4. The Coverage Entails: Hospitalisation Cover: All expenses pertaining to in - patient hospitalisation such as room rent, intensive care unit charges, surgeon’s and doctor’s fee, anesthesia, blood, oxygen, operation theatre charges etc. incurred during hospitalisation for a minimum period of 24 consecutive hours are covered under the basic hospitalisation cover. Day Care Surgeries / Treatments Coverage: All the medical expenses incurred while undergoing Day Care Procedures / Treatment which require less than 24 hours hospitalisation are covered. Due to Technological advancement of Medical. Pre and Post Hospitalisation Expenses: Medical expenses incurred, immediately, 30 days before and 60 days after hospitalisation will be covered. In Patient AYUSH Treatment: Expenses for Ayurveda, Yoga and Naturapthy, Unani, Siddha and Homeopathy (AYUSH) treatment only when it has been undergone in a AYUSH hospital or in AYUSH Day Care Center on Re - imbursement basis. Unlimited Reset Benefit: We will reset up to 100% of the base Sum Insured unlimited times in a policy year in case the Sum Insured including accrued additional Sum Insured (if any), Super No Claim Bonus (if any) and Sum Insured protector (if any) is insufficient as a result of previous claims in that policy year. Emergency Services: 1. Domestic Road Ambulance: Reimbursement up to 1% of Sum Insured maximum up to Rs.10,000 per hospitalisation for reasonable expenses incurred on availing an ambulance service offered by a hospital /ambulance service provider in an emergency condition. 2. Ambulance Assistance: Ground medical transportation assistance by a Service provider to transport the Insured Person to the nearest Hospital or any clinic or nursing home for medically necessary treatment on cashless basis. 3. Tele Consultation: Consultations and recommendations for routine health issues by a qualified Medical Practitioner or health care professional. ASI: An Additional Sum Insured of 10% of Annual Sum Insured provided on each renewal for every claim free year up to a maximum of 50%. In case of a claim under the policy, the accumulated Additional Sum Insured will be reduced by 10% of the Annual Sum Insured in the following year. Wellness Program: The wellness points so accrued by You can be redeemed against out-patient medical expenses like consultation charges, medicines and drugs, diagnostics etc Free Health Check-up: The customer is entitled for a Free Health Check-up at designated centres. The coupons would be provided to each Insured for every policy year, subject to a maximum of 2 coupons per year for floater policies.

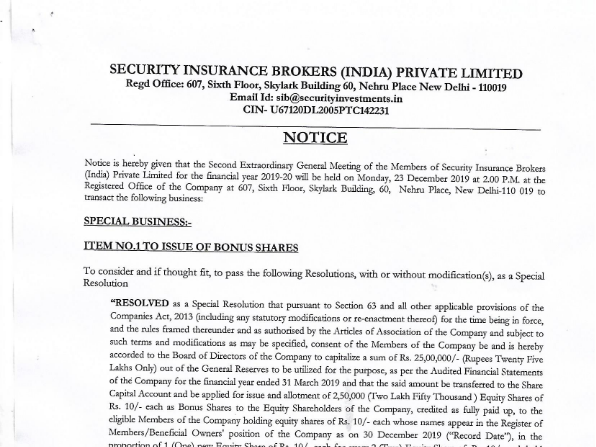

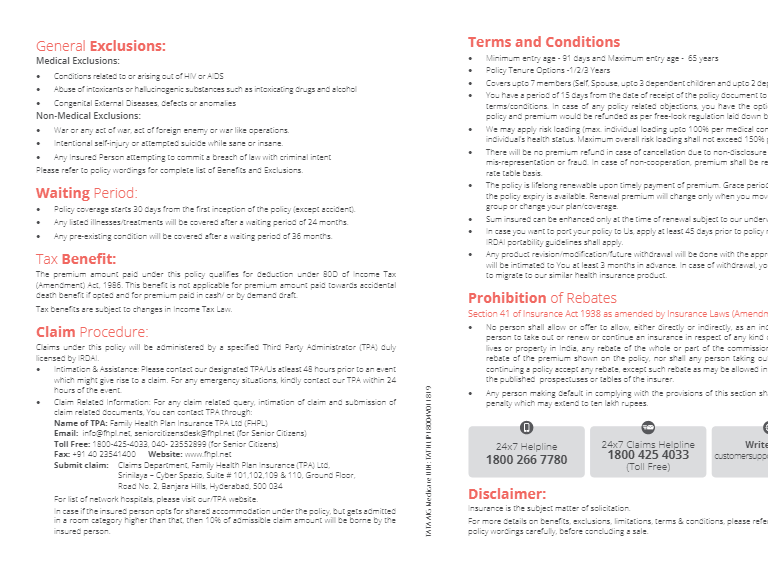

21. Statutory Warning: Prohibition of Rebates (Under Section 41 of Insurance Act 1938). No person shall allow or offer to allow, either directly or indirectly as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property, in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the Policy, nor shall any person taking out or renewing or continuing a Policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the Insurer. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to Ten Lakh Rupees. ICICI trade logo displayed above belongs to ICICI Bank and is used by ICICI Lombard GIC Ltd. under license and Lombard logo belongs to ICICI Lombard GIC Ltd. The advertisement contains only an indication of the cover offered. Add on cover is covered if insured opts for it by paying additional applicable premium. For complete details on risk factors, terms, conditions, coverages and exclusions, please read the policy document carefully before concluding a sale. ICICI Lombard General Insurance Company Limited. Registered Office: ICICI Lombard House, 414, Veer Savarkar Marg, Near Siddhivinayak Temple, Prabhadevi, Mumbai - 400 025. IRDA Reg. No. 115. ICICI Lombard Complete Health Insurance. UIN: ICIHLIP21383V052021. Misc 128. Toll Free No. 1800 2666. Fax No 02261961323. CIN L67200MH2000PLC129408. We bsite: www.icicilombard.com. Email: customersupport@icicilombard.com. ADV/1 0740.

