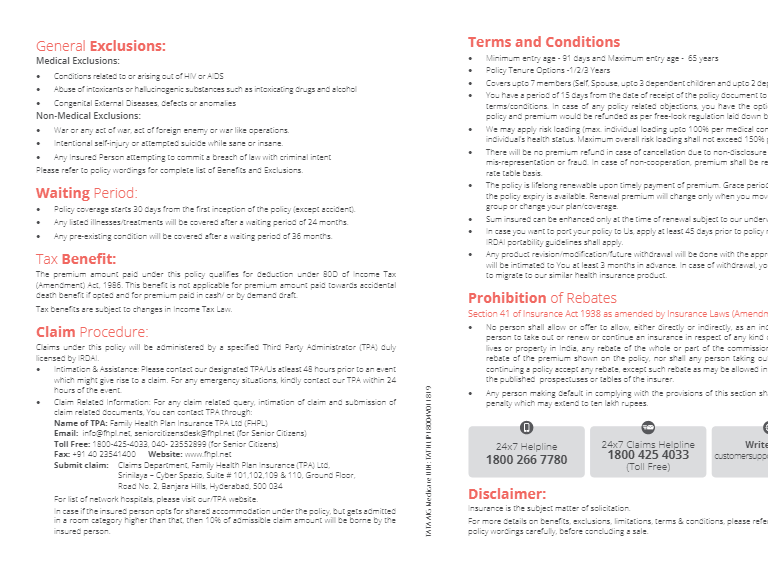

2. reflects our commitment of o�ering access to Quality Healthcare to individuals who have been su�ering from pre-existing cardiac ailments/disorders and undergone a cardiac surgery/proce - dures for the same. And we’re here for the long run, so rest assured of lifelong renewability with us. * Optional Cover is available on payment of additional premium. One medical emergency in the family and the entire household is in a state of flux. We understand this and therefore will be there by your side at the time of need. Here’s how: 1. In-patient Care: In-patient Care: Hospitalization for at least 24 hours - We will pay for the medical expenses, through Cashless or Reimbursement Facility (maximum up to Sum Insured) - from room charges, nursing expenses, ICU charges, surgeon’s fee, doctor’s fee, anesthesia, blood, oxygen, OT charges and the like. 2. Day Care Treatment: Hospitalization involving less than 24 hours – We will pay through Cashless or Reimbursement Facility for such listed day care treatments, maximum up to Sum Insured. 3. Pre-Hospitalization & Post-Hospitalization Medical Expenses: Medical expenses are not just restricted to the hospitalization costs, so with Care Heart you are covered for pre-hospitalization and post-hospitalization expenses as well. All you need to do is just focus on your treatment and recovery – the insured are covered for 30 days preceding the hospitalization and 60 days after discharge (maximum up to 5% of Sum Insured). 4. Ambulance Cover: Through this cover, we will pay you up-to a specified amount per hospitalization, for expenses that you incur on ambulance service o�ered by the hospital or any service provider , in an emergency situation. 5. Alternative Treatments: Combination of conventional medical and alternative treatments such as Ayurveda, Unani, Sidha and homeopathy quicken & aid the process of recovery therefore we will pay up-to specified amount towards alternative treatments for your speedy recovery. 6. Cardiac Health Check-up: On request, CHI will arrange a Cardiac Health Check-up on cashless basis for the set of medical tests specified in the policy as per the Sum Insured at its network provider or any other empanelled providers in India. This benefit shall be available only once during a policy year for each insured covered under the Policy. 7. Automatic Recharge: A refill is always welcome! So your sum insured is reinstated just when you need it the most. If, due to claims made, you ever utilize the maximum limit of Sum Insured and thereby run out of/exhaust your health cover, we reinstate the entire sum insured immediately, once in the policy year. This re-instated amount can be used for future claims which are not in relation to any Illness or Injury for which a Claim has already been admitted for You during that Policy Year. In case of a floater policy, the insured(s) who have not claimed will be eligible to utilize the Recharge amount for any illness or injury pertaining to that Policy Year. 8. No Claims Bonus: Get a flat increase of 10 per cent in sum insured for the next Policy year. No Claims bonus in any case will not exceed 50% of the Sum insured under the policy and in the event there is a claim in a policy year, then the No Claims bonus accrued will be reduced by 10% of the sum insured but in no case shall the Total Sum Insured be less than the Sum insured. It’s just our way to tell you that we’re there with you in good times and in bad. 9. Domiciliary Hospitalization: Sometime you are not in a condition