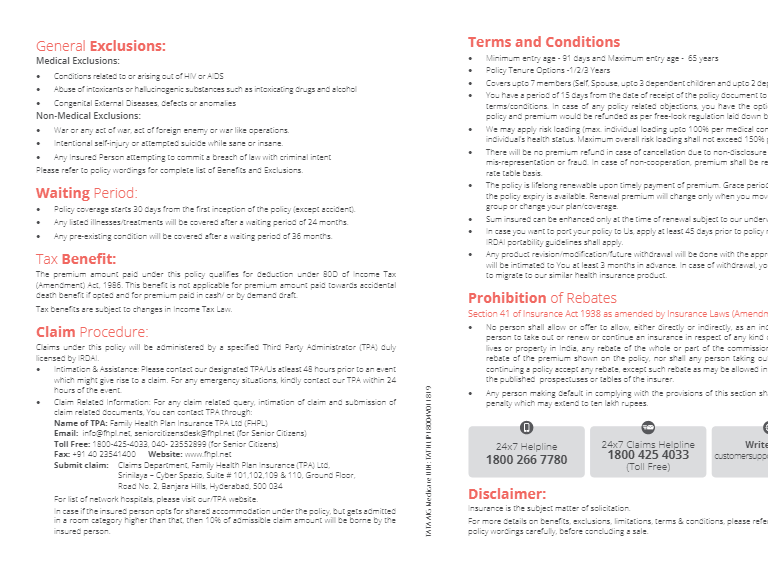

1. Plan Options Care Health Insurance (CHI) is a specialized Health Insurer o�ering health insurance services to employees of corporates, individual customers and for financial inclusion as well. With CHI’s operating philosophy being based on the principal tenet of ‘consumer-centrici - ty’, the company has consistently invested in the e�ective application of technology to deliver excellence in customer servicing, product innovation and value-for-money services. Care Health Insurance currently o�ers products in the retail segment for Health Insurance, Critical Illness, Personal Accident, Top-up Coverage, International Travel Insurance and Maternity along with Group Health Insurance and Group Personal Accident Insurance for corporates. The organization has been adjudged the ‘Best Health Insurance Company’ at the ABP News-BFSI Awards 2015 & ‘Best Claims Service Leader of the Year – Insurance India Summit & Awards 2018. Care Health Insurance has also received the ‘Editor’s Choice Award for Best Product Innovation’ at Finnoviti 2013 and was conferred the ‘Best Medical Insurance Product Award’ at The FICCI Healthcare Awards 2015. Care Health Insurance Limited e , R emember , ther e ar e some tr eatments such as non-inf ec tiv e ar thritis, joint r epla cement et c ., which ar e co v er ed onl y af t er completion of 2 consecutiv e policy y ears. For a detailed set of exclusions, please log on to www.careinsurance.com. • • An y diseases contra c t ed during f irs t 30 da ys of the policy s t ar t dat ex cept those arising out of a ccidents • Non-allopathic tr eatment • Expenses attribute to self-destruction or self-inflicted Injury, attempted suicide or suicide while sane or insane • Expenses arising out of or attributable to consumption, use, • • Medical treatment expenses traceable to childbirth (including complicated deliveries and caesarean sections incurred during hospitalization) except ectopic pregnancy • External congenital disease • T es ts and tr eatment r elating t o sterility and infertility Any pre-existing ailment/injury that was diagnosed/accquired within 48 months prior to issuance of the first policy What is not covered ? misuse or abuse of tobacco, intoxicating drugs and alcohol or hallucinogens Charges incurred in connection with cost of routine eye and ear examinations, dentures, artificial teeth and all other similar external appliance Features / Plan(Sum Insured ` ) Deductible Sum Insured Post-Hospitalization Day Care Treatment Room Rent/Category ICU Charges, Doctor’s fee etc Organ Donor Cover Health Check-up Enhance Anywhere Expert Opinion (Add-on Benefit) Pre-Hospitalization 60 Days Yes Single Private Room with A.C No Limit Up to Sum Insured Yes 30 Days In-patient Care Up to Sum Insured Up to Sum Insured 60 Days Yes Single Private Roomwith A.C., upgradable to next level No Limit Up to Sum Insured Yes Yes Yes No Yes 30 Days 1 lac to 10 lac (multiple of 1 lac) 1 lac to 30 lac (multiple of 1 lac) 5 Lac 45 Lac 55 Lac 10 Lac 15 Lac 20 Lac Enhance 1 Enhance 2 40 Lac 50 Lac 35 Lac 45 Lac 30 Lac 40 Lac Policy Terms Minimum entry age Individual – Adult : 18 years and above, Children: 5 Years to 24years Floater – Adult : 18 years and above, Children: 1 day to 24 years with at least 1 member of age 18 years or above Maximum Entry Age No age bar Renewal lifelong renewability The Policy can be renewed under the then prevailing Health Insurance Product or its nearest substitute approved by IRDA. Renewal premium Premium payable on renewal and on subsequent continuation of cover are subject to change with prior approval from IRDA. Co-payment If you enroll at the age of 61 years or more, you will have to pay 20% of the claim amount under the policy. We pay the rest. Four years of continuous coverage. Waiting period 30 days for any illness except injury. Based on the assessment of the extra risk on account of medical conditions by the underwriter, the premium shall be loaded accordingly . Group discount 5% to 20%, depending upon the group size. Change in sum insured You can modify your sum insured under the policy only upon renewal. Grace period 30 days from the date of expiry to renew the policy. Waiting period for pre-existing illnesses Two years of continuous coverage. Waiting period (Named ailments) Underwriting loading This is only summary of selective features of product . For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. Please seek the advice