1. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 1 BAJAJ ALLIANZ EXTRA CARE PLUS A SUPER TOP UP PLAN TO TAKE CARE OF HIGHER MEDICAL EXPENSES CIN: U66010PN2000PLC015329 | UIN:BAJHLIP20147V021920

18. 18 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 For more details on risk factors, Terms and Conditions, please read the sales brochure before concluding a sale. CIN: U66010PN2000PLC015329 |UIN: BAJHLIP20147V021920 ADCODE Policy holders can download Caringly Yours app for one -touch access Available on: BAJAJ ALLIANZ GENERAL INSURANCE CO. LTD. BAJAJ ALLIANZ HOUSE, AIRPORT ROAD, YERAWADA, PUNE - 411006. IRDA REG NO.: 113. FOR ANY QUERY (TOLL FREE) 1800-209-0144 /1800-209-5858 www.bajajallianz.com bagichelp@bajajallianz.co.in

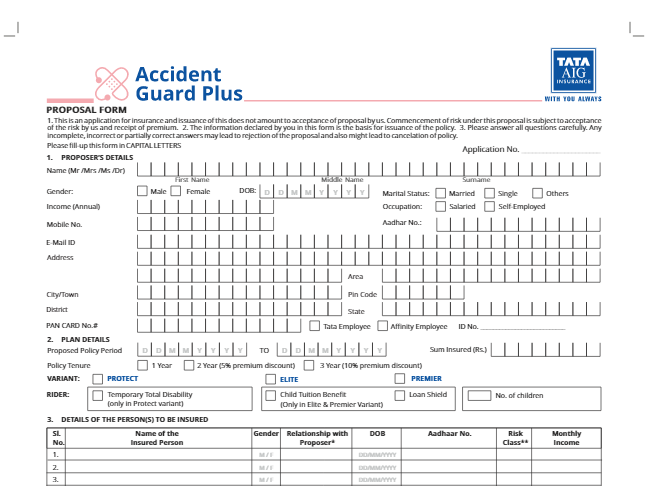

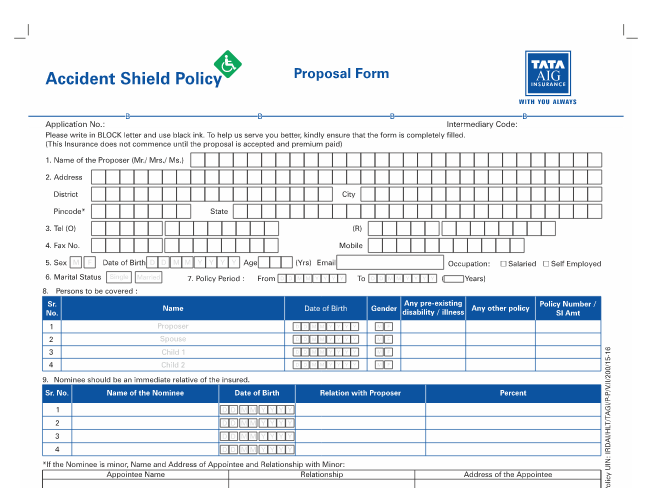

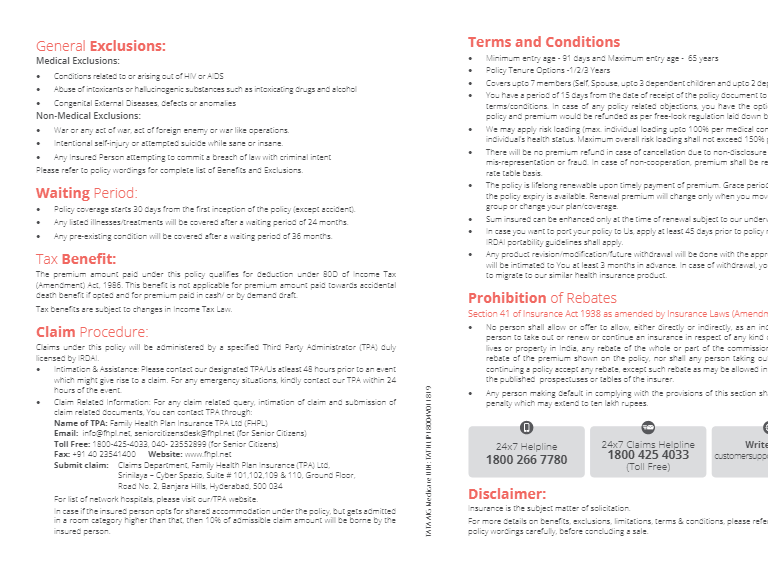

17. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 17 iv. However, where the circumstances of a claim warrant an investigation, the Company will initiate and complete such investigation at the earliest, in any case not later than 30 days from the date of receipt of last necessary document. In such cases, the Company will settle the claim within 45 days from the date of receipt of last necessary document. In case of delay beyond stipulated 45 days, the Company will be liable to pay interest at a rate which is 2% above the bank rate from the date of receipt of last necessary document to the date of payment of claim v. If the insurer, for any reasons decides to reject the claim under the policy the reasons regarding the rejection shall be communicated to the insured in writing within 30 days of the receipt of documents. The insured may take recourse to the Grievance Redressal procedure. ◼ HOW DO I BUY THIS POLICY? 1. Discuss the policy benefits, coverage and premium details with your insurance advisor or visit our website (www.bajajallianz.com) for details 2. Actively seek information on the charges and exclusions under the policy 3. Fill the proposal form stating your personal details and health profile 4. Ensure that the information given in the form is complete and accurate 5. The Policy Schedule, Policy Wordings, Cashless Cards and Health Guide will be sent to your mailing address mentioned on the proposal form Contact: Health Administration Team, Bajaj Allianz General Insurance Co. Ltd. 2nd floor, Bajaj Finserv Building, Behind Weikfield IT Park, Off Nagar Road,Viman Nagar-Pune - 411 014. For sales and Renewal-1800- 209- 0144 For service-1800- 209- 5858 / 1800- 102- 5858 / 020-30305858 Cashless facility offered through network hospitals of Bajaj Allianz only.Cashless facility at 5500+ Network hospitals PAN India. Please visit our website for list of network hospitals and network Diagnostic Centers , Website: www. bajajallianz.com or get in touch with 24*7 helpline number: 1800-103-2529 (toll free) / 020-30305858 Grievance Redressal Cell for Senior Citizens Senior Citizen Cellfor Insured Person who are Senior Citizens ‘Good things come with time’ and so for our customers who are above 60 years of age we have created special cell to address any health insurance related query. Our senior citizen customers can reach us through the below dedicated channels to enable us to service them promptly Health toll free number: 1800-103-2529 Exclusive Email address:bagichelp@bajajallianz.co.in, seniorcitizen@bajajallianz.co.in ◼ SECTION 41 OF INSURANCE ACT 1938 AS AMENDED BY INSURANCE LAWS AMENDMENT ACT, 2015 (PROHIBITION OF REBATES) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a Policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurers. Any person making default in complying with the provision of this section shall be liable for a penalty which may extend to 10 lakh rupees.

10. 10 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 ◼ PORTABILITY CONDITIONS Portability shall be allowed under all individual indemnity health insurance policies issued by General Insurers and Health Insurers including family floater policies. ◼ MIGRATION OF POLICY: 1. Every individual policy holder (including members under family floater policy) covered under indemnity based individual health insurance policy shall be provided an option of migration at the explicit option exercised by the policyholder; a. To an individual health insurance policy or a family floater policy, or; b. To a group health insurance policy, if members complies with the norms relating to the health insurance coverage under the concerned group insurance policy. 2. Every Individual member, including family members covered under an indemnity based group health insurance policy shall be provided an option of migration at the time of exit from group or in the event of modification of group policy (including the revision in the premium rates) or withdrawal of the group policy : a. To an individual health insurance policy or a family floater policy. 3. Migration shall be applicable to the extent of the sum insured under the previous policy and the cumulative bonus, if any, acquired from the previous policies. 4. Only the unexpired/residual waiting period not exceeding the applicable waiting period of the previous policy with respect to pre-existing diseases and the time bound exclusions shall be made applicable on migration under the new policy. 