2. Agenda Unique Selling Points Product Construct MediCare Plus - Coverages Waiting Pe r iod Key Policy Criteria This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

11. MediCarePlus Coverages This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

1. MediCare Plus Aggregate Deductible (Super Top-up) This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

7. Product Construct This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

18. KeyPolicy Criteria This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

31. Notification of Claims & Supporting Documents This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

37. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

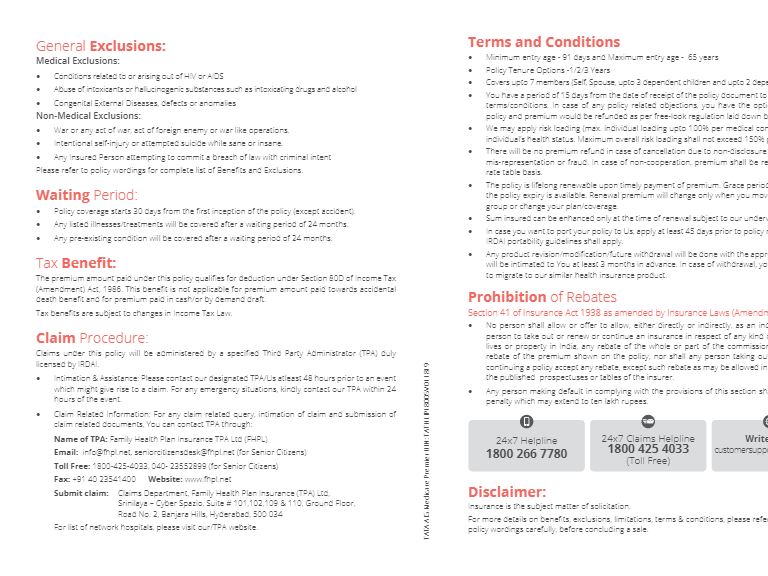

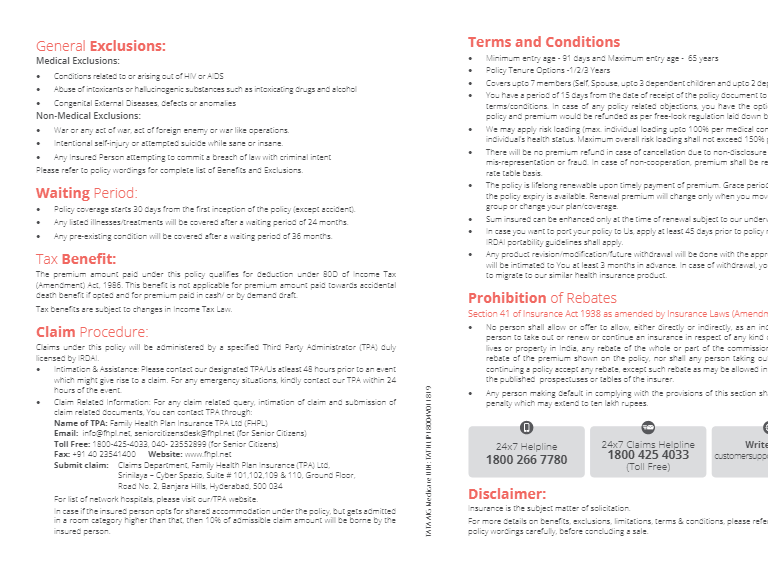

26. Exclusions & Waiting Period This content is for training purpose & internal circulation only. Business cannot be solicited basis this content.

29. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. For detailed list, refer policy wording The abuse or the consequences of the abuse of intoxicants or hallucinogenic substances such as intoxicating drugs and alcohol by the insured person, including smoking cessation programs and the treatment of nicotine addiction or any other substance abuse treatment or services, or supplies. Alcoholic pancreatitis and its related disorders or complications arising out of it. Treatment of Obesity and any weight control program Admission primarily for long term confinement or rehabilitative care where there is no active line of treatment in case of Psychiatric, mental disorders Parkinson’s and Alzheimer’s disease General debility or exhaustion or run-down condition Congenital External Diseases, defects or anomalies;; Stem cell implantation or surgery; or growth hormone therapy; Sleep-apnoea Charges related to Peritoneal Dialysis (CAPD), including supplies (except during pre-post hospitalization period) Medical Exclusions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Excluded

30. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. For detailed list, refer policy wording War or any act of war, invasion, act of foreign enemy, civil war, public defence, rebellion, revolution, insurrection, military or usurped acts, nuclear weapons/materials, chemical and biological weapons, ionising radiation. Any Insured Person’s participation or involvement in naval, military or air force operation, racing, diving, aviation, scuba diving, parachuting, hang-gliding, rock or mountain climbing. Any Insured Person committing or attempting to commit a breach of law with criminal intent Intentional self-injury or attempted suicide while sane or insane. Charges incurred at a Hospital primarily for diagnostic, X-ray or laboratory examinations not consistent with or incidental to the diagnosis and treatment of the positive existence or presence of any Illness or Injury, for which confinement is required at a Hospital. Items of personal comfort and convenience like television (wherever specifically charged for), charges for access to telephone and telephone calls, internet, foodstuffs (except patient’s diet), cosmetics, hygiene articles, body care products and bath additive, barber or beauty service, guest service Treatment rendered by a Medical Practitioner which is outside his discipline Doctor’s fees charged by the Medical Practitioner sharing the same residence as an Insured Person or who is an immediate relative of an Insured Person's family. Provision or fitting of hearing aids, spectacles or contact lenses including optometric therapy unless explicitly stated and covered in the policy, 1. 2. 3. 4. 5. 6. 7. 8 9. Non-Medical Exclusions Excluded

23. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. (Annual)Per Person Rates (Rs.) (Exclusive of taxes) Deductible Amount: 5 Lac Age band 3 Lac 5 Lac 10 Lac 15 Lac 20 Lac 25 Lac 50 Lac 1 Crore 0-18yrs 692 841 992 1,285 1,693 1,856 1,916 2,568 2,950 1,010 1,177 1,441 1,884 2,559 3,109 3,410 3,986 4,920 1,361 1,797 2,179 2,973 3,849 4,722 5,910 6,791 8,083 1,945 2,528 3,094 4,260 5,516 6,772 8,477 9,743 11,599 2,435 3,139 3,859 5,336 6,910 8,484 10,621 12,207 14,533 2,697 3,466 4,267 5,907 7,649 9,391 11,755 13,510 16,084 3,264 3,800 4,628 6,286 8,481 10,276 12,483 14,275 17,233 4,203 4,827 5,938 7,953 10,716 13,288 15,779 17,690 21,239 19-35yrs 36-45yrs 46-50yrs 51-55yrs 56-60yrs 61-65yrs 66-70yrs 71+yrs Premium Table

17. Which of the following is an Optional Cover under MediCare Plus? This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. In-patient Dental Treatment Global Cover Second Opinion Consumable Benefit 1. 3. 2. 4. Knowledge Checks

28. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. For detailed list, refer policy wording The following Illnesses/diseases would be covered after a waiting period of two years irrespective of the treatment undergone, medical or surgical: The following treatments are covered after a waiting period of two years irrespective of the illness for which it is done: Tumors, Cysts, polyps including breast lumps (benign) Polycystic ovarian disease Fibromyoma Adenomyosis Endometriosis Prolapsed Uterus Non-infective arthritis Gout and Rheumatism Osteoporosis etc. Adenoidectomy Mastoidectomy Tonsillectomy Tympanoplasty Surgery for nasal septum deviation Nasal concha resection Surgery for Turbinate hypertrophy Hysterectomy Joint replacement surgeries Eg: Knee replacement, Hip replacement etc. Exclusions with Waiting Periods

8. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Sum Insured options: (in Rs.) Deductible options: (in Rs.) + - 3 5 10 15 20 25 50 100 Lacs 2 3 5 10 15 20 Lacs

