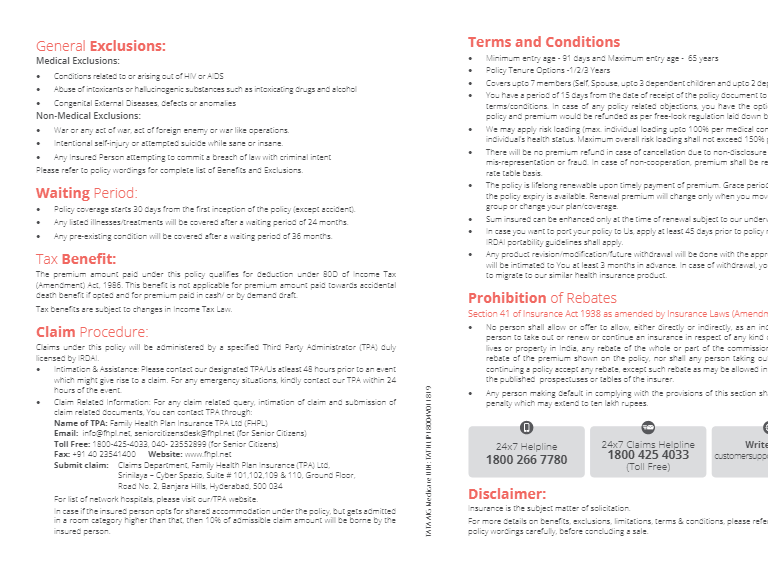

2. Comprehensive Coverage 1. Hospitalisation Expenses • In-patient Care (at least 24 hrs of Hospitalisation ) If you are admitted to a hospital for in-patient care, for a minimum period of 24 consecutive hours, we pay for - room charges, nursing expenses and intensive care unit charges to surgeon’s fee, doctor’s fee, anaesthesia, blood, oxygen, operation theatre charges, etc. • Day Care (less than 24 hrs of Hospitalisation ) We also pay for your medical expenses if you undergo day care treatment at a hospital that requires hospitalisation for less than 24 hours – we cover comprehensive range of day care treatments. 2. Pre-Hospitalisation (Up to 30 days) • Examination, tests and medication Sometimes the procedures that finally lead you to hospital, such as investigative tests and medication, can be quite financially draining. We cover the medical expenses incurred by you before your hospitalisation. • Getting to the hospital It is our utmost concern that you get the medical attention you require as soon as possible, especially in an emergency. We will reimburse you for expenses that you incur on an ambulance service offered by the hospital or any service provider, in an emergency situation. 3. Post-Hospitalisation (Up to 60 days) • Back home and till you are back on your feet The expenses don’t end once you are discharged. There are bound to be follow-up visits to your medical practitioner, medication that is required and sometimes even further confirmatory tests. We also cover the medical expenses incurred by you after your hospitalisation. THE JOY OF MATERNITY – ASSURED! KEY BENEFITS Maternity Cover We will cover maternity-related expenses incurred with respect to hospitalisation for the delivery of the child. What’s more, we even cover pre and post-natal expenses! Newborn Baby Cover We will cover the medical expenses of your newborn from birth till the completion of 90 days. After 90 days, your baby would be covered under the regular policy upon payment of additional premium. THE JOY HIGHLIGHTS • In-patient Care • Day Care Treatment • Maternity Cover • Newborn Baby Cover • Pre & Post Hospitalisation Cover • Ambulance Cover • No Claim Bonanza (Optional Cover - available on payment of additional premium) • Single Private Room with AC The miracle of life is one of the most overwhelming experiences you can ever have. No matter how much you prepare for it, when the event finally occurs, you are sure to be completely overjoyed. Motherhood and parenthood is life’s greatest journey. It will be highlighted by moments of wonder and delight but also moderated by numerous concerns and apprehensions. Your precious bundle of joy will certainly add many memorable instances to your life. And yet, at Care Health Insurance, we understand that your happiness will only be complete when you live with complete reassurance about your family’s health and that of your newest member’s. That’s why we have designed – a new-age insurance product that comprehensively addresses your maternity and health needs, both today and tomorrow. has been conceived to not only cover hospitalisation expenses during pregnancy but also stand by you in the most important phase of your life. So give your precious bundle of joy the present it truly deserves – ARE YOU READY FOR THE GREATEST JOURNEY OF YOUR LIFE? Welcoming a baby into your life is a wonderful thing and you would leave no stone unturned to plan and ensure everything is simply perfect. This is particularly true when it comes to health – both yours and that of your baby’s. While no one can assure you that you will always be in the pink of health, Care Health Insurance can assure you that we will take care of any health hassles you may face during your pregnancy and even after the delivery. We will provide you access to the quality