5. Migration may be subject to underwriting as follows: a. For individual policies, if the policyholder is continuously covered in the previous policy without any break for a period of four years or more, migration shall be allowed without subjecting the policyholder to any underwriting to the extent of the sum insured and the benefits available in the previous policy. b. Migration from group policies to individual policy will be subject to underwriting ◼ REVISION/ MODIFICATION OF THE POLICY: There is a possibility of revision/ modification of terms, conditions, coverages and/or premiums of this product at any time in future, with appropriate approval from IRDAI. In such an event of revision/modification of the product, intimation shall be set out to all the existing insured members at least 3 months prior to the date of such revision/modification comes into the effect ◼ WITHDRAWAL OF POLICY There is possibility of withdrawal of this product at any time in future with appropriate approval from IRDAI, as We reserve Our right to do so with a intimation of 3 months to all the existing insured members. In such an event of withdrawal of this product, at the time of Your seeking renewal of this Policy, You can choose, among Our available similar and closely similar Health insurance products. Upon Your so choosing Our new product, You will be charged the Premium as per Our Underwriting Policy for such chosen new product, as approved by IRDAI. Provided however, if You do not respond to Our intimation regarding the withdrawal of the product under which this Policy is issued, then this Policy shall be withdrawn and shall not be available to You for renewal on the renewal date and accordingly upon Your seeking renewal of this Policy, You shall have to take a Policy under available new products of Us subject to Your paying the Premium as per Our Underwriting Policy for such available new product chosen by You and also subject to Portability condition.

3. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 3 c. Post-hospitalisation expenses The medical expenses incurred in the 90 days immediately after you were discharged, provided that: i. Such medical expenses were in fact incurred for the same condition requiring earlier Hospitalisation, and; ii. We have accepted the claim under In-Patient Hospitalisation expenses d. Day care treatment We will pay you the medical expenses as listed under In-patient Hospitalisation Expenses for Day care procedures / Surgeries taken as an inpatient in a hospital or day care centre but not in the outpatient department. List of Day Care Procedures is given in the annexure I of Policy wordings. e. Modern Treatment Methods: Modern Treatment Methods and Advancement in Technologies are covered up to 50% of Sum Insured or 5 lacs whichever is lower, subject to policy terms, conditions, coverages, waiting periods and exclusions. i. Uterine Artery Embolization and HIFU ii. Balloon Sinuplasty iii. Deep Brain stimulation iv. Oral chemotherapy v. Immunotherapy- Monoclonal Antibody to be given as injection vi. Intra vitreal injections vii. Robotic surgeries viii.Stereotactic radio surgeries ix. Bronchical Thermoplasty x. Vaporisation of the prostrate (Green laser treatment or holmium laser treatment) xi. IONM -(Intra Operative Neuro Monitoring) xii. Stem cell therapy: Hematopoietic stem cells for bone marrow transplant for haematological conditions to be covered. 2. Maternity Expenses: We will pay the Medical Expenses related to pregnancy, childbirth or medically recommended and lawful termination of pregnancy, limited to maximum 2 deliveries or termination(s) or either, during the lifetime of the insured person as below:-. i. We will cover the Medical expenses for maternity including complications of maternity over and above the aggregate deductible limit as specified under the policy schedule ii. We will also cover expenses towards lawful medical termination of pregnancy during the Policy period. iii. In patient Hospitalization Expenses of pre-natal and post-natal hospitalization iv. Waiting Period of 12 months from the date of inception of the first Extra Care Plus Policy with us. However this 12 months exclusion would not be applicable in case of continuous renewal of Extra Care Plus Policy without break in cover. 3. Ambulance Expenses If a claim under Medical Expenses is accepted, We will also pay the ambulance expenses to a maximum of Rs3000/- per valid hospitalization claim for transferring You/Your family member(s) named in the schedule to or between Hospitals in the Hospital’s ambulance or in an ambulance provided by any ambulance service provider. 4. Organ Donor Expenses We will pay for Medical treatment of the organ donor for harvesting the organ i.e. including surgery to remove organs from a donor provided that, i. The organ donor is any person whose organ has been made available in accordance and in compliance with THE TRANSPLANTATION OF HUMAN ORGANS (AMENDMENT) BILL, 2011 ii. The organ donated is for the use of the Insured Person, and iii. We have accepted an inpatient Hospitalisation claim for the insured member under Medical expenses section