of your insurance advisor if you require any further information or clarification. Insurance is a subject matter of solicitation. CIN:U66000DL2007PLC161503 UAN:20094047 UIN:RHIHLIP21372V022021 is a trademark of Care Health Insurance Limited. IRDAI Registration Number - 148 Ver: SEP/20 Care Health Insurance Limited (Formerly Religare Health Insurance Company Limited) Registered Office: 5th Floor, 19 Chawla House, Nehru Place,New Delhi-110019 Corresp.Office: Unit No. 604 - 607, 6th Floor, Tower C, Unitech Cyber Park, Sector-39, Gurugram -122001 (Haryana) Website: www.careinsurance.com E-mail: customerfirst@careinsurance.com Call us: 1800-102-4488 To know more, visit our website 1800-102-4488 customerfirst@careinsurance.com www.careinsurance.com Online renewals Customer support Claim centre Quick quote & buy BEST HEALTH INSURANCE COMPANY OF THE YEAR EMERGING ASIA INSURANCE AWARDS 2019

2. is a simple, straightforward plan designed to o�er you an unmatched hassle-free experience. But what if the illness is way too critical and expenses tower beyond what you ever imagined or could a�ord? Considering the growing medical inflation, you sure don’t want that extra burden turning your world upside down. Simply put, if you opt for a ` 6 lac Sum Insured with deductible of ` 2 lac, then 2 lac will be borne by you and 6 lac over and above the deductible of 2 lac will be borne by us during the policy period. Which is why, at Care Health Insurance (CHI), we have designed - a high deductible health insurance for you and your family. With , you have that extra safety net of coverage which works on the principle of policy deductible. Simply choose your comfort level in terms of the deductible you can manage (either by self-financing or any other insurance) along with your desired Sum Insured and stay worry free when it comes to you and your family’s current and future healthcare needs. Think Health Insurance and a hundred questions pop up in your mind. First among them being, how much insurance cover do I need? While some feel capable enough to self-finance their healthcare treatment if and when need arises; others feel satisfied with their existing insurance cover. Pre Hospitalization - We cover medical expenses like examination, tests, medication etc. incurred by you before your hospitalisation. Post Hospitalization - We also cover the medical expenses incurred by you on follow-up visits, consultations, therapy, medication etc. after your hospitalisation. • Flexible choice of deductible with wide range of Sum insured options max upto ` 55 lakhs* • Annual health check-up for adult insured members – regardless of claim history • No p re-policy medical check-up for coverage – (Deductible + Sum Insured) less than 40 lacs, till 50 years of age • Avail selec t medical treatment anywhere in the world with Anywhere feature • Hassle-free cashless treatment at leading hospitals, across the country • Claim settlement directly by us Advantage Highlights • In-patient Care • Organ donor cover • Day Care Treatment • Floater Option • Pre & Post Hospitalization • Longer Policy Term • Enhance Anywhere • Tax Benefit • Expert Opinion (Add-on Benefit) - Get enhanced coverage for greater protection! - From the worry-free world of CHI. Come join in anytime Be a part of the CHI family and continue to get uninterrupted coverage with no compromises at all. Get quality service, enhanced product features and even a reduction in waiting period by the number of years of continuous coverage under a similar plan with your previous insurer. The table below will help you understand better. We would like you to undergo certain medical tests that will enable us to get a better understanding of your current and future health needs, and help us in ensuring your sustained good health. Cost of Medical Check-up - • The cost of the medical test will be borne by Us in case the policy is opted for 2 or 3 years. • I f the polic y is opted for 1 year and the proposal is accepted, we shall reimburse at least 50% of the cost incurred towards Medical Check-up. • I f your proposal is rej ected, or policy cancelled during the free-look period, the cost of medical tests will be deducted from the refund-able premium. Pre-Policy Medical Check-up Age / (SI + Deductible) Up to 14 L 15L to 40L No Ye s No No Ye s Ye s Ye s Ye s > 40 L No No No Ye s Up to 17 Years 18 - 24 Years 25 - 50 Years 51 Years and above One policy. Covers entire family. Under the ‘floater plan’, you