5. Hospital Daily Cash Allowances*: A certain amount (as per the plan chosen) will be paid for each and every completed day of hospitalisation, if such hospitalisation is atleast for a minimum of 3 consecutive days and subject to maximum of 10 consecutive days. Convalescence Benefit*: A benefit amount of Rs.10,000 per insured once during the policy period will be paid in case of hospitalisation arising out of any injury or illness as covered under the policy, for a period of consecutive 10 days or more. Nursing At Home*: A certain amount (as per the plan chosen) per day for a maximum of up to 15 days post hospitalisation for the medical services of a nurse at your residence. Compassionate Visit*: In the event of hospitalisation exceeding 5 days, the cost of economy class air ticket up to a certain amount (as per the plan chosen) incurred by the customer’s “immediate family member” while traveling to place of hospitalisation from the place of origin / residence and back will be reimbursed. “Immediate family member” would mean spouse, children and dependant parents. Maternity Benefit*: Reimbursement for medical expenses incurred for delivery, including a cesarean section, during hospitalisation or lawful medical termination of pregnancy during the policy period. The waiting period for maternity cover is 3 years. The cover shall be limited to 2 deliveries / terminations during the period of insurance. Pre - natal and Post - natal expenses shall be covered under this benefit. This cover is applicable only for floater plan having Self and Spouse in the same policy. (Inbuilt under Health Elite and Health Elite Plus plans only) New Born Baby Cover*: The new born child can be covered under this policy during hospitalisation for a maximum period up to 91 days from the date of birth of the child. This cover will be provided only if maternity cover is opted. (Inbuilt under Health Elite and Health Elite Plus plans only) Out-patient Treatment Cover*: Reimbursement for the medical expenses incurred as an Outpatient (OPD). Critical Illness*: The customer can opt for Critical Illness Cover covering specified Critical Illnesses / medical procedures like Cancer of Specified Severity, First Heart Attack - of Specified Severity, Open Chest Cabg, Stroke Resulting in Permanent Symptoms, Permanent Paralysis of Limbs, Kidney Failure Requiring Regular Dialysis, Major Organ / Bone Marrow Transplant, Multiple Sclerosis with Persisting Symptoms, Open Heart Replacement or Repair of Heart Valves, Coma of specified severity. A benefit amount is paid up on the diagnosis of the chosen critical illness. Personal Accident Cover*: The customer can also opt for a Personal Accident Cover where a fixed sum is paid upon the unfortunate event of Accidental Death or Permanent Total Disablement resulting from an accident. This cover can be availed only once during your lifetime. Once a claim becomes payable under this cover, no benefit will be provided under the same thereafter. *Add on not mandatory and are available for a nominal extra cost. Critical Illness and Personal Accident available only for adults, subject to maximum of 2 Adults only up to 60 ye ars of a ge.

16. Major Permanent Exclusions • Any illness / disease / injury pre-existing before the inception of the policy for the first 2 years. Such waiting period shall reduce if the insured has been covered under a similar policy before opting for this policy, subject however to portability regulations. • Medical expenses incurred during the first 30 days of inception of the policy, except those arising out of accidents. This exclusion doesn’t apply for subsequent renewals without a break. • Expenses attributable to self-inflicted injury (resulting from suicide, attempted suicide). • Expenses arising out of or attributable to alcohol or drug use / misuse / abuse • Cost of spectacles / contact lenses, dental treatment • Medical treatment expenses traceable to childbirth (including complicated deliveries and caesarean sections incurred during Hospitalisation) except ectopic pregnancy. Claim Service Guarantee: ICICI Lombard guarantees on time claim service. • For Reimbursement Claims: We shall make the payment of admissible claim (as per terms and conditions of Policy) OR communicate non admissibility of claim within 14 days after You submit complete set of documents and information in respect of the claims. In case We fail to make the payment of admissible claims or to communicate non admissibility of claim within the time period, We shall pay 2% interest over and above the rate defined as per IRDAI (Protection of Policyholder's interest) Regulation 2017. • For Cashless Claims: If you notify pre - authorisation request for cashless facility through any of our empanelled network hospitals along with complete set of documents and information, we shall respond within 4 hours of the actual receipt of complete set of documents. • Approval, or • Rejection, or • Query seeking further information In case the request is for enhancement, i.e. request for increase in the amount already authorised, we shall respond to it within 3 hours post receiving necessary documents. What We Will Not Pay (Exclusions Under the Policy) • Any Pre-Existing condition(s) until 24 months of Your continuous coverage has elapsed, since Period of Insurance Start Date • Any Expenses related to the treatment of Hypertension, Diabetes, cardiac conditions within 90 days from the first policy start date. • Any Medical Expenses incurred by You on treatment of following Illnesses within the first two (2) consecutive years of Period of Insurance Start Date: • Cataract* • All types of Hernia, Hydrocele • Arthritis, gout, rheumatism and spinal disorders • Surgery on tonsils, adenoids and sinuses • Dilatation and curettage, Endometriosis • Gastric and Duodenal erosions and ulcers • Varicose Veins / Varicose Ulcers • Benign Prostatic Hypertrophy • Joint replacements unless due to accident • Sinusitis and related disorders • Stones in the urinary and billiary systems • Dialysis required for chronic renal failure • Deviated Nasal Septum • Fissures / Fistula in anus, hemorrhoids / piles • All types of internal congenital anomalies / illness / defects • Myomectomy, Hysterectomy unless because of malignancy • All types of Skin and internal tumors / cysts / nodules / polyps of any kind including breast lumps unless malignant *After two years of continuous coverage (subject to portability provisions), a Sub - Limit of 1 Lakh per eye will be applicable for Sum Insured greater than 5 Lakhs and 20,000 for the Sum Insured 5 Lakhs and below.