2. 2 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 ◼ INTRODUCTION In the times of rising medical costs Bajaj Allianz’s Extra Care Plus Policy acts as an additional cover to your existing health insurance cover and provides wider health protection for you and your family. In case of higher expenses due to illness or accidents, Extra Care Plus policy takes care of the additional expenses. It is important to consider the fact that with rising inflation the health insurance cover may not be adequate, at the same time buying a large insurance cover may not be affordable. This policy is a perfect fit for a wider health insurance cover to take care of the rising health care expenses. A Simple and affordable solution to help ensure that you have an adequate Health Insurance Cover! ◼ WHAT ARE THE SPECIAL FEATURES OF EXTRA CARE PLUS POLICY? • Floater policy for proposer/ spouse/ dependent children/dependent parents (dependent parents under same policy) • Entry age 91 days to 80 years • Wide range of sum insured and aggregate deductible options • No pre-policy medical tests up to 55 years of age (subject to clean proposal form) • Pre-existing disease covered after 12 months from your first Extra Care Plus policy • In patient Hospitalisation cover • Pre 60 days and post 90 days hospitalisation expenses cover • Emergency road ambulance cover • Option to opt for Air Ambulance Cover • Day care procedures as defined under the policy • Free health check up • Maternity expenses including complications of maternity • Income tax benefit under 80 D of the IT Act on premiums paid for this policy, subject to changes in the tax laws ◼ COVERAGE ◼ What is covered under Extra Care Plus Policy? 1 Medical Expenses If You are hospitalized on the advice of a Doctor because of Illness or Accidental Bodily Injury sustained or contracted during the Policy Period, then We will pay You, Reasonable and Customary Medical Expenses incurred, subject to aggregate deductible as specified on the policy document Aggregate deductible is a cost sharing requirement under this policy that provides that the company will not be liable for a specified rupee amount of the covered expenses, which will apply before any benefits are payable by the company. A deductible does not reduce the sum insured. The deductible is applicable in aggregate towards hospitalisation expenses incurred during the policy period a. In patient Hospitalisation expenses:- i. Room Rent/Boarding and Nursing Expenses ii. ICU Rent/ Boarding and Nursing Expenses iii. Fees of Medical Practitioner, Surgeon , Anaesthetist, Nurses and Specialist Doctor iv. Operation theatre charges, Anesthesia, surgical appliances, diagnostic tests, medicines, blood, oxygen and cost of prosthetic and other devices or equipment if implanted internally like pacemaker during a surgical process b. Pre-hospitalisation expenses The medical expenses incurred in the 60 days immediately before you were hospitalised, provided that: i. Such medical expenses were incurred for the same condition requiring subsequent Hospitalisation, and; ii. We have accepted the claim underIn-Patient Hospitalisation expenses

16. 16 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 vi. In the event of the death of the insured person, someone claiming on his behalf must inform Us in writing immediately and send Us a copy of the post mortem report (if any) within 30 days. vii. We shall not indemnify you for any period of hospitalisation of less than 24 hrs, except for Day Care Procedures. viii. We shall make claim payment in Indian Rupees only. ix. In event of a claim, the original documents to be submitted & after the completion of the claims assessment process the original documents may be returned if requested by the insured in writing, however we will retain the Xerox copies of the claim documents. *Note: Waiver of conditions (i), (v) and (vi) may be considered where it is proved to the satisfaction of the Company that under the circumstances in which the insured was placed it was not possible from him or any other person to give notice or file claimwithin the prescribed time limit. Documents to be submitted for Claims 1. First Consultation letter from the Doctor 2. Duly completed claim form and NEFT Form signed by the Claimant 3. Original Hospital Discharge Card 4. Original Hospital Bill giving detailed break up of all expense heads mentioned in the bill. Clear break ups have to be mentioned for OT Charges, Doctor’s Consultation and Visit Charges, OT Consumables, Transfusions, Room Rent, etc. 5. Original Money Receipt, duly signed with a Revenue Stamp 6. All original Laboratory and Diagnostic Test Reports. E.g. X-Ray, E.C.G, USG, MRI Scan, Haemogram etc. 7. In case of a Cataract Operation, IOL Sticker will have to be enclosed 8. Claim settlement letter from any other insurer (if any) in case of partial settlement 9. In cases of suspected fraud / misrepresentation, we may call for any additional document(s) in addition to the documents listed above. 10. Aaadhar card & PAN card Copies (Not mandatory if the same is linked with the policy while issuance or in previous claim) List of Claim Document Specific to Air Ambulance Cover (if Opted) 1. Duly completed claim form signed by the Claimant 2. Original bills and receipts paid for the transportation from Registered Ambulance Service Provider 3. In cases of suspected fraud / misrepresentation, we may call for any additional document(s) in addition to the documents listed above. All documents related to claims should be submitted to: Health Administration Team Bajaj Allianz General Insurance Co. Ltd 2nd Floor, Bajaj Finserv Building Viman Nagar, Pune 411014 Toll Free no: 1800 209 5858 c. Paying a Claim i. You agree that We need only make payment when You or someone claiming on Your behalf has provided Us with necessary documentation and information. ii. We will make payment to You or Your Nominee. If there is no Nominee and You are incapacitated or deceased, We will pay Your heir, executor or validly appointed legal representative and any payment We make in this way will be a complete and final discharge of Our liability to make payment. iii. On receipt of all the documents and on being satisfied with regard to the admissibility of the claim as per policy terms and conditions, we shall offer a settlement of the claim to the insured. Upon acceptance of an offer of settlement by the insured, the payment of the amount due shall be made within 7 days from the date of acceptance of the offer by the insured. We will settle the claim within thirty days of the receipt of the last necessary document. In the cases of delay in the payment, the insurer shall be liable to pay interest at a rate which is 2% above the bank rate prevalent at the beginning of the financial year in which the claim is reviewed by it.

