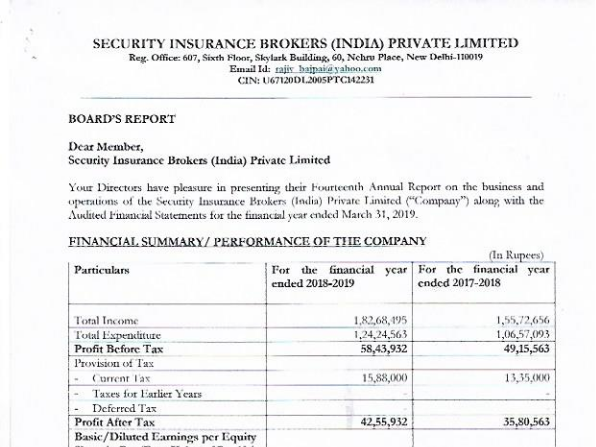

2. G l o b a l C o v e r Global Cover Covers Medical Expenses related to Inpatient & Day Care Hospitalization of the Insured Person incurred outside India, provided that the diagnosis was made in India. Bariatric Surgery Covers expenses incurred for Bariatric Surgery for treatment of Obesity and weight control. Emergency Air Ambulance Covers expense for ambulance transportation by airplane or helicopter for emergency life threatening health conditions, which require immediate ambulance transportation to the hospital/medical centre. Consumables benefit Covers expenses incurred, for consumables which are consumed during the period of hospitalization directly related to the insured person's medical or surgical treatment of illness/disease/injury. Restore Benefits It automatically restores your sum insured to 100% for you and your family members. Day Care Procedures Covers expenses for 540+ Day Care Treatment due to disease/illness/injury during the policy period taken at a hospital or a Day Care Centre. Emergency Air Ambulance Bariatric Surgery Key features In-Patient Treatment High End Diagnostics Accidental Death Benefit Maternity Cover First year Vaccinations Organ Donor Vaccination Cover Compassionate Travel OPD Dental Treatment Others Features Covers expenses for hospitalization due to disease/illness/Injury during the policy period that requires an Insured Person’s admission in a hospital as an inpatient. Medical expenses directly related to the hospitalization would be payable Covers the insured person for the listed diagnostic tests on OPD basis if required as part of a treatment subject to Rs. 25,000 per policy year annually. Covers 100% of sum insured in the event of death of insured person due to accident. This benefit is not applicable for dependent children covered in the policy. Covers maternity expenses – upto a maximum of Rs. 50,000/- (in case of birth of girl child cover would be for Rs. 60,000) per policy. No limit on number of delivery events. Covers vaccination expenses for up to one year after the birth of the child subject to a limit of Rs.10,000/- (in case of girl child cover would be for Rs. 15,000) provided the child is covered with us. Covers Medical and surgical Expenses of the organ donor for harvesting the organ where an Insured Person is the recipient Covers expenses related to Human Papilloma Virus (HPV) vaccine & Hepatitis B Vaccine after 2 years of continuous coverage and Anti-rabies vaccine & Typhoid vaccination without any waiting p eriod. Covers expenses upto Rs. 20,000 related to a round trip economy class air ticket, or first-class railway ticket, to allow the Immediate Family Member to be at insured person's bedside during his stay in the hospital. Covers expenses upto Rs. 10,000 related to root canal, filling, tooth extractions over and above sum insured. Does not impact cumulat ive bonus. Pre-Hospitalization expenses Daily Cash for choosing Shared Accommodation Se cond Opinion OPD Treatment Ambulance Cover Health Checkup Hearing Aid The above mentioned benefits are subject to terms and conditions apply. 100% of PPC charges would be borne by TATA AIG General Insuranc e Company Ltd. upon acceptance of the proposal. Age/ s um i nsured 5 Lacs 10 Lacs >10 Lacs 0-45 Nil Nil Tele-MER 46-50 Tele-MER Tele-MER MER, RUA, FBS, CBC, Lipids, ECG 51-55 MER, RUA, FBS, ECG, CBC, TC MER, RUA, FBS, CBC, Lipids, ECG MER, RUA, FBS, CBC, Lipids, ECG 56-60 MER, RUA, FBS, CBC, Lipids, ECG MER, RUA, FBS, CBC, Lipids, SGOT, TMT, HbA1c, Sr Creat, USG abd MER, RUA, FBS, CBC, Lipids, SGOT, TMT, HbA1c, Sr Creat, USG abd 61-65 MER, RUA, FBS, CBC, Lipids, TMT, LFT, RFT, USG Abd , HbA1C MER, RUA, FBS, CBC, Lipids, TMT, LFT, RFT, USG Abd , HbA1C MER, RUA, FBS, CBC, Lipids, TMT, LFT, RFT, USG Abd , HbA1C Premium Chart: Calculate Your Premium Age/Sum Insured 5 Lakhs 10 Lakhs 15 Lakhs 20 Lakhs 25 Lakhs 50 Lakhs 0-18 yrs 6,535 7,668 8,528 9,139 9,613 11,646 19-35 yrs 8,362 10,319 11,475 12,297 12,936 15,223 36-45 yrs 9,868 12,266 13,638 14,614 15,373 17,735 46-50 yrs 14,893 19,042 21,169 22,683 23,860 27,517 51-55 yrs 20,247 24,307 27,016 28,944 30,445 35,106 56-60 yrs 24,901 29,150 32,399 34,711 36,510 42,094 61-65 yrs 30,804 44,415 49,369 52,892 55,632 64,134 66-70 yrs* 45,829 61,509 68,372 73,250 77,043 88,808 71+ yrs* 57,636 77,686 86,353 92,513 97,301 112,155 Premium Calculations: The premium will be charged on the completed age of the Insured Person. The premium for the policy will remain the same for the policy period as mentioned in the policy schedule. For family floater, premium is calculated by adding the premium of respective individual members and applying family floater discount. You Spouse upto 3 Children upto 2 Dependent Parents T OTAL Individual Premiums Family Floater Discount Long Term Discount Family Floater Discount Long Term Discount Total Premium 20% 28% 32% for 2 members for 3 members for more than 3 5% 10% for 2yrs tenure for 3yrs tenure When thinking of health, DON'T Compromise! Being the risk experts, we know there can be no compromise in the matters of health and making sure that starts with a robust insurance plan. Choosing the right mix of features and coverage levels is essential to get everything you would need in an ideal health insurance plan. Tata AIG Medicare Premier is a simplified and comprehensive Health Insurance plan. The product is designed keeping in mind the important role that your health insurance plays considering the cost of medical emergencies. Tata AIG General Insurance has been accredited with iAAA rating by ICRA for highest claims playing ability. With a legacy built on trust be rest assured that we will not compromise on your health insurance and neither should you. Think Ahead! Pre-Policy Check-up (PPC) T OTAL Apply discount T OTAL Apply discount TATA AIG Medicare Premier UIN: TATHLIP18005V011819 TATA AIG Medicare Premier UIN: TATHLIP18005V011819 TATA AIG Medicare Premier UIN: TATHLIP18005V011819 Post-Hospitalization expenses Daily Cash for Accompanying an Insured Child Domiciliary Treatment New Born Baby Cover Prolonged Hospitalization Benefit AYUSH Benefit In-patient Treatment-Dental Cumulative Bonus Premium calculated are Exclusive of GST Premium mentioned is per person in INR (Exclusive of GST) *Applicable for renewals only