to be moved to a Hospital or a Hospital room may not be available when you need the medical treatment the most. Under this Benefit, We will pay you up to Sum Insured, for the Medical Expenses incurred during your treatment at home, as long as it involves medical treatment for a period exceeding 3 consecutive days. ‘Pre Hospitalization Medical Expenses and Post Hospitalization Medical Expenses' shall not be payable in respect of a claim made under this Benefit. Salient Features Life-long Renewability Cardiac Health check-up No Claim Bonus Only 2 years wait period for pre-existing ailments Plan Details: SUM INSURED ** ` 3 Lakh ` 5 Lakh ` 7 Lakh ` 10 Lakh Pre-policy Issuance Medical Check up In-Patient Hospitalization None Up to Sum Insured Pre Hospitalization Medical Expenses and Post Hospitalization Medical Expenses Pre-Hospitalization for 30 days & Post-Hospitalization for 60 days; Maximum up to 5% of SI Up to Sum Insured Day Care Treatment Up to 25% of Sum Insured Alternative Treatments Up to 100% of Sum Insured covered after 3 days Domiciliary Hospitalization 100% of original Sum Insured upon exhaustion of SI Automatic Recharge Annually Cardiac Health Check-up 30 Days Initial Waiting Period 24 Months Pre-existing Diseases Co-payment 20% Co-payment if the entry age<=70 years 30% Co-payment if the entry age>70 years 24 Months Specific Waiting Period Up to Rs.1,000 per day; Max. 7 days per occurrence & Max. 45 days per policy year per Insured Person; Covered after a deductible of 1 day Up to Rs.2,000 per day; Max. 7 days per occurrence & Max. 45 days per policy year per Insured Person; Covered after a deductible of 1 day Home Care (Optional Cover) Up to 1% of SI per day Single Private Room Room Rent / Room Category Up to 2% of SI per day No Limit ICU Charges 10% increase in SI per Policy Year in case of claim-free year; Max up to 50% of SI (10% decrease in SI per Policy Year in case a claim has been paid; Such decrease is only in SI accrued as NCB) No Claims Bonus Ambulance Cover Up to Rs 2,000 per Hospitalization Up to Rs 3,000 per Hospitalization Wait Periods provides the flexibility to choose from any of the follow - ing benefits according to the plan suitable for your needs. Optional Benefits Live a Hearty life with - A Stand Out Product ACTIVE HEALTH CHECK-UP * THRICE A YEAR OPD CARE * HOME CARE * INTERNATIONAL 2 ND OPINION *

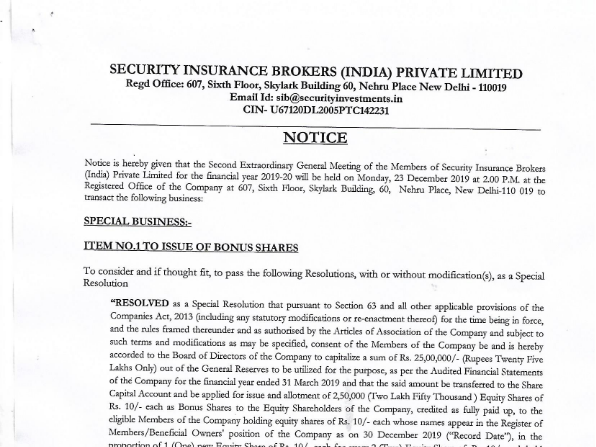

1. Care Health Insurance Limited (Formerly known as Religare Health Insurance Company Limited) Registered Office: 5th Floor, 19 Chawla House, Nehru Place, New Delhi-110019 Correspondence Office: Unit No. 604 - 607, 6th Floor, Tower C, Unitech Cyber Park, Sector-39, Gurugram -122001 (Haryana) Website: www.careinsurance.com E-mail: customerfirst@careinsurance.com Call us: 1800-102-4488 | 1800-102-6655 Disclaimer: This is only summary of selective features of product For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. Please seek the advice of your insurance advisor if you require any further information or clarification. Insurance is a subject matter of solicitation. CIN:U66000DL2007PLC161503 UAN:20094045 UIN: RHIHLIP19066V011819 IRDA Registration Number - 148 Care Health Insurance Limited Care Health Insurance (CHI) is a specialized Health Insurer o�ering health insurance services to employees of corporates, individual customers and for financial inclusion as well. With CHI’s operating philosophy being based on the principal tenet of ‘consumer-centrici - ty’, the company has consistently invested in the e�ective application