4. 4 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 Specific exclusions: 1. Claims which have NOT been admitted under Medical expenses section 2. Claims not in compliance with THE TRANSPLANTATION OF HUMAN ORGANS (AMENDMENT) BILL, 2011 3. The organ donors Pre and Post-Hospitalisation expenses. Additional benefits (Additional benefits for which aggregate deductible is not applicable) 4. Free Medical Check-up At the end of every continuous period of 3 years during which You have held Extra Care Plus policy with us, We will reimburse the free medical checkup expenses as below • The actual amount of medical checkup expenses up to Rs. 1000/- for policy covering 1 member. • The actual amount of medical checkup expenses up to Rs. 2000/- for policies covering more than 1 member under the same policy. For the avoidance of doubt, We shall only be liable for medical check up expenses and any other cost incurred such as for transportation, accommodation, food or sustenance shall not be payable by us. ◼ OPTIONAL COVER: 1. Air Ambulance Cover In consideration of payment of additional premium by the Insured to the Company and realization thereof by the Company, it is hereby agreed and declared that Extra Care Plus Policy is extended to pay the expenses incurred for ambulance transportation in an airplane or helicopter for rapid ambulance transportation from the site of first occurrence of the illness / accident to the nearest hospital during policy period which directly and independently of all other causes results in emergency life threatening health conditions provided such hospitalization claim is admissible under the Extra Care Policy. The claim would be reimbursed up to the actual expenses subject to a maximum limit as specified under the Air Ambulance Cover in the Policy Schedule, subject otherwise to all other terms, conditions and Exclusions of the Policy. Specific Conditions Applicable to Air Ambulance Cover: 1. Return transportation to the Insured’s home by air ambulance is excluded. 2. Such air ambulance should have been duly licensed to operate as such by competent authorities of the Government/s. 3. Deductible will not be applied on the claim admissible under Air Ambulance cover ◼ WHAT ARE THE EXCLUSIONS AND WAITING PERIOD UNDER THE POLICY? I. Waiting Period A. Pre-Existing Diseases - Code- Excl01 a. Expenses related to the treatment of a pre-existing Disease (PED) and its direct complications shall be excluded until the expiry of 12 months of continuous coverage after the date of inception of the first Extra Care Plus policy with us. b. In case of enhancement of sum insured the exclusion shall apply afresh to the extent of sum insured increase. c. If the Insured Person is continuously covered without any break as defined under the portability norms of the extant IRDAI (Health Insurance) Regulations then waiting period for the same would be reduced to the extent of prior coverage. d. Coverage under the policy after the expiry of 12 months for any pre-existing disease is subject to the same being declared at the time of application and accepted by us. B. Specified disease/procedure waiting period- Code- Excl02 a. Expenses related to the treatment of the listed Conditions, surgeries/treatments shall be excluded until the expiry of 12 months of continuous coverage after the date of inception of the first Extra Care Plus policy with us. This exclusion shall not be applicable for claims arising due to an accident. b. In case of enhancement of sum insured the exclusion shall apply afresh to the extent of sum insured increase. c. If any of the specified disease/procedure falls under the waiting period specified for pre-Existing diseases, then the longer of the two waiting periods shall apply. d. The waiting period for listed conditions shall apply even if contracted after the policy or declared and accepted