17. How To Earn Wellness Points? To earn wellness points, follow the appended below steps: • Collect relevant reports / receipts and bills for the specific category of activity / activities under which you want to earn your wellness points. • Send the requisite documents along with dully filled submission form to ICICI Lombard Health Care, ICICI Bank tower, Plot No. 12, Financial District, Nanakramguda, Gachibowli, Hyderabad - 500 032. • An acknowledgment will be sent and keep you updated regarding the status of your points accumulation request. • To track your earned points, Call our toll free no. 1800 2666 or send email to ihealthcare@icicilombard.com. You can also access your earned points by simply log - on to www.icicilombard.com -> claims and wellness management. • Your total wellness points earned will be sent to your registered email - id once in every 3 months. • Each wellness point is equivalent to 0.25 INR. You can redeem your earned wellness points against reimbursement of medical expenses like consultation charges, medicine and drugs, diagnostic expenses, dental expenses, wellness and preventive care and other miscellaneous charges that are not covered under any medical insurance. To redeem your wellness points under OPD, follow the appended below steps: • Collect all original bills of medicines / consultations, expenses of which you would like to redeem against the points accumulated. • Send the original bills / invoices, test reports if any along with the duly completed redemption form to ICICI Lombard Health Care, ICICI Bank tower, Plot No. 12, Financial District, Nanakramguda, Gachibowli, Hyderabad - 500 032. • We will acknowledge you once the documents are received and keep you updated regarding the status of your redemption request. • To track the status yourself, call on our toll free no. 1800 2666 or simply log - on to www.icicilombard.com > Claims and Wellness management ->Track your claims. Enter your Claim No. or AL No. and click on search to know the status of your claim. • You can also send in a email to ihealthcare@icicilombard.com to enquire about status of your redemption request. Maximum points that can be earned under each category are as mentioned in the Table 1.

1. ICICI LOMBARD COMPLETE HEALTH INSURANCE T he revamped version of our health insurance is here, packed with new features and plans for enhanced protection

19. Cancellation Grid Refund % for 1 year tenure policy C a n ce ll a t i on p e r i o d Refund % for 2 year tenure policy Refund % for 3 year tenure policy In case of delay in response by us beyond the stipulated time period as stated above for cashless claims, we shall be liable to pay 1,000 to the insured. Our maximum liability in respect of a single hospitalisation shall, at no time exceed 1,000. Cancellation / Termination • Disclosure to information norm: The policy shall be void and all premium paid hereon shall be forfeited to the company, in the event of misrepresentation, mis - description or non disclosure of any material. • You may cancel the policy by giving us 15 days prior written notice for the cancellation of the policy by registered post, and after which we shall refund the premium on short term rates for the unexpired policy period as per the rates mentioned below, provided no claim has been payable on your behalf under the Policy. In case of re-alignment of your Health Booster policy we shall refund the premium on pro rata basis for the balance tenure. From 16 days to 1 month From 1 month to 3 months From 3 months to 6 months From 6 months to 9 months From 9 months to 12 months From 12 months to 15 months From 15 months to 18 months From 18 months to 21 months From 21 months to 24 months From 24 months to 27 months From 27 months to 30 months From 30 months to 33 months From 33 months to 36 months 80.00% 60.00% 40.00% 20.00% 0.00% NA NA NA NA NA NA NA NA 80.00% 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% NA NA NA NA 80.00% 75.00% 67.50% 60.00% 52.50% 47.50% 40.00% 32.50% 25.00% 20.00% 12.50% 5.00% 0.00%

14. Key Points To Note: Wide Range of Sum Insured: The customer has option to choose from a wide range of Sum Insured starting from ` 5 Lakhs to 50 Lakhs as per his / her needs. Eligibility: The minimum entry age for the customer to receive the policy is 6 years and there is no restriction on maximum entry age. Children between 3 months to 5 years can be insured under floater plan only. Floater Benefit: Floater cover to get family (self, spouse, dependent parents, dependent children, brothers and sisters) covered for the same Sum Insured under a single policy by paying one premium amount. Individual above 3 months of age can be covered under the policy provided 1 adult is also covered under the same policy. Pre-Existing Disease: All declared and accepted Pre-Existing conditions / diseases will be covered immediately after 2 years of continuous coverage under the policy, if the policy is issued for the first time with ICICI Lombard. Such waiting period shall reduce if the insured has been covered under a similar policy before opting for this policy, subject however to portability regulations. Life Long Renewability: The policy provides life - long renewal. Factors determining the renewal premium are (i) age slab of the senior most insured member at the time of renewal (ii) any change in the renewing policy. Policy Period: Option of choosing 1, 2 or 3 year policy period under various plans offered. Cashless Hospitalisation: Avail cashless hospitalisation at any of our network providers / hospitals. A list of these hospitals / providers is available on our website www.icicilombard.com. Tax Benefit: Avail tax deduction on premium paid under health insurance policy as per applicable provisions of Section 80D of Income Tax Act, 1961 and amendments made thereto. Pre-Policy Medical Check-up: No medical tests will be required for insurance cover below the age of 46 years and Sum Insured up to ` 10 Lakhs. Free Look Period: Policy can be cancelled by giving written notice within 15 days of receiving the policy. Value Added Services: Avail Value Added Services like Free Health Check-up, Online chat with doctors, specialist e-consultation, Dietician and Nutrition e-consultation, Provide information on offers related to healthcare services like consultation, diagnostics, medical equipments and pharmacy.