can cover any member of your immedi ate family (yourself, spouse and children or parents) for the sum insured in a single policy. Longer policy term, more convenience To make the process of renewing your health insurance more convenient, you can choose a policy with tenure between one to three years. is simple We believe in the old adage, “The proof of the pudding is in the eating.” So we back up our promise with an enduringly simple claims procedure, which involves just you and us. Either in the case of an emergency or a planned hospitalisation, all you have to do is present the CHI Health Card at our network of more than 7000+ leading hospitals pan India and avail cashless service. In case of reimbursement of expenses when you use a non-network hospital, all you need to do is notify us immediately about the claim. Call us directly, send us the specified documents and we’ll process your claim. Right from the time of diagnosis to hospitalisation and even beyond discharge, we take care of your health, hamesha! Since you interact directly with us, we can be doubly sure that you are satisfied. And when you are satisfied, we feel satisfied too. Hospitalisation for at least 24 hours - If you are admitted to a hospital for in-patient care, for a minimum period of 24 consecutive hours, we pay for - room charges, nursing expenses and intensive care unit charges to surgeon’s fee, doctor’s fee, anaesthesia, blood, oxygen, operation theater charges, etc. We deliver on ou r promises. We ta ke pride in offering hassle-free clea ra nce a nd speedy settle ments. With cashless hospitalisation, you no longer need to run around paying o� hospital bills and then following up for a reimbursement. All you now need to do is get admitted to any of our network hospitals and concentrate only on your recovery. Relieve yourself from the worry of arranging for the funds. Leave the bill payment arrangements to us. Cashless Treatment File your claims directly with us Your treatment is comprehensive Being committed to your total well-being, we go an extra mile to provide you with holistic features & services. Health check-up - regardless of claim history Our concern is your good health. To pre-empt your ever having to visit a hospital, we provide an annual health check-up for yourself and adult members of your family covered by the policy. We cover organ donors We care about those who help you as much as we care for you. So, beyond ensuring that your medical needs are met, we will reimburse you for medical expenses that are incurred by an organ donor while undergoing the organ transplant surgery. Reduce your tax liability* Opting for health insurance is certainly a step in the right direction, and it comes with a two-fold benefit. Not only does it ensure that you and your family can access good medical care at all times, it also enables you to avail of a tax benefit on the premiums you pay towards your health insurance, as per prevailing tax laws of the Income Tax Act, 1961. Review your decision We have your best interests at heart and at the same time recognise that you know your needs best. Hence, after purchasing the policy, if you find it unsuitable, you can cancel and return the policy to us. Our policies come with a free-look period of 15 days from the date of receipt of policy. comes with much more works on the simple principle of Policy Deductible , which is the pre-defined amount that you will bear, through your own finances or any other insurance, during a medical event. Any amount over and above policy deductible will be borne by us. 600,000 200,000 75,000 125,000 100,000 100,000 - - 600,000 200,000 75,000 250,000 300,000 300,000 - 125,000 600,000 200,000 250,000 400,000 400,000 50,000 150,000 400,000 Sum Insured Scenario 1 Scenario 2 Scenario 3 Deductible Claim Amount 1 Claim Amount 2 Claim Amount 3 Payable Amount 1 Payable Amount 2 Payable Amount 3 Add On Benefit* Expert Opinion We take your illness as seriously as you do. If you are su�ering from a serious illness and feel uncertain about your diagnosis or wish to get a second opinion of an expert/doctor, we arrange one for you. *Available on payment of additional premium. *Tax Benefits under the policy will be as per the prevailing Income Tax laws and are subject to amendments from time to time. For tax related queries, contact your independent tax advisor. * Deductible options are available upto a max of 20 Lacs. Select combinations of SI & deductible are available.