6. 6 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 ii. Any services for people who are terminally ill to address medical, physical, social, emotional and spiritual needs. 6. Obesity/Weight Control (Excl06) Expenses related to the surgical treatment of obesity that does not fulfil all the below conditions: 1. Surgery to be conducted is upon the advice of the Doctor 2. The surgery/Procedure conducted should be supported by clinical protocols 3. The member has to be 18 years of age or older and 4. Body Mass Index (BMI); a. greater than or equal to 40 or b. greater than or equal to 35 in conjunction with any of the following severe co-morbidities following failure of less invasive methods of weight loss: i. Obesity-related cardiomyopathy ii. Coronary heart disease iii. Severe Sleep Apnea iv. Uncontrolled Type2 Diabetes 7. Change-of-gender treatments: (Excl07) Expenses related to any treatment, including surgical management, to change characteristics of the body to those of the opposite sex 8. Cosmetic or plastic Surgery (Excl08) Expenses for cosmetic or plastic surgery or any treatment to change appearance unless for reconstruction following an Accident, Burn(s) or Cancer or as part of medically necessary treatment to remove a direct and immediate health risk to the insured. For this to be considered a medical necessity, it must be certified by the attending Medical Practitioner. 9. Hazardous or Adventure Sports (Excl09) Expenses related to any treatment necessitated due to participation as a professional in hazardous or adventure sports, including but not limited to, para-jumping, rock climbing, mountaineering, rafting, motor racing, horse racing or scuba diving, hand gliding, sky diving, deep-sea diving. 10. Breach of law: (Excl10) Expenses for treatment directly arising from or consequent upon any Insured Person committing or attempting to commit a breach of law with criminal intent. 11. Excluded Providers: (Excl11) Expenses incurred towards treatment in any hospital or by any Medical Practitioner or any other provider specifically excluded by the Insurer and disclosed in its website / notified to the policyholders are not admissible. However, in case of life threatening situations or following an accident, expenses up to the stage of stabilization are payable but not the complete claim. 12. Treatment for Alcoholism, drug or substance abuse or any addictive condition and consequences thereof. (Excl12) 13. Treatments received in heath hydros, nature cure clinics, spas or similar establishments or private beds registered as a nursing home attached to such establishments or a Hospital where the Hospital has effectively become the Insured Person’s home or permanent abode or where admission is arranged wholly or partly for domestic reasons. (Excl13) 14. Dietary supplements and substances that can be purchased without prescription, including but not limited to Vitamins, minerals and organic substances unless prescribed by a medical practitioner as part of hospitalization claim or day care procedure. (Excl14) 15. Refractive Error: (Excl15) Expenses related to the treatment for correction of eye sight due to refractive error less than 7.5 dioptres. 16. Unproven Treatments: (Excl16) Expenses related to any unproven treatment, services and supplies for or in connection with any treatment. Unproven treatments are treatments, procedures or supplies that lack significant medical documentation to support their effectiveness. 17. Sterility and Infertility (Excl17) Expenses related to sterility and infertility. This includes: i. Any type of contraception, sterilization ii. Assisted Reproduction services including artificial insemination and advanced reproductive technologies such as IVF, ZIFT, GIFT, ICSI

5. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 5 without a specific exclusion. e. If the Insured Person is continuously covered without any break as defined under the applicable norms on portability stipulated by IRDAI, then waiting period for the same would be reduced to the extent of prior coverage. f. List of specific diseases/procedures 1. Any types of gastric or duodenal ulcers, 11. Hernia of all types 2. Benign prostatic hypertrophy 12. Fistulae, Fissure in ano 3. All types of sinuses 13. Hydrocele 4. Haemorrhoids 14. Fibromyoma 5. Dysfunctional uterine bleeding 15. Hysterectomy 6. Endometriosis 16. Surgery for any skin ailment 7. Stones in the urinary and biliary systems 17. Surgery on all internal or external tumours/ cysts/ nodules/polyps of any kind including breast lumps with exception of Malignant tumor or growth. 8. Surgery on ears/tonsils/adenoids/paranasal sinuses 18. All Joint Replacement surgeries 9. Surgery for intervertebral disc disorders 19. Internal Congenital 10. Cataracts C. 30-day waiting period- Code- Excl03 a. Expenses related to the treatment of any illness within 30 days from the first policy commencement date shall be excluded except claims arising due to an accident, provided the same are covered. b. This exclusion shall not, however, apply if the Insured Person has Continuous Coverage for more than twelve months. c. The within referred waiting period is made applicable to the enhanced sum insured in the event of granting higher sum insured subsequently. II. Waiting Period for Maternity Expenses 1. Any treatment arising from or traceable to pregnancy, child birth including cesarean section and/or any treatment related to pre and postnatal care and complications arising out of Pregnancy and Childbirth until 12 months continuous period has elapsed since the inception of the first Extra Care Plus with US. However this exclusion will not apply to Ectopic Pregnancy proved by diagnostic means and certified to be life threatening by the attending medical practitioner. III. General Exclusion 1. We are not liable for claim(s) amount falling within Aggregate Deductible limit as opted and mentioned on the policy schedule. 2. Any Medical Expenses of the new born baby 3. Dental treatment or surgery of any kind unless requiring hospitalisation and as a result of accidental Bodily Injury to natural teeth. 4. Investigation & Evaluation (Excl04) a. Expenses related to any admission primarily for diagnostics and evaluation purposes only are excluded even if the same requires confinement at a Hospital. b. Any diagnostic expenses which are not related or not incidental to the current diagnosis and treatment are excluded. 5. Rest Cure, rehabilitation and respite care (Excl05) Expenses related to any admission primarily for enforced bed rest and not for receiving treatment. This also includes: i. Custodial care either at home or in a nursing facility for personal care such as help with activities of daily living such as bathing, dressing, moving around either by skilled nurses or assistant or non-skilled persons.

8. 8 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 • Maximum Entry Age for dependent Children - 25 years ◼ WHAT WILL BE THE RENEWAL AGE? • For proposer/ spouse/ dependent parents: Life time Renewal • For dependent children policy is renewable up to 35 years, In both the cases, renewal will not be denied except on the grounds of Your moral hazard, misrepresentation, non- cooperation or fraud ◼ ELIGIBILITY • Indian nationals residing in India would be considered for this policy. • This policy can be opted by Non-Resident Indians also, provided premium is paid in Indian currency & by Indian Account only ◼ WHAT IS THE POLICY PERIOD? 1 Year, 2 Year & 3 Year ◼ DISCOUNT UNDER THE POLICY: Long Term Policy Discount: a. 4 % discount is applicable if policy is opted for 2 years b. 8 % discount is applicable if policy is opted for 3 years ◼ IS THERE ANY PRE-POLICY CHECKUP FOR ENROLLING UNDER THE POLICY? Pre-policy Medical Examination criteria for new Proposals & Portability proposals • No Medical tests up to 55 years, subject to no adverse health conditions • Medical tests are applicable for members 56 years and above. • The validity of the test reports would be 30 days from date of medical examination. • If pre-policy checkup is conducted, 50% of the medical tests charges would be reimbursed, subject to acceptance of proposal and policy issuance. Age of the person to be insured Sum Insured Medical Examination Up to 55 years All Sum Insured options No Medical Tests* 56 years to 80 years All Sum Insured options Medical Tests required as listed below: Full Medical Report, CBC, Urine R, ECG, Lipid profile, Fasting BSL, HbA1c, SGOT, SGPT, Sr Creatinine *Subject to no adverse health conditions ◼ WHEN CAN I ENHANCE MY SUM INSURED? • Sum Insured enhancement will be allowed only at the time of renewals. ◼ FREE LOOK PERIOD You have a period of 15 days from the date of receipt of the first policy document to review the terms and conditions of this Policy. If You have any objections to any of the terms and conditions, You have the option of canceling the Policy stating the reasons for cancellation. If you have not made any claim during the Free look period, you shall be entitled to refund of premium subject to, • A deduction of the expenses incurred by Us on Your medical examination, stamp duty charges, if the risk has not commenced, • A deduction of the stamp duty charges, medical examination charges & proportionate risk premium for period on cover, If the risk has commenced • A deduction of such proportionate risk premium commensurating with the risk covered during such period ,where only a part of risk has commenced • Free look period is not applicable for renewal policies.

11. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 11 ◼ WHAT ARE THE SUM INSURED OPTIONS UNDER THE POLICY? Sum Insured (in INR) Aggregate Deductible Options (in INR) 300000 200000 - - - 500000 200000 300000 - - 1000000 200000 300000 500000 - 1500000 - 300000 500000 - 2000000 - 300000 500000 1000000 2500000 - 300000 500000 1000000 5000000 - 300000 500000 1000000 Air Ambulance Sum Insured options (Optional Cover) Base SI (In INR) Air Ambulance SI (In INR) 300000 200000 500000 500000 1000000 500000 1500000 1000000 2000000 1000000 2500000 1000000 5000000 1000000 ◼ PREMIUM CHART

9. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 9 ◼ RENEWAL i. Under normal circumstances, renewal will not be refused except on the grounds of Your moral hazard, misrepresentation, non- cooperation or fraud. ii. In case of Our own renewal, a grace period of 30 days is permissible and the Policy will be considered as continuous for the purpose of 12 month waiting period. However, any treatment availed for an Illness or Accident sustained or contracted during the break period will not be admissible under the Policy. iii. For dependent children, Policy is renewable up to 35 years. After the completion of maximum renewal age of dependent children, the policy would be renewed for lifetime, Subject to Separate proposal form to be submitted to us at the time of renewal with the insured member as proposer and subsequently the policy should be renewed with us annually and within the Grace period of 30 days from date of Expiry. Suitable credit of continuity/waiting periods for all the previous policy years would be extended in the new policy, provided the policy has been maintained without a break. iv. Premium payable on renewal and on subsequent continuation of cover are subject to change with prior approval from IRDAI. ◼ CANCELLATION i. We may cancel this insurance by giving You at least 15 days written notice, and if no claim has been made then We shall refund a pro-rata premium for the unexpired Policy Period. Under normal circumstances, Policy will not be cancelled except for reasons of mis-representation, fraud, non-disclosure of material facts or Your non- cooperation. ii. You may cancel this insurance by giving Us at least 15 days written notice, and if no claim has been made then We shall refund premium on short term rates for the unexpired Policy Period as per the rates detailed below. Cancellation grid for premium received on annual & long term basis and refund is as under Period in Risk Premium Refund Policy Period 1Year Policy Period 2Year Policy Period 3Year Within 15 Days Pro Rata Refund Exceeding 15 days but less than or equal to 3 months 65.00% 75.00% 80.00% Exceeding 3 months but less than or equal to 6 months 45.00% 65.00% 75.00% Exceeding 6 months but less than or equal to 12 months 0.00% 45.00% 60.00% Exceeding 12 months but less than or equal to 15 months 30.00% 50.00% Exceeding 15 months but less than or equal to 18 months 20.00% 45.00% Exceeding 18 months but less than or equal to 24 months 0.00% 30.00% Exceeding 24 months but less than or equal to 27 months 20.00% Exceeding 27 months but less than or equal to 30 months 15.00% Exceeding 30 months but less than or equal to 36 months 0.00% ◼ GRACE PERIOD • The grace period is 30 days • If hospitalisation of the member occurs during this grace period, the company will not be liable to make any payments if claims are made due to any treatment of illness/ailment/disease diagnosed or hospitalisation taking place. • If the premium is not paid within 30 days of the due date of the first unpaid premium then the policy will be terminated.

7. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 7 iii. Gestational Surrogacy iv. Reversal of sterilization 18. The cost of spectacles, contact lenses, hearing aids, crutches, artificial limbs, dentures, artificial teeth and all other external appliances and/or devices whether for diagnosis or treatment except for intrinsic fixtures used for orthopedic treatments such as plates and K-wires. 19. War, invasion, acts of foreign enemies, hostilities (whether war be declared or not), civil war, commotion, unrest, rebellion, revolution, insurrection, military or usurped power or confiscation or nationalization or requisition of or damage by or under the order of any government or public local authority. 20. Circumcision unless required for the treatment of Illness or Accidental bodily injury, cosmetic or aesthetic treatments of any description, treatment or surgery for change of life/gender. 21. External medical equipment of any kind used at home as post Hospitalization care including cost of instrument used in the treatment of Sleep Apnoea Syndrome (C.P.A.P), Continuous Peritoneal Ambulatory Dialysis (C.P.A.D) and Oxygen concentrator for Bronchial Asthmatic condition. 22. Intentional self-injury (including but not limited to the use or misuse of any intoxicating drugs or alcohol) 23. Vaccination or inoculation unless forming a part of post bite treatment or if medically necessary and forming a part of treatment recommended by the treating Medical practitioner. 24. All non-medical Items as per Annexure II 25. Any treatment received outside India is not covered under this Policy. 26. Treatment for any other system other than modern medicine (also known as Allopathy) 27. Venereal disease or any sexually transmitted disease or sickness. ◼ WHAT IS AGGREGATE DEDUCTIBLE? Aggregate deductible is a cost sharing requirement under this policy that provides that the company will not be liable for a specified rupee amount of the covered expenses, which will apply before any benefits are payable by the company. A deductible does not reduce the sum insured. The deductible is applicable in aggregate towards hospitalisation expenses incurred during the policy period ◼ HOW DOES EXTRA CARE PLUS POLICY BENEFIT ME? • In times of rising medical inflation Extra Care Plus acts as an additional cover to your existing health insurance cover. • This policy can be opted even if there is no existing health insurance policy. • Extra Care Plus policy pays the hospitalisation expenses incurred above the aggregate deductible opted by you. For Example- Case : Insured has opted a plan for 2 members, Sum Insured is Rs-10,00,000 and Deductible of Rs. 200000. The Policy Period is from 01-April-2017 to 31-March-2018 Sum Insured: Rs. 10 Lacs ; Aggregate Deductible Opted: Rs. 2 Lacs Claim details Date of Hospitalisation Total Claim Amount(inRs.) Deductible Utilization(inRs.) Balance deductible(inRs.) Payable by insured(if any)(inRs.) Payable under Extra Care PlusPolicy(inRs.) Claim 1 10-Aug-2017 1,50,000 1,50,000 50,000 1,50,000 0 Claim 2 10-Sep-2017 3,00,000 50,000 0 50,000 2,50,000 Claim 3 10-Oct-2017 7,50,000 0 0 0 7,50,000 ◼ WHO CAN BE COVERED UNDER THIS POLICY? • Self, spouse, dependent children, dependent parents can be covered under this policy. A maximum of six members can be covered under single floater policy. ◼ WHAT IS THE ENTRY AGE UNDER THIS POLICY? • Minimum entry age for proposer/ spouse/ dependent parents - 18 years • Maximum Entry Age for proposer/ spouse/ dependent parents - 80 years • Minimum Entry age for dependent Children - 3 months

15. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 15 AIR AMBULANCE COVER Base Sum Insured (in INR) Air Ambulance Sum Insured (in INR) Premium Amount in INR ( Premiums are exclusive of GST ) Family Size 1 Family Size 2 Family Size 3 Family Size 4 Family Size 5 Family Size 6 300000 200000 77 123 142 159 176 195 500000 500000 192 307 356 397 441 488 1000000 500000 192 307 356 397 441 488 1500000 1000000 385 615 712 794 882 976 2000000 1000000 385 615 712 794 882 976 2500000 1000000 385 615 712 794 882 976 5000000 1000000 385 615 712 794 882 976 ◼ WHAT WOULD BE THE PROCESS IN CASE OF A CLAIM? All Claims will be settled by In house claims settlement team of the company and no TPA is engaged. a. Cashless Claims Procedure: Cashless treatment is only available at a Network Hospital. In order to avail cashless treatment, following procedure must be followed by You. i. Prior to taking treatment and/or incurring Medical Expenses at a Network Hospital, You must call Us and request pre- authorization by way of the written form We will provide. Waiver of this condition shall be considered in case of emergency hospitalisation arising out of accidental bodily injury. In the event of : • Planned Hospitalization- Insured member should intimate such admission at least 72 hours prior to the planned admission. • Emergency Hospitalization- Insured member or his representative should intimate such admission within 24 hours of such admission ii. After considering Your request and after obtaining any further information or documentation we have sought, We may if satisfied send You or the Network Hospital, a pre- authorization letter. The pre- authorization letter, the ID card issued to You along with this Policy and any other information or documentation that We have specified must be produced to the Network Hospital identified in the pre-authorization letter at the time of Your admission to the same. iii. If the procedure above is followed, You will not be required to directly pay for the Medical Expenses above the Aggregate deductible in the Network Hospital that We are liable to indemnify under the policy and the original bills and evidence of treatment in respect of the same shall be left with the Network Hospital. Pre- authorization does not guarantee that all costs and expenses will be covered. We reserve the right to review each claim for Medical Expenses and accordingly coverage will be determined according to the terms and conditions of this Policy. You shall, in any event, be required to settle all other expenses directly. b. Reimbursement Claim Procedure If pre-authorization under Cashless Claim Procedure mentioned above is denied by Us or if treatment is taken in a Hospital other than a Network Hospital or if You do not wish to avail cashless facility, then following procedure must be followed by You: i. You or someone claiming on Your behalf must inform Us in writing immediately within 48 hours of hospitalisation in case of emergency hospitalisation and 48 hours prior to hospitalisation in case of planned hospitalisation ii. You must immediately consult a Doctor and follow the advice and treatment that he recommends. iii. You must take steps or measure to minimize the quantum of any claim that may be made under this Policy. iv. You must have Yourself examined by Our medical advisors if We ask for this, at the insurers cost. v. You or someone claiming on Your behalf must promptly and in any event within 30 days of discharge from a Hospital give Us the documentation.