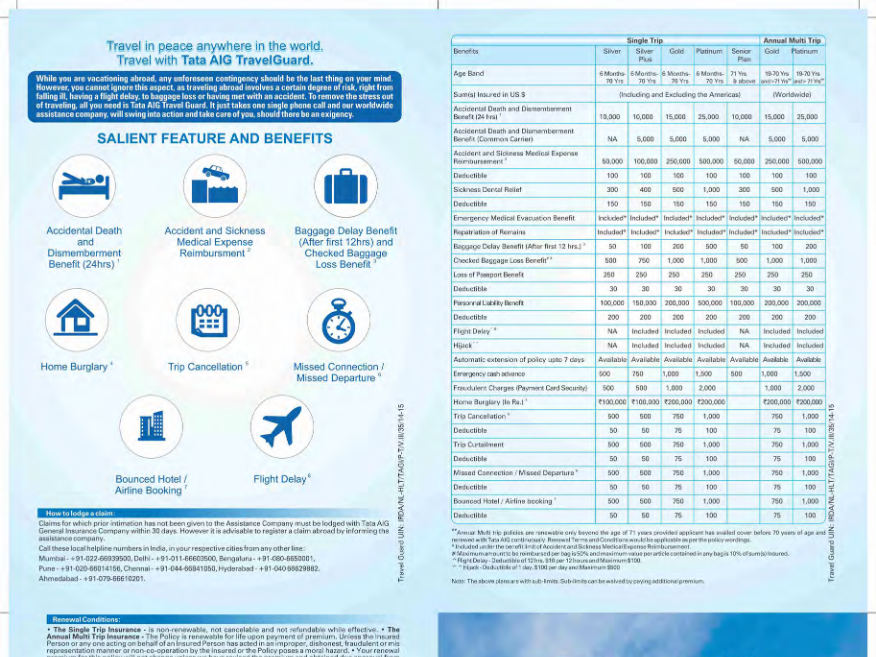

9. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Optional Cover In-patient Treatment Pre/Post Hospitalization Day Care Procedures Organ Donor Domiciliary Treatment In-patient Dental Treatment Health Check-up benefit Second opinion Ambulance cover Cumulative Bonus Consumables benefit AYUSH benefit Global Cover

36. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. If the Insured Person has exercised the Portability Option at the time of Renewal of previous health insurance policy by submitting application and the completed Portability form with complete documentation at least 45 days before the expiry of previous Policy Period to Tata AIG, upon acceptance of the proposal the Insured Person will be provided with credit gained for Pre-existing Diseases in terms of Waiting Periods and time bound exclusions up to the existing Sum Insured (& deductible) and cover in accordance with the existing guidelines of The Insurance Regulatory and Development Authority of India (IRDAI). Portability TATA AIG X INSURANCE

22. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Tele Medical Calling (Tele-MER) Age (in years)/ Sum Insured + Deductible U pto 10 lacs > 10 Lacs 0-45 46-65 Tele MER No PPC Tele MER Tele MER Who is eligible for Tele-MER? If sum insured opted is Rs. 2 lakhs and deductible is of Rs 10 lakhs, total of sum insured and deductible is Rs 12 lakhs which is greater than 10 lakhs, so customer will undergo Tele-MER If sum insured opted is Rs. 5 lakhs and deductible is of Rs 2 lakhs, total of sum insured and deductible is Rs 7 lakhs which is less than 10 lakhs, so customer will not undergo Tele-MER

3. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. AGGREGATE DEDUCTIBLE HEALTH INSURANCE All claims under the policy benefits shall be payable only if the aggregate of covered medical expenses, in respect to hospitalizations in a policy year is in excess of deductible specified in policy schedule. In case of family floater policy, the deductible shall be per policy per year and in case of individual policy, the deductible shall be per insured person per year. Base health insurance policy which covers hospitalization expenses as per plan. MediCare Plus Aggregate Deductible

10. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. What is the maximum deductible option available under MediCare Plus? 15 Lakhs 1. 25 Lakhs 3. 20 Lakhs 2. 50 Lakhs 4. Knowledge Checks

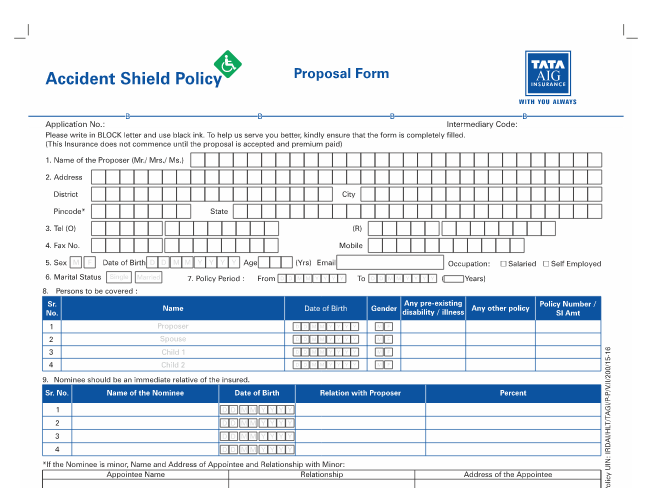

21. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. 1 Year 2 Years 3 Years Policy Tenure 2 Years 3 Years 05% 10% Long Term Discount

19. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Policy Type Individual Family Floater Self | Spouse | 3 dependent Children | 2 Dependent Parents 10% Employee Discount/Affinity Partner Discount 2 Members 3 Members More than 3 Members 20% 28% 32% Family Discount

25. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. What is the family discount available for more than 3 members? 10% 1. 28% 3. 20% 2. 32% 4. Knowledge Checks

4. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. How Aggregate Deductible plan works Date of admission for all claims should fall under same policy year and in case of policy with tenure more than 1 year, deduct ible will be applicable on per policy year basis. Aggregate of all admissible claims should cross deducible amount Admissible claim amount will be calculated on basis of MediCare Plus terms and conditions In case of floater policy, deductible amount floats over all insured members and at the time of claim, total of all claims in the policy period will be considered for computation of claim amount payable under MediCare Plus. Sum Insured Deductible Claim 1 Claim 2 Claim 3 Payable 1 Payable 2 Payable 3 10,00,000 3,00,000 1,00,000 50,000 2,00,000 - - 50,000 10,00,000 3,00,000 2,00,000 2,00,000 5,00,000 - 1,00,000 5,00,000 10,00,000 3,00,000 3,50,000 4,00,000 6,00,000 50,000 4,00,000 5,50,000

27. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Initial Waiting Period 30 days will be applicable. 36 months will be applicable. Specific Waiting Period Pre-existing Disease 24 months waiting period will be applicable for illnesses/diseases specified in the policy. Waiting Periods

33. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Call our designated TPA/Us and request pre-authorization before incurring Medical Expenses at a Network Hospital. Call our designated TPA/Us and request pre-authorization before incurring Medical Expenses at a Network Hospital. Inform our designated TPA/We within 24 hours of emergency hospitalization/ treatment. Inform our designated TPA/We 48 hours prior to the start of any planned hospitalization/treatment. Procedure for Cashless Service A rejection letter would be sent to the hospital within 6 hours in case of insufficient documents or policy related ineligibility . If the cashless is approved, original bills and evidence of tre atment shall be left with the Network Hospital. Deficiency in the documents for cashless authorization shall be communicated to the hospital by TPA/Us within 6 hours of receipt of the documents. Rejection of cashless in no way indicates rejection of the claim. Submit the claim along with required documents to decide on the admissibility of the claim. Pre-authorization does not guarantee that all costs and expenses will be covered. We reserve the right to review each claim for Medical Expenses and accordingly coverage will be determined according to the terms and conditions of this Policy. An authorization letter will be sent to the provider after checking the coverage eligibility for which you’ll need the issued ID card and complete documentation.

6. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Consumables Expenses Deductible Options No PPC, only Tele-MER Availability of consumable expenses coverage Deductible available from 2 Lakhs upto 20 Lakhs Higher Sum Insured Global Cover (Optional) Hassle free claim processing Higher sum insured options available upto 1 Crore. Option to choose Global Cover benefit U n i q u e S elli n g P o i nts

15. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Cumulative Bonus Get 50% cumulative bonus on the Sum Insured for next policy year after every claim free Policy Year, on renewing the policy with Us, without a break. The maximum cumulative bonus shall not exceed 100% of the Sum Insured in any Policy Year. Health Check-up Policy will pay for expenses for complementary preventive health check-up upto 1% of previous year policy sum insured subject to a maximum of Rs. 10,000/- , only if the insured has not made any claims in last two consecutive years Renewal Benefits

12. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Day Care Procedures 541 day care procedures will be covered upto the sum insured. Pre Hospitalization Expenses incurred in 60 days immediately before the person was hospitalized will be covered upto sum insured. Post Hospitalization Expenses incurred in 90 days immediately after the person is discharged from hospital will be covered upto sum insured. In-patient Treatment Expenses incurred for hospitalization due to disease/illness/Injury during the policy period that requires an Insured Person’s admission in a hospital as an inpatient. Coverages

13. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Organ Donor Policy covers inpatient medical expenses incurred for the donor for harvesting the organ. Domiciliary Treatment Expenses incurred in treatment taken at home which otherwise would have required hospitalization. In-patient Dental Treatment Expenses incurred for hospitalization due to disease/illness/Injury during the policy period that requires an Insured Person’s admission in a hospital as an inpatient. AYUSH Treatment Cover for expenses incurred on in-patient treatment taken under Ayurveda, Unani, Sidha and Homeopathy. Coverages

14. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Ambulance Cover Pays for ambulance service upto Rs.3000 per hospitalization in case of an Emergency or from one hospital to another hospital for better medical facilities and treatment. Global Cover (Optional Cover) Cover for Medical Expenses of the Insured Person incurred outside India, upto the sum insured, provided that the diagnosis was made in India and the insured travels abroad for treatment. Consumable Benefits Covers expenses incurred, for consumables, which are consumed during the period of hospitalization directly related to the insured person's medical or surgical treatment of illness/disease/injury. Second Opinion Provides Second opinion if the insured is diagnosed with any of the illnesses mentioned in policy wordings. Coverages

34. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Supporting Documentation & Examination Our claim form, duly completed and signed for on behalf of the Insured Person. We, upon receipt of a notice of claim, will furnish your representative with such forms as We may require for filing proofs of loss or you may download the claim form from our Web site. Photocopy of documents can also be submitted in case customer has submitted original documents with another insurer. All medical reports, case histories, investigation reports, indoor case papers/ treatment papers (in reimbursement cases, if available), discharge summaries. A precise diagnosis of the treatment for which a claim is made. A detailed list of the individual medical services and treatments provided and a unit price for each in case not available in the submitted hospital bill. All pre and post investigation, treatment and follow up (consultation) records pertaining to the present ailment for which claim is being made, if and where applicable. Stickers and invoice of implants used during surgery Copy of MLC (Medico Legal Case) records, if carried out and FIR (First Information Report), if registered, in case of claims arising out of an accident and available with the claimant. Regulatory requirements as amended from time to time, currently mandatory NEFT (to enable direct credit of claim amount in bank account) and KYC (recent ID/Address proof and photograph) requirements

24. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. PLAN Term (years) No. of members Sum Insured (Rs. Lacs) Deductible (Rs. Lacs) Age (years) 35 30 7 Total Individual Premium Global Rider Loading Apply Term Discount Apply Floater Discount (for 3 members) Net Premium (Rs.) (exclusive of tax) 3 3 10 5 15,629 10% 10% 28% 11,140 FLOATER 1,797 1,797 1,361 Individual Premium Year 1 2,179 1,797 1,361 Individual Premium Year 2 2,179 1,797 1,361 Individual Premium Year 3 Premium Computation Illustration

16. Ambulance cover pays _______ per hospitalization towards ambulance service. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. ` 2,000/- 1. ` 5,000/- 3. ` 3,000/- 2. ` 7,000/- 4. Knowledge Checks

5. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. HEALTH EXPENSES (IN LAKHS) How Deductible works All claims under the policy benefits shall be payable only if the aggregate of covered medical expenses, in respect to hospitalizations in a policy year is in excess of deductible specified in policy schedule. In case of family floater policy, the deductible shall be per policy per year and in case of individual policy, the deductible shall be per insured person per year. E.g.: Mr. ABC has taken MediCare Plus with deductible of ` 3 Lakhs. He meets with a medical expense of ` 7 Lakhs. Customer pays ` 3 Lakhs deductible Company pays the remaining ` 4 Lakhs 1 2 3 ` 4 5 6 7 ` Note: Admissible amount for all claims in a policy year should cross the deductible amount

20. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Entry Age Age Criteria No max ceasing age i.e. Lifelong Renewals Minimum Maximum Dependent children between 91 days to 5 years can be covered only if both parents are covered under the policy. 5 years Children 25 years Toddler 18 years Adults 65 years

32. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. TPA* as mentioned in the policy schedule N oti fi cation o f Claims 1 Treatment, Consultation or Procedure: 2 We or Our TPA* must be informed: If any treatment for which a claim may be made and that treatment requires planned Hospitalisation. If any treatment for which a claim may be made and that treatment requires emergency Hospitalisation. At least 48 hours prior to the Insured Person’s admission. Within 24 hours of the Insured Person’s admission to Hospital. Note: Cashless Service is only available at Network Hospitals.

35. This content is for training purpose & internal circulation only. Business cannot be solicited basis this content. Supporting Documentation & Examination In case of partial claims, photocopy of document to be submitted In case a claim is settled by another insurer, then settlement letter to be provided SETTLEMENT LETTER In case of partial claims, letter is required from another insurer that original documents have been submitted with them Admissible amount for all claims in a policy year should cross the deductible amount In case of floater policy, deductible is applicable on floater basis ie. Anyone can exhaust the deductible limit & in case of individual policy deductible is applicable on individual basis