1.

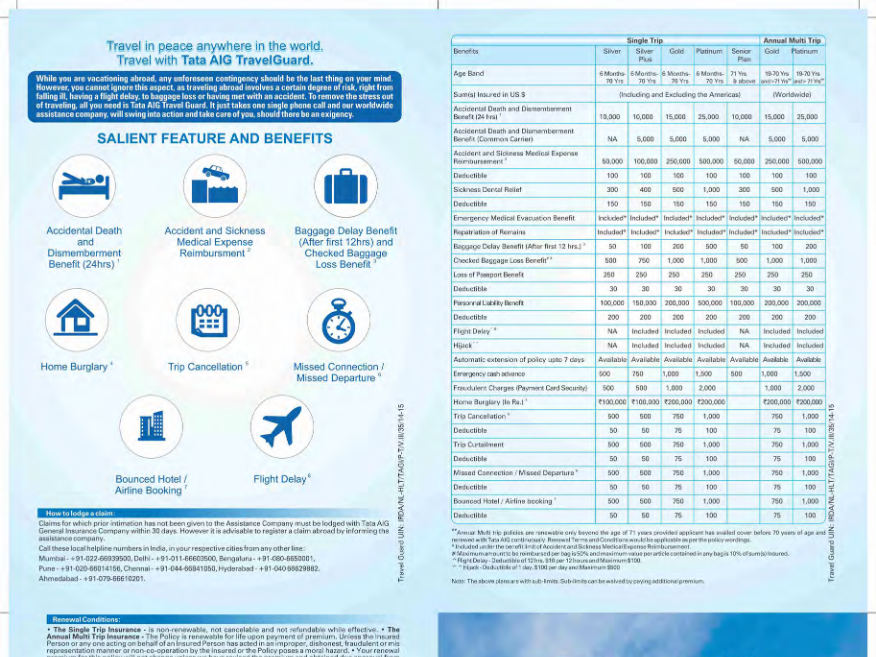

2. Renewal Condition: (i) The Single Trip Insurance – The Single Trip Insurance is non-renewable, not cancelable and not refundable while effective. Cancellation of the Policy may be done only prior to the Effective Date stated in the Policy Schedule and will be subject to deduction of cancellation charge of Rs 350/- by Us. (ii) Annual Trip Insurance - The Annual Trip Insurance may be renewed with Our consent by the payment in advance of the total premium specified by Us, which premium shall be at Our premium rate in force at the time of renewal. • Cancellation of the Policy may be done prior to the Effective Date stated in the Policy Schedule and will be subject to deduction of cancellation charge of Rs 350/- by Us • The policy shall be ordinarily renewable upon payment of premium unless the Insured Person or any one acting on behalf of an Insured Person has acted in an improper, dishonest or fraudulent manner or due to non cooperation by the Insured or any misrepresentation under or in relation to this policy or poses a moral hazard. • Grace period in payment up to 30 days from the premium due date is allowed where you can still pay your premium and continue your policy. Coverage would not be available for the period for which no premium has been received. • We may extend the renewal automatically if opted by You in the Proposal Form and provided You are eligible for renewal as per age criteria as per Policy terms and paid the premium. • You may enhance the sum insured only at the time of renewal of the policy. However the quantum of increase shall be subject to underwriting guidelines of the company. • We will not apply any additional loading on your policy premium at renewal based on claim experience. • Your renewal premium for this policy will not change unless we have revised the premium and obtained due approval from Authority. Your premium will also change if you move into a higher age group, or change the plan. • This policy will be renewed till the Insured attains a completed age of 35 years thereafter it will not be renewed • In the likelihood of this policy being withdrawn in future, we will intimate you about the same 3 months prior to expiry of the policy. You will have the option to migrate to any Travel insurance policy available with us. • Any revision / modification in the product will be done with the approval of the Insurance Regulatory and Development Authority of India and will be intimated to You atleast 3 months in advance. Free Look Period: (i) Single Trip Insurance – Free look period is not applicable. (ii) Annual Trip Insurance - You have a period of 15 days from the date of receipt of the Policy document to review the terms and conditions of this Policy provided no trip has been commenced. If You have any objections to any of the terms and conditions, You have the option of cancelling the Policy stating the reasons for cancellation and You will be refunded the premium paid by You after adjusting the amounts spent on stamp duty charges and proportionate risk premium. You can cancel Your Policy only if You have not made any claims under the Policy. All Your rights under this Policy will immediately stand extinguished on the free look cancellation of the Policy. Free look provision is not applicable and available at the time of renewal of the Policy. Cancer screening & mammography examinations � Sickness Dental Relief Study Interruption � Bail Bond � Missed Connection/ Missed Departur e � Salient F eatures & Benefits ^^ Premium Table Amount in INR^ Plan A Plan B Ultimate Ultimate Plus