healthcare facilities when you need it so that you don’t face any anxiety about medical bills and other related expenses. With standing by you, you can be worry-free as you look forward to your family’s precious new addition. With us as your health insurer, it is truly health... hamesha! CHI PHILOSOPHY Along with maternity and new born coverage, offers you a number of thoughtfully designed features and services that give you several advantages at the most critical of times. These include: • A perfect blend of hospitalisation and maternity insurance • Only 9 month waiting period for maternity-related insurance claims • Newborn Baby Cover • Long-term policy tenure of 3 years • 100% increase in sum insured with No Claim Bonanza (Optional Cover) ENJOY THE ADVANTAGE Simple, Convenient and More We believe in the power of sim plicity. That’s why JOY is an uncom - plicated, clear-cut plan designed to offer maximum convenience. • Longer Policy Term (3 year policy) - We want to ensure that you consistently stay healthy and happy. That’s why we have reduced the hassles by making JOY a 3 year policy. This means you don’t have to worry about policy renewal and instead, focus on what’s important – your baby. • Cashless Facility - With cashless facility, you no longer need to run around paying off hospital bills and then following up for a reimbursement. Simply get admitted to any of our network hospitals and concentrate only on your recovery and leave the bill payment arrangements to us. • File your claim directly with us - We make claims procedures very simple. • Either in the case of an emergency or a planned hospitali - sation, all you have to do is present the CHI JOY Health Card at our network of more than 7000+ leading hospitals pan India and avail of the cashless service. • In case of reimbursement of expenses when you use a non-networked hospital, all you need to do is notify us immediately about the claim. Call us directly, send us the specified documents and we’ll process your claim. • Since you interact directly with us, we can be doubly sure that you are satisfied. A nd when you are satisfied, we feel satisfied too.

1. Health Insurance with Maternity & Newborn Cover Disclaimer: This is only summary of selective features of product ( Plan Joy Today). For more details on risk factors , terms and conditions please read sales brochure carefully before concluding a sale. Please seek the advice of your insurance advisor if you require any further information or clarification. Insurance is a subject matter of solicita tion. CIN:U66000DL2007PLC161503 UAN: 20094050 UIN:RHIHLIP21373V022021 is a trademark of Care Health Insurance Limited. IRDAI Registration Number - 148 Care Health Insurance Lim ited (Formerly Religare Health Insurance Company Limited) Registered Office: 5th Floor, 19 Chawla House, Nehru Place, New Delhi-110019 Correspondence Office: Unit No. 604 - 607, 6th Floor, Tower C, Unitech Cyber Park, Sector-39, Gurugram -122001 (Haryana) Website: www.careinsurance.com E-mail:customerfirst@careinsurance.com Call us: 1800-102-4488 Ver: OCT/20 WHAT IS NOT COVERED • Any pre-existing ailment/injury that was diagnosed/acquired within 48 months prior to issuance of the first policy • Any diseases contracted during first 30 days of the policy start date except those arising out of accidents • Non-allopathic treatment • Expenses attributable to self-destruction or self-inflicted Injury, attempted suicide or suicide while sane or insane • Expenses arising out of or attributable to consumption, use, misuse or abuse of tobacco, intoxicating drugs and alcohol or hallucinogens • Charges incurred in connection with cost of routine eye and ear examinations, dentures, artificial teeth and all other similar external appliances • External congenital disease For a detailed set of exclusions, please log on to