18. Table 1. List of wellness activities A c t i v i t y 1. Health Risk Assessment 2. Medical Risk Assessment* 3. Heart related screening tests (under PRA**) above 45 years. 4. HbA1c / Complete lipid profile (under PRA) any age 5. PAP Smear (under PRA) for females above age 45 6. Mammogram (under PRA) for females above age 45 9. Gym / Yoga membership for 1 year 12. Quit smoking - based on self declaration 13. Share your fitness success story 7. Prostate Specific Antigen (PSA) (under PRA) males above age 45 8. Any other test as suggested by our empanelled Medical expert (under PRA) 10. Participation in professional sporting events like Marathon / Cyclothon / Swimathon, etc. 11. Participation in any other health and fitness activity / event organised by ICICI Lombard 14. On winning any Health quiz organized by Us 500 Points accumulated per insured 250 1000 500 500 500 500 500 2500 2500 2500 100 100 100 500 Points accumulated per floater policy 500 2000 500 500 500 500 500 2500 2500 2500 100 100 100 *Under MRA from 2nd year onwards, if tests are within normal limits, additional 1000 / 2000 points will be awarded. **PRA stands for Preventive Risk Assessment. Note: For HRA and MRA, the customer doesn’t need to submit any form or documents as the points earned under those categories will automatically be updated against the policy.

20. 1. Why do I need Health Insurance? Healthcare is expensive. Technological advances, new procedures and more effective medicines have driven up the cost of healthcare. This increase has to be borne by the consumer, making treatment unaffordable for too many. Health Insurance overcomes these obstacles so that you remain free of anxiety regarding your health. Think for a moment about the enormous medical costs you would incur if you suffered a major accident tomorrow or were suddenly stricken by an illness. Uninsured people live with such risks everyday. Health insurance seeks to shield you from that risk. It provides the much needed financial relief. You also get tax benefit under section 80D of the Income Tax Act and amendments made thereto. 2. How will health insurance pay for my emergency medical expenses? Your health insurance will either pay your hospital bills directly if opted for the cashless facility or it will reimburse any payment made by you towards medical expenses incurred due to an illness or injury as per the policy terms. 3. What do you mean by Family Floater Policy? Family Floater is one single policy that takes care of the hospitalization expenses of your entire family. The policy has one single sum insured, which can be utilized by any/all insured persons in any proportion or amount subject to maximum of overall limit of the policy sum insured, as per policy terms and conditions. 4. Will my health insurance cover begin from day one? When you get a new policy, there will be a 30 days waiting period starting from the policy inception date, during which period any hospitalization charges will not be payable by the insurance companies. However, this is not applicable to any emergency hospitalization occurring due to an accident. This waiting period will not be applicable for subsequent policies under renewal. Furthermore, in the case of a declared & accepted pre-existing disease or specific diseases, you will have to serve the waiting period of 2 years for these diseases / conditions. 5. What is pre-existing condition in health insurance policy? It is a medical condition/disease that existed before you obtained health insurance policy 6. If my policy is not renewed in time before expiry date, will it be denied for renewal? The policy will be renewable provided you pay the premium within 30 days (called as Grace Period) of expiry date. However, coverage would not be available for the period for which no premium is received by Us. The policy will lapse if the premium is not paid within the grace period. 7. What happens to the policy coverage after a claim is filed? After a claim is filed and settled, the policy coverage is reduced by the amount that has been paid out on settlement. For Example: In January you start a policy with a coverage of ` 5 Lakh for the year. In April, you make a claim of ` 2 Lakh. The coverage available to you for the May to December will be the balance of ` 3 Lakh. 8. What is Unlimited Reset Benefit? It is a benefit that allows an insured to reinstate the entire sum insured in the policy year when it gets exhausted due to incurred claims. In case the entire cover is exhausted, it gets replenished automatically for the next hospitalization that occurs within the policy year. Reset will not trigger on first claim and cannot be used by same person for same illness for which the claim has already been paid in the policy. 9. Does my policy offer worldwide cover? Basis the plan and add on selected, Complete Health Insurance policy covers Hospitalization expenses incurred abroad with a co-pay of 10% 10. What is covered under Domiciliary Hospitalization? Domiciliary Hospitalization offers coverage for medical expenses in a situation where the Insured Person is in such a state that he/she cannot be moved to a hospital or the treatment is taken at home if there's a non-availability of room in the hospital. 11. What is Super No Claim Bonus? In case the customer has opted for this additional cover with extra premium, there will be a 50% bonus awarded for every claim free year subject to a maximum of 100% for SI options up to 10 Lakhs and up to 200% for SI options 15 Lakhs and above. 12. What is the maximum Sum Insured under the new plans ? All plans come with multiple Sum Insured options up to a maximum of 50 Lakhs 13. Can I increase my Sum Insured at the time of renewal? Yes, you can increase the Sum Insured at the time of renewal. However, fresh waiting period would apply for the enhanced Sum Insured (this condition would not apply on the original sum insured including the accrued Additional Sum insured) Health Insurance FAQs

15. *Disclaimer: Cashless approval is subject to pre-authorisation by the company. Only expenses relating to hospitalisation will be reimbursed as per the policy coverage. Non-medical expenses will not be reimbursed. All the claims have to be intimated 48 hours prior to hospitalisation and within 24 hours post hospitalisation in case of emergency. Standard List Of Documents • Duly completed claim form signed by you and the medical practitioner. • Original bills, receipts and discharge certificate / card from the hospital / medical practitioner. • Original bills from chemists supported by proper prescription. • Original investigation test reports and payment receipts. • Indoor case papers. • Medical Practitioner’s referral letter advising hospitalisation in non-accident cases. • Any other document as required by ICICI Lombard Health Care to investigate the claim or our obligation to make payment for the same. How Do I Make A Claim? 1 Cashless Claims Reimbursement Claims Get admitted in any one of our network hospital Upon discharge, pay all hospital bills and collect all original documents of treatments and expenses underdone 2 HELP DESK HELP DESK Fax the pre-authorsiation along with relevant documents (investigation reports, Previous consultation papers if any, Cashless ID, Photo ID) Send the duly filled (and signed by insured and treating doctor) claim form and required calim documents. 4 ICICI Lombard Health Care settles the claim (as per policy terms and conditions) with the hospital after completion of all formalities ICICI Lombard Health Care Settles the claim (as per policy terms and conditions) and reimburses the approved amount. 3 ICICI Lombard Health Care reviews your claim requested and accordingly will approve, query or reject the same (as per policy terms and conditions). ICICI Lombard Health Care reviews your claim requested and accordingly will approve, query or reject the same (as per policy terms and conditions)