of technology to deliver excellence in customer servicing, product innovation and value-for-money services. Care Health Insurance currently o�ers products in the retail segment for Health Insurance, Critical Illness, Personal Accident, Top-up Coverage, International Travel Insurance and Maternity along with Group Health Insurance and Group Personal Accident Insurance for corporates. The organization has been adjudged the ‘Best Health Insurance Company’ at the ABP News-BFSI Awards & ‘Best Claims Service Leader of the Year – Insurance India Summit & Awards. Care Health Insurance has also received the ‘Editor’s Choice Award for Best Product Innovation’ at Finnoviti and was conferred the ‘Best Medical Insurance Product Award’ at The FICCI Healthcare Awards. Best Health Insurance Company - ABP News – BFSI Awards 2015, Best Claims Service Leader of the Year - Insurance India Summit & Awards 2018, Best Product Innovation - Editor’s Choice Award Finnoviti 2013, Best Medical Insurance Product - FICCI Healthcare Awards 2015. A HEART SURGERY WILL NOT STOP YOU FROM GETTING A HEALTH INSURANCE Ver: SEP/20 Eligibility Criteria Ent r y Age Minimum 18 years Entry Age Maximum No Maximum Age Renewable Life long T e n u r e 1/2/3 Y ears Eligibility Criteria Person/either one Person in case of a Floater Policy with 2 Adults, who have been diagnosed with a cardiac ailment/disorder in the past and undergone a Cardiac surgical intervention or procedure for the same Who are Covered (Relationship with Respect to the Proposer) Individual: Self, legally married Spouse, Son, Daughter, Father, Mother, Brother, Sister, Mother-in-Law, Father-in-Law, Grandmother, Grandfather, Grandson, Granddaughter, Uncle, Aunt, Nephew, Niece, Employee or any other relationship having an insurable interest. C o v er T ype Individual : Maximum 6 persons in a Policy Floater :2 Adults (self and spouse) Notes: - All the Age calculations are as per “Age Last Birthday” as on the date of first issue of Policy and / or at the time of Renewal. Option of Mid-term inclusion of a Person in the Policy will be only upon marriage or childbirth; Additional di�erential premium will be calculated on a pro rata basis. - If Insured persons belonging to the same family are covered on an Individual basis, then every Insured person can opt for di�erent Sum Insured and di�erent Optional Benefits. - Your Eligibility Criteria is Subject to Underwriting Criteria of the Company. BEST HEALTH INSURANCE COMPANY OF THE YEAR EMERGING ASIA INSURANCE AWARDS 2019 Sub-limits SUM INSURED ** ` 3 Lakh ` 5 Lakh ` 7 Lakh ` 10 Lakh Up to ` 30,000 per eye Up to ` 1,20,000 per knee Up to ` 20,000 per eye Treatment of Cataract i. Surgery for treatment of all types of Hernia ii. Hysterectomy iii. Surgeries for Benign Prostate Hypertrophy (BPH) iv. Surgical treatment of stones of renal system Up to ` 80,000 per knee Up to ` 1,00,000 per knee Up to ` 80,000 Up to ` 50,000 Up to ` 65,000 Treatment of Total Knee Replacement Treatment for each and every Ailment / Procedure mentioned below:- i. Treatment of Cerebrovascular disorders ii. Treatments/ Surgeries for Cancer iii. Treatment of other renal complications and Disorders iv. Treatment for breakage of bones Up to ` 300,000 Up to ` 200,000 Up to ` 250,000 Treatment for each and every Ailment / Procedure mentioned below:- **Other sum insured options are also available. To know more, visit our website 1800-102-4488 | 1800-102-6655 customerfirst@careinsurance.com www.careinsurance.com Online renewals Customer support Claim centre Quick quote & buy