www.careinsurance.com. Pre-Policy Medical Check up We would like you to undergo medical tests (as per the grid alongside) that will enable us to get a better understanding of your current and future health needs, and help us in ensuring your sustained good health. The cost of the medical test will be borne by Us. If your proposal is rejected, or policy cancelled during the free-look period, the cost of medical tests will be deducted from the refundable premium. Sum Insured – On annual basis ` 3 Lakh Hospitalisation Expenses Yes, up to Sum Insured Room Category Single Private Room with AC Pre-Hospitalisation Medical Expenses Up to 30 days Post-Hospitalisation Medical Expenses Up to 60 days Ambulance Cover Up to ` 1,000 per Claim Maternity Cover (including Pre-natal & Post-natal expenses) Up to ` 35,000 Newborn Baby Cover Up to ` 30,000 No Claim Bonanza (Optional Cover) Yes ` 5 Lakh Yes, up to Sum Insured Single Private Room with AC Up to 30 days Up to 60 days Up to ` 1,000 per Claim Up to ` 50,000 Up to ` 50,000 Ye s Plan Details Entry Age – Minimum Adult: 18 years Child: 1 Day New Born: 1 Day Entry Age – Maximum Adult: 65 years Child: 24 years New Born: 90 Days Exit Age Lifelong Cover Type Individual/ FamilyFloater Renewal Lifelong Renewability. The policy can be renewed under the then prevailing Health Insurance with Maternity Benefit Product or its nearest substitute approved by IRDA. Co-payment If you enroll at the age of 61 years or more, you will have to pay 20% of the claim amount under the policy. We pay the rest. Waiting Period 30 days for any illness except accident 9 months for maternity 2 years for specific treatments/illnesses 4 years for pre-existing diseases Grace Period 30 days from the date of expiry to renew the policy Policy Tenure 3 years Maternity Cover Available only up to 45 years of age Policy Terms Age/Sum Insured ` 3 Lakh ` 5 Lakh Up to 45 years N. A. N. A. 46 years to 55 years Yes Yes 56 years & above Yes Yes We deliver on our promises. We take pride in offering hassle-free clearance and speedy settlements. • Tax Benefi t Opting for health insurance is certainly a step in the right direction, and it comes with a two-fold benefit. Not only does it ensure that you and your family can access good medical care at all times, it also enables you to avail of a tax benefit on the premiums you pay towards your health insurance, as per prevailing tax laws of the Income Tax Act, 1961 * . • Free Look Period We have your best interests at heart and at the same time recognise that you know your needs best. Hence, after purchasing the policy, if you find it unsuitable, you can cancel and return the policy to us with no questions asked. Our policies come with a free-look period of 15 days from the date of receipt of Policy. If no Claim has been made under the Policy, we will refund the premium received after deducting proportionate risk premium for the period on cover, expenses for medical examination and stamp duty charges, as applicable. * Tax Benefits will be as per the prevailing Income Tax laws and are subject to amendments from time to time. For tax related queries, contact your independent tax advisor. Optional Cover – No Claim Bonanza # CHI believes th at g o od health should not only be celebrated but rewarded as well. That’s why comes with the No Claim Bonanza feature, wherein, if there are no claims during the policy tenure of 3 years, you receive a bonus of 100% of your sum insured. It's just our way to tell you that we're there with you - in good times and in bad. # Optional Cover is available on payment of additional premium. To know more, visit our website 1800-102-4488 | 1800-102-6655 customerfirst@careinsurance.com www.careinsurance.com Online renewals Customer support Claim centre Quick quote & buy BEST HEALTH INSURANCE COMPANY OF THE YEAR EMERGING ASIA INSURANCE AWARDS 2019