3. ASI Protector: ASI accrued by the customer shall not be impacted if any one claim or multiple claims admissible in the previous year does not exceed the overall amount of Rs. 50,000. This benefit is available for Sum Insured of 5 Lacs and above. Sum Insured Protector: In case the customer has opted for this cover, the SI will be increased at renewal on the basis of inflation rate of previous year. Air Ambulance Cover: Coverage up to the base Sum Insured for Air Ambulance expenses incurred to transfer the Insured Person following an emergency to the nearest Hospital. Donor Expenses: Medical Expenses incurred in respect of the donor for any of the organ transplant surgery, provided the organ donated is for the insured person’s use. Domicillary Hospitalisation: Coverage for medical expenses in a situation where the Insured Person is in such a state that he/she cannot be moved to a hospital or the treatment is taken at home if there's a non-availability of room in the hospital. *These are add-on covers except for Emergency Services. Add-covers are available by paying extra premium.

2. At ICICI Lombard, we believe that health insurance is not just a matter of saving tax or getting the protection you need. It can be so much more. It’s about partnering with you to find precisely what works for you based on your needs and then going the extra mile to deliver more than what we promise. With countless features and benefits that include Donor Expenses, Emergency Assistance, World Wide Coverage, Unlimited Reset, Air Ambulance, Super No Claim Bonus, ASI Protector, Sum Insured Protector, Claim protector and a lot more, we’re redefining the way you stay protected. include Donor Expenses, Emergency Assistance, World Wide Coverage, Unlimited World Wide Cover: In case the customer has opted for this cover, Hospitalization expenses incurred abroad shall be paid with a co-pay of 10%. This benefit is available for Sum Insured of 10 Lacs and above. Claim Protector: In case the customer has opted for this cover, the IRDAI list of non-payable items shall become payable in case of a claim. Super No Claim Bonus: In case the customer has opted for this cover, there will be a 50% bonus awarded for every claim free year subject to a maximum of 100% for SI options up to 10L and up to 200% for SI options 15L and above. Emergency Services: i. Domestic Road Ambulance - Expenses incurred on road ambulance services will be covered. Coverage limit under this shall be 1% of the SI up to a maximum of ` 10,000 ii. Assistance for ambulance iii. Tele-consultation Unlimited Reset Benefit: We will reset up to 100% of the base Sum Insured unlimited times in a policy year in case the Sum Insured including accrued additional Sum Insured (if any), Super No Claim Bonus (if any) and Sum Insured protector (if any) is insufficient as a result of previous claims in that policy year. Upgrade your protection with additional * covers

10. Plan Name Health Shield Plus Sum Insured Cover Type 15 Lakhs 20 Lakhs 25 Lakhs 50 Lakhs In Patient Treatment Pre Hospitalisation Post Hospitalisation Daycare Procedures and Treatment PED waiting period (Declared & Accepted) In Patient AYUSH hospitalisation Donor Expenses Unlimited Reset benefit Domicillary hospitalisation Air Ambulance Cover ASI Protector Additional Sum Insured (ASI) Emergency Services Domestic Road Ambulance Ambulance Assisstance Tele Consultation Value Added Service (VAS) Health Check Up Online Chat with Doctor E-Second Opinion Dietician & Nutrition e-consultation Health Assistance Wellness Program Claim Protector Sum Insured Protector World Wide Cover (Planned; 10% Copay) Super No claim Bonus Hospital Daily Cash Convalescence Benefit Nursing at Home Compassionate Visit Critical Illness Personal Accident In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On 30 days 60 days 2 years Upto 10 lakhs ` 10,000 Optional ` 3,000 per day ` 10,000 ` 3,000 per day ` 20,000 Upto 50% of SI Upto SI

6. Introducing 4 new plans under our Complete Health Insurance - Health Shield, Health Shield Plus, Health Elite and Health Elite Plus, which offer a host of benefits to cater to all your healthcare needs. Plan Name Health Elite Plus Sum Insured Cover Type 15 Lakhs 20 Lakhs 25 Lakhs 50 Lakhs In Patient Treatment Pre Hospitalisation Post Hospitalisation Daycare Procedures and Treatment PED waiting period (Declared & Accepted) In Patient AYUSH hospitalisation Donor Expenses Unlimited Reset benefit Domicillary hospitalisation Air Ambulance Cover ASI Protector Additional Sum Insured (ASI) Emergency Services Domestic Road Ambulance Ambulance Assisstance Tele Consultation Value Added Service (VAS) Health Check-up Online Chat with Doctor E-Second Opinion Dietician & Nutrition e-consultation Health Assistance Wellness Program Claim Protector Sum Insured Protector World Wide Cover (Planned; 10% Copay) Super No Claim Bonus Hospital Daily Cash Convalescence Benefit Maternity with New Born Baby Cover (3 years waiting period) Outpatient Treatment Cover Nursing at Home Compassionate Visit Critical Illness Personal Accident In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built Optional Add On Optional Add On 30 days 60 days 2 years Upto 10 lakhs ` 10,000 ` 3,000 per day ` 10,000 ` 20,000 ` 3,000 per day ` 20,000 Upto 50% of SI Upto SI Normal: ` 25,000; Cesarean: ` 50,000 Pre post Natal: ` 2,000 each New Born: ` 100,000