Supreme Plan A Plan B Ultimate Ultimate Plus Supreme 1,240 1,382 1,614 1,785 1,886 2,846 3,185 3,529 3,823 4,132 3,152 3,587 4,300 4,825 5,132 8,081 9,120 10,179 11,080 12,028 2,164 3,789 8,823 10,891 6,019 4,322 10,129 12,515 6,895 5,196 12,268 15,174 8,328 5,837 13,841 17,130 9,383 6,214 14,763 18,275 10,002 9,826 23,611 29,273 15,932 11,099 26,731 33,151 18,025 12,396 29,905 37,098 20,153 13,499 32,608 40,457 21,965 14,659 35,451 43,990 23,870 2,447 2,912 3,254 3,454 5,376 6,053 6,744 7,330 7,948 *Excluding Americas *Including Americas Premium Chart (inclusive of 18% GST) Age Band – 16 to 35 years – Maximum Trip Duration 365 Days Premium rates are subject to change with prior approval from IRDA of India AD & D 24 Hours 10,000 25,000 25,000 30,000 50,000 Felonious Assault (AD & D) 5,000 5,000 25,000 25,000 25,000 Child care benefits 250 500 1,000 1,250 1,500 Ambulance Charges 250 250 250 500 500 Assistance Services Included Included Included Included Included Repatriation of Remains 2,500 5,000 7,500 10,000 10,000 Checked Baggage Delay# (After 12 hours only) 50 150 250 250 Emergency Evacuation 5,000 10,000 15,000 25,000 25,000 Continuing Treatment (following Medical Repatriation to your Country of Origin)## NA NA NA NA 20,000 Physiotherapy 500 500 500 500 500 Study Interruption � 7,500 7,500 15,000 25,000 25,000 Hijack Cash Benefit 100 per day (Max 500) 100 per day (Max 500) 100 per day (Max 500) 100 per day (Max 500) 100 per day (Max 500) Sponsor Protection 10,000 10,000 20,000 25,000 25,000 Compassionate Visit ( 2-Way) Visit 1,500 5,000 7,500 10,000 10,000 Bail Bond � 500 1,000 5,000 5,000 5,000 Cancer screening and mammography examinations � 250 500 1,500 2,500 3,000 Sickness Dental Relief � 250 300 400 500 500 100 100 100 100 100 Coverage for Pre existing Conditions under A&S** 500 1,000 2,500 5,000 5,000 Maternity Benefit (Only Inpatient Treatment incl 1 month post Natal Cover) - Waiting Period - 10 Months 500 1,000 2,000 2,500 3,000 Treatment for mental and nervous disorders: including alcoholism and drug dependency. 500 1,000 2,000 2,500 Accident & Sickness Medical Expenses Reimbursement � Deductible Deductible 50,000 1,00,000 2,50,000 5,00,000 5,00,000 100 100 100 100 100 Supreme Ultimate Plan B Plan A Coverages “SI” in US$ Ultimate Plus Personal Liability 1,00,000 1,00,000 5,00,000 5,00,000 5,00,000 200 200 200 200 200 Deductible 1 Day 1 Day 1 Day 1 Day 1 Day Deductible Loss of passport 250 250 250 250 250 30 30 30 30 30 Deductible Checked Baggage Loss* 500 1,000 2,000 2,500 2,500 - - Missed Connection/ Missed Departure � 250 500 750 1,000 1,000 25 50 75 100 100 Deductible Trip Delay 10 per 12 hr (Max 100) 10 per 12 hr (Max 100) 10 per 12 hr (Max 100) 10 per 12 hr (Max 100) 10 per 12 hr (Max 100) 12 Hrs 12 Hrs 12 Hrs 12 Hrs 12 Hrs Deductible Fraudulent Charges(Payment Card Security) 500 1,000 1,500 2,000 2,000 #Reimbursement of purchase of necessary personal effect, due to baggage delay overseas. *The maximum amount to be reimbursed per bag is 50%, and the maximum value per article contained in any bag is 10% ** Pre-existing condition is covered only in case of life threatening unforeseen emergency. ##coverage is applicable within 60 days from the date of your return to your country of Origin. 0-30 61-90 31-60 91-120 181-270 271-365 120-180 Trip Band Student Guard - Overseas Health Insurance Plan UIN: IRDAI/NL-HLT/TAGI/P-T/V.II/237/14-15 Student Guard - Overseas Health Insurance Plan UIN: IRDAI/NL-HLT/TAGI/P-T/V.II/237/14-15 ^^For complete list of detailed benefits please refer to policy wordings. Accident & Sickness Medical Expenses Reimbursemen t � �