12. In Patient Treatment Pre Hospitalisation Post Hospitalisation Daycare Procedures and Treatment PED waiting period (Declared & Accepted) In Patient AYUSH hospitalisation Donor Expenses Unlimited Reset benefit Domicillary hospitalisation Air Ambulance Cover ASI Protector Additional Sum Insured (ASI) Emergency Services Domestic Road Ambulance Ambulance Assisstance Tele Consultation Value Added Service (VAS) Health Check-up Online Chat with Doctor E-Second opinion Dietician & Nutrition e-consultation Health Assistance Wellness Program Claim Protector Sum Insured Protector World Wide Cover (Planned; 10% Copay) Super No claim Bonus Hospital Daily Cash Convalescence Benefit Nursing at Home Compassionate Visit Critical Illness (for adults only) Personal Accident (for adults only) In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Plan Name Health Shield Sum Insured Cover Type 5 Lakhs 30 days 60 days 2 years Optional Optional Optional ` 10,000 7 & 10 Lakhs 15, 20, 25 & 50 Lakhs Upto SI Upto SI Upto 10 lakhs 1% of SI 1% of SI ` 10,000 NA Optional (For SI 10 lakhs only) Optional ` 1,000 per day ` 2,000 per day ` 3,000 per day ` 2,000 per day ` 3,000 per day ` 3,000 per day ` 10,000 ` 20,000 ` 20,000 Upto SI Upto SI Upto SI Upto SI Upto 50% of SI Upto SI

13. Rates are inclusive of GST, Policy Tenure: 1 year Indiv. 7,393 8,045 9,206 9,206 13,138 19,422 26,695 37,132 48,941 54,459 62,543 72,590 1A+2K 13,894 14,299 15,018 15,018 19,022 23,295 28,240 35,338 54,509 59,255 66,207 74,847 1A+1K 10,927 11,404 12,251 12,251 16,473 21,500 27,318 35,668 49,525 54,380 61,494 70,335 2A 10,927 11,880 13,574 13,574 21,069 31,124 42,760 59,460 86,087 95,799 110,026 127,709 2A+1K 13,894 14,704 16,142 16,142 22,929 31,475 41,366 55,561 90,241 99,732 113,636 130,917 2A+2K 18,353 19,163 20,602 20,602 27,795 36,341 46,232 60,427 96,328 105,819 119,723 137,004 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 Indiv. 8,739 9,520 11,047 11,047 16,047 23,755 32,677 45,462 59,827 66,637 76,573 87,968 2A 12,913 14,054 16,283 16,283 25,739 38,072 52,347 72,803 105,255 117,241 134,729 154,783 1A+2K 16,442 16,926 17,873 17,873 22,868 28,109 34,176 42,870 66,203 72,059 80,605 90,404 2A+2K 21,750 22,719 24,612 24,612 33,631 44,114 56,248 73,635 117,389 129,102 146,192 165,791 2A+1K 16,442 17,411 19,303 19,303 27,837 38,320 50,454 67,841 110,139 121,851 138,942 158,541 Indiv. 11,269 12,283 14,292 14,292 20,703 30,734 42,540 59,376 78,370 87,115 100,025 115,059 1A+2K 21,172 21,801 23,046 23,046 29,495 36,316 44,344 55,792 86,511 94,031 105,134 118,062 1A+1K 16,618 17,359 18,826 18,826 25,650 33,675 43,120 56,588 78,848 86,543 97,904 111,133 2A 16,618 18,099 21,033 21,033 33,198 49,247 68,137 95,073 137,897 153,287 176,010 202,468 2A+1K 21,172 22,429 24,921 24,921 35,911 49,553 65,609 88,505 144,218 159,258 181,465 207,322 2A+2K 28,057 29,315 31,806 31,806 43,432 57,074 73,130 96,026 153,647 168,687 190,894 216,751 Indiv. 14,125 15,411 17,957 17,957 26,081 38,791 53,752 75,085 99,155 110,236 126,596 145,645 2A 20,802 22,679 26,396 26,396 41,811 62,148 86,085 120,219 174,483 193,986 222,779 256,307 1A+2K 26,513 27,310 28,888 28,888 37,060 45,704 55,877 70,383 109,309 118,838 132,908 149,291 1A+1K 20,802 21,741 23,599 23,599 32,247 42,416 54,384 71,451 99,658 109,409 123,805 140,569 2A+2K 35,178 36,772 39,929 39,929 54,661 71,948 92,294 121,308 194,323 213,382 241,521 274,287 2A+1K 26,513 28,107 31,264 31,264 45,190 62,476 82,823 111,836 182,434 201,493 229,632 262,398 HEALTH SHIELD - PREMIUM CHART 500,000 2,500,000 5,000,000 1,000,000 1A+1K 12,913 13,484 14,598 14,598 19,893 26,059 33,196 43,424 60,298 66,291 75,035 85,062

7. 2,500,000 Indiv. 32,666 34,047 43,281 43,462 57,049 83,744 98,621 149,039 193,370 209,776 232,833 253,580 2A 51,956 53,972 63,612 63,884 88,345 130,919 154,982 236,381 335,154 364,027 404,609 441,123 1A+2K 53,936 54,793 60,518 60,667 73,491 91,644 102,090 137,003 204,266 218,375 238,204 256,046 1A+1K 43,840 44,848 51,589 51,739 65,609 86,912 99,079 139,894 190,569 205,005 225,296 243,553 2A+2K 75,747 77,459 85,068 85,269 107,941 144,216 164,798 234,185 362,917 391,134 430,793 466,477 2A+1K 62,095 63,807 71,416 71,687 93,476 129,766 150,504 220,085 345,920 374,137 413,797 449,480 5,000,000 Indiv. 36,674 38,129 49,529 49,759 66,447 99,901 117,907 180,470 235,022 254,711 282,119 308,256 1A+2K 61,248 62,150 69,218 69,408 85,192 107,941 120,603 163,942 246,907 263,840 287,411 309,888 1A+1K 49,689 50,751 59,073 59,264 76,319 103,015 117,756 168,416 230,844 248,171 272,290 295,290 2A 57,821 59,946 72,749 73,092 103,336 156,689 185,827 286,853 408,509 443,161 491,400 537,400 2A+1K 69,924 71,728 82,023 82,278 109,153 154,613 179,543 265,665 420,794 454,659 501,801 546,756 2A+2K 85,726 87,531 97,826 98,081 126,156 171,616 196,546 282,668 441,398 475,263 522,405 567,360 2,000,000 Indiv. 31,467 32,766 41,321 41,489 54,089 78,807 92,650 139,362 180,481 195,768 217,258 236,540 2A 50,202 52,098 60,748 60,998 83,622 123,045 145,431 220,844 312,456 339,360 377,182 411,120 1A+2K 51,587 52,393 57,697 57,837 69,730 86,538 96,255 128,600 190,982 204,128 222,609 239,193 1A+1K 42,091 43,039 49,284 49,423 62,286 82,011 93,330 131,144 178,145 191,597 210,507 227,477 2A+2K 72,762 74,373 81,140 81,326 102,289 135,879 155,026 219,310 338,701 364,993 401,958 435,123 2A+1K 59,853 61,464 68,231 68,481 88,626 122,229 141,520 205,984 322,688 348,980 385,944 419,110 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 1,500,000 Indiv. 30,150 31,348 39,197 39,351 50,900 73,512 86,152 128,946 166,601 180,542 200,182 217,633 1A+2K 49,248 49,991 54,857 54,983 65,878 81,254 90,128 119,761 176,869 188,858 205,748 220,757 1A+1K 40,168 41,042 46,772 46,899 58,685 76,730 87,066 121,709 164,743 177,012 194,294 209,652 2A 48,274 50,023 57,641 57,871 78,534 114,595 135,038 204,127 288,012 312,550 347,115 377,830 2A+1K 57,390 58,875 64,768 64,997 83,385 114,124 131,741 190,799 297,649 321,628 355,408 385,425 2A+2K 69,483 70,969 76,860 77,030 96,166 126,892 144,379 203,270 312,576 336,555 370,335 400,352 HEALTH ELITE PLUS - PREMIUM CHART Rates are inclusive of GST, Policy Tenure: 1 year

9. Rates are inclusive of GST, Policy Tenure: 1 year 1,000,000 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 500,000 Indiv. 11,326 11,979 13,139 13,139 17,072 23,356 30,628 41,066 52,875 58,392 66,476 76,523 1A+2K 19,500 19,904 20,624 20,624 24,628 28,901 33,846 40,944 60,115 64,861 71,812 80,454 1A+1K 15,696 16,173 17,020 17,020 21,242 26,270 32,088 40,439 54,294 59,150 66,264 75,106 2A 18,609 19,562 19,149 19,149 26,273 36,327 47,963 64,664 91,291 101,002 115,229 132,913 2A+1K 22,412 23,221 22,553 22,553 28,969 37,515 47,405 61,601 96,281 105,772 119,676 136,957 2A+2K 27,708 28,517 27,849 27,849 34,671 43,218 53,108 67,304 103,204 112,695 126,599 143,880 Indiv. 16,441 17,223 18,749 18,749 23,750 31,458 40,380 53,165 67,529 74,339 84,276 95,671 2A 27,389 28,530 26,918 26,918 35,507 47,840 62,114 82,571 115,023 127,008 144,497 164,551 1A+2K 27,159 27,644 28,590 28,590 33,585 38,827 44,893 53,587 76,921 82,777 91,323 101,121 1A+1K 22,124 22,694 23,808 23,808 29,102 35,269 42,407 52,634 69,508 75,501 84,245 94,273 2A+2K 39,241 40,210 38,262 38,262 46,414 56,896 69,030 86,417 130,172 141,884 158,976 178,574 2A+1K 32,425 33,394 31,446 31,446 39,112 49,595 61,729 79,117 121,414 133,126 150,218 169,816 2,500,000 Indiv. 25,837 26,852 28,862 28,862 35,273 45,303 57,110 73,945 92,939 101,684 114,595 129,628 1A+2K 40,099 40,728 41,973 41,973 48,421 55,243 63,270 74,719 105,438 112,958 124,060 136,990 1A+1K 33,366 34,107 35,573 35,573 42,397 50,423 59,867 73,336 95,595 103,290 114,652 127,881 2A 41,419 42,900 41,993 41,993 53,291 69,340 88,230 115,167 157,990 173,381 196,103 222,561 2A+1K 48,152 49,410 48,060 48,060 58,182 71,824 87,881 110,777 166,490 181,530 203,736 229,594 2A+2K 57,216 58,474 57,124 57,124 67,883 81,525 97,581 120,477 178,097 193,139 215,344 241,201 5,000,000 Indiv. 28,694 29,979 32,526 32,526 40,650 53,361 68,321 89,654 113,724 124,804 141,165 160,215 2A 45,603 47,480 47,356 47,356 61,904 82,241 106,179 140,311 194,576 214,079 242,872 276,400 1A+2K 45,439 46,236 47,815 47,815 55,987 64,630 74,804 89,309 128,235 137,765 151,834 168,217 1A+1K 37,550 38,488 40,347 40,347 48,995 59,163 71,132 88,198 116,406 126,156 140,553 157,316 2A+2K 64,337 65,931 65,247 65,247 79,112 96,399 116,746 145,758 218,774 237,833 265,972 298,737 2A+1K 53,493 55,087 54,403 54,403 67,462 84,749 105,094 134,108 204,706 223,765 251,904 284,669 HEALTH ELITE - PREMIUM CHART

11. Rates are inclusive of GST, Policy Tenure: 1 year Indiv. 13,507 13,922 20,973 21,127 31,277 52,918 63,333 102,629 136,001 147,049 161,901 179,040 1A+2K 25,277 25,534 29,906 30,033 39,695 54,411 61,773 89,026 140,151 149,652 162,425 177,164 1A+1K 19,830 20,133 25,280 25,408 35,819 53,086 61,643 93,487 131,812 141,535 154,605 169,688 2A 19,883 20,488 30,783 31,013 49,938 84,447 101,329 164,821 239,455 258,899 285,040 315,204 2A+1K 25,366 25,881 34,624 34,854 51,829 81,249 95,840 150,141 245,583 264,586 290,131 319,610 2A+2K 33,598 34,113 42,856 43,028 60,689 90,095 104,555 158,690 256,401 275,404 300,950 330,428 Indiv. 14,750 15,210 22,910 23,077 34,176 57,854 69,311 112,272 148,799 160,984 177,347 196,284 2A 21,701 22,373 33,613 33,865 54,562 92,321 110,889 180,303 261,994 283,440 312,237 345,565 1A+2K 27,477 27,763 32,537 32,675 43,247 59,349 67,443 97,238 153,205 163,684 177,756 194,042 1A+1K 21,644 21,980 27,600 27,739 39,128 58,022 67,431 102,245 144,196 154,919 169,318 185,982 2A+2K 36,692 37,263 46,809 46,996 66,316 98,492 114,394 173,578 280,537 301,495 329,639 362,209 2A+1K 27,690 28,260 37,807 38,057 56,626 88,815 104,861 164,225 268,697 289,655 317,799 350,369 2,000,000 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 SI Age / SI 0-25 26-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71-75 76-80 >80 5,000,000 Indiv. 19,969 20,595 31,149 31,379 46,583 79,009 94,656 153,511 203,523 220,146 242,478 268,288 1A+2K 37,161 37,549 44,093 44,284 58,761 80,810 91,869 132,687 209,310 223,605 242,811 265,007 1A+1K 29,260 29,717 37,422 37,613 53,210 79,083 91,938 139,632 197,069 211,696 231,349 254,061 2A 29,339 30,253 45,662 46,006 74,355 126,062 151,427 246,520 358,369 387,624 426,930 472,354 2A+1K 37,784 38,560 51,647 51,902 77,228 121,290 143,012 224,092 367,129 395,719 434,131 478,523 2A+2K 49,688 50,464 63,551 63,806 90,267 134,328 156,051 237,130 383,570 412,160 450,573 494,965 HEALTH SHIELD PLUS - PREMIUM CHART 1,500,000 Indiv. 15,886 16,381 24,710 24,892 36,893 62,488 74,844 121,300 160,778 173,906 191,543 211,929 2A 23,364 24,086 36,247 36,519 58,896 99,711 119,740 194,799 283,090 306,195 337,236 373,116 1A+2K 29,710 30,017 35,181 35,331 46,758 64,163 72,895 105,113 165,599 176,889 192,056 209,589 1A+1K 23,302 23,663 29,744 29,894 42,206 62,629 72,779 110,425 155,764 167,317 182,838 200,778 2A+2K 39,521 40,135 50,464 50,665 71,551 106,332 123,485 187,482 303,079 325,659 355,995 391,059 2A+1K 29,815 30,428 40,757 41,028 61,102 95,898 113,206 177,399 290,309 312,889 343,224 378,289 2,500,000

8. Plan Name Health Elite Sum Insured Cover Type In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built In built Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On Optional Add On 30 days 60 days 2 years ` 10,000 Optional Optional Optional Upto SI In Patient Treatment Pre Hospitalisation Post Hospitalisation Daycare Procedures and Treatment PED waiting period (Declared & Accepted) In Patient AYUSH hospitalisation Donor Expenses Unlimited Reset benefit Domicillary hospitalisation Air Ambulance Cover ASI Protector Additional Sum Insured (ASI) Emergency Services Domestic Road Ambulance Ambulance Assisstance Tele Consultation Value Added Service (VAS) Health Check-up Online Chat with Doctor E-Second Opinion Dietician & Nutrition e-consultation Health Assistance Wellness Program Hospital Daily Cash Convalescence Benefit Maternity with New Born Baby Cover (3 years waiting period) Outpatient Treatment Cover Claim Protector Sum Insured Protector World Wide Cover (Planned; 10% Copay) Super No Claim Bonus Nursing at Home Compassionate Visit Critical Illness Personal Accident Normal: ` 15,000; Cesarean: ` 25,000 Pre post Natal: ` 2,000 each New Born: ` 10,000 5 Lakhs Upto SI 1% of SI ` 1,000 per day ` 5,000 NA ` 2,000 per day Upto SI ` 10,000 Normal: ` 25,000; Cesarean: ` 50,000 Pre post Natal: ` 2,000 each New Born: ` 100,000 15, 20, 25 & 50 Lakhs ` 20,000 Optional ` 3,000 per day Upto 50% of SI ` 20,000 Upto 10 lakhs ` 10,000 ` 3,000 per day Normal: ` 25,000; Cesarean: ` 50,000 Pre post Natal: ` 2,000 each New Born: ` 10,000 7 & 10 Lakhs Upto SI 1% of SI ` 2,000 per day ` 10,000 Optional (for SI 10 lakhs only) ` 3,000 per day Upto SI ` 20,000