13. CIN: U66010PN2000PLC015329, UIN:BAJHLIP20147V021920 13 FAMILY SIZE: 3 MEMBER Sum Insured (in INR) 300000 500000 1000000 1500000 2000000 2500000 5000000 Age/ deduc - tible 200000 200000 300000 200000 300000 500000 300000 500000 300000 500000 1000000 300000 500000 1000000 300000 500000 1000000 21-25 4,256 4,550 2,826 6,679 4,808 3,291 6,289 4,650 7,504 5,788 3,999 8,546 6,397 4,663 12,389 10,485 8,679 26-30 4,572 4,885 3,033 7,166 5,156 3,527 6,744 4,983 8,045 6,202 4,282 9,161 6,854 4,992 13,275 11,232 9,293 31-35 4,761 5,085 3,157 7,457 5,364 3,668 7,015 5,182 8,368 6,449 4,451 9,528 7,127 5,189 13,804 11,677 9,659 36-40 5,251 5,605 3,478 8,212 5,904 4,035 7,719 5,699 9,207 7,092 4,889 10,482 7,836 5,700 15,179 12,835 10,611 41-45 5,654 6,050 3,737 8,987 6,469 4,415 8,515 6,291 10,192 7,860 5,423 11,628 8,697 6,336 16,917 14,326 11,865 46-50 7,161 7,656 4,722 11,379 8,185 5,577 10,781 7,957 12,907 9,947 6,852 14,728 11,005 8,006 21,424 18,134 15,009 51-55 8,891 9,502 5,853 14,131 10,159 6,914 13,390 9,876 16,035 12,351 8,498 18,299 13,664 9,932 26,620 22,525 18,635 56-60 10,527 11,246 6,922 16,737 12,029 8,180 15,862 11,694 19,000 14,630 10,059 21,686 16,186 11,758 31,549 26,691 22,075 61-65 12,992 13,874 8,534 20,653 14,837 10,083 19,571 14,421 23,445 18,046 12,398 26,760 19,965 14,494 38,928 32,926 27,222 66-70 14,708 15,717 9,651 23,493 16,882 11,466 22,315 16,444 26,759 20,603 14,155 30,563 22,803 16,558 44,518 37,669 31,158 More than 70 17,799 19,014 11,671 28,418 20,416 13,859 26,988 19,881 32,363 24,911 17,106 36,963 27,569 20,010 53,834 45,543 37,661 FAMILY SIZE: 4 MEMBER Sum Insured (in INR) 300000 500000 1000000 1500000 2000000 2500000 5000000 Age/ deduc - tible 200000 200000 300000 200000 300000 500000 300000 500000 300000 500000 1000000 300000 500000 1000000 300000 500000 1000000 21-25 5,010 5,361 3,326 7,906 5,695 3,899 7,466 5,523 8,918 6,882 4,759 10,163 7,610 5,553 14,756 12,498 10,354 26-30 5,298 5,667 3,515 8,350 6,013 4,114 7,880 5,827 9,411 7,260 5,017 10,724 8,027 5,853 15,565 13,178 10,914 31-35 5,470 5,849 3,628 8,615 6,202 4,242 8,127 6,008 9,705 7,485 5,171 11,058 8,276 6,032 16,047 13,584 11,247 36-40 5,917 6,324 3,921 9,303 6,694 4,576 8,769 6,479 10,470 8,071 5,571 11,928 8,922 6,498 17,300 14,640 12,115 41-45 6,284 6,729 4,157 10,010 7,210 4,923 9,495 7,018 11,368 8,772 6,057 12,973 9,707 7,078 18,884 15,999 13,258 46-50 7,902 8,446 5,217 12,508 8,996 6,134 11,828 8,731 14,147 10,902 7,512 16,134 12,057 8,772 23,444 19,839 16,416 51-55 9,710 10,372 6,399 15,371 11,049 7,525 14,537 10,722 17,392 13,395 9,218 19,837 14,814 10,768 28,825 24,385 20,168 56-60 11,200 11,962 7,373 17,746 12,753 8,680 16,790 12,380 20,095 15,472 10,641 22,924 17,113 12,432 33,318 28,182 23,304 61-65 13,671 14,595 8,989 21,660 15,559 10,581 20,492 15,101 24,529 18,879 12,973 27,984 20,880 15,159 40,671 34,393 28,430 66-70 15,236 16,275 10,008 24,249 17,424 11,841 22,993 16,945 27,550 21,210 14,575 31,451 23,468 17,041 45,767 38,717 32,017 More than 70 18,115 19,356 11,886 28,933 20,791 14,120 27,482 20,251 32,956 25,373 17,432 37,640 28,082 20,391 54,825 46,390 38,370

14. 14 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 FAMILY SIZE: 5 MEMBER Sum Insured (in INR) 300000 500000 1000000 1500000 2000000 2500000 5000000 Age/ deduc - tible 200000 200000 300000 200000 300000 500000 300000 500000 300000 500000 1000000 300000 500000 1000000 300000 500000 1000000 21-25 5,768 6,177 3,830 9,136 6,584 4,507 8,642 6,395 10,330 7,975 5,517 11,777 8,822 6,440 17,118 14,504 12,022 26-30 6,039 6,465 4,007 9,553 6,882 4,709 9,031 6,680 10,793 8,330 5,760 12,304 9,214 6,723 17,877 15,143 12,548 31-35 6,200 6,636 4,113 9,802 7,060 4,830 9,263 6,851 11,069 8,542 5,904 12,618 9,447 6,891 18,330 15,525 12,861 36-40 6,620 7,081 4,388 10,449 7,523 5,144 9,866 7,293 11,788 9,093 6,280 13,435 10,054 7,329 19,508 16,516 13,677 41-45 6,966 7,462 4,610 11,112 8,007 5,469 10,548 7,800 12,632 9,751 6,737 14,417 10,792 7,873 20,996 17,793 14,751 46-50 8,486 9,075 5,606 13,459 9,685 6,607 12,740 9,409 15,243 11,752 8,103 17,387 13,000 9,465 25,280 21,401 17,718 51-55 10,549 11,266 6,958 16,656 11,972 8,158 15,731 11,604 18,809 14,485 9,971 21,445 16,017 11,642 31,139 26,338 21,780 56-60 11,950 12,760 7,874 18,887 13,573 9,243 17,848 13,162 21,348 16,437 11,308 24,345 18,177 13,206 35,360 29,906 24,726 61-65 14,352 15,319 9,444 22,688 16,298 11,089 21,442 15,804 25,652 19,744 13,571 29,256 21,833 15,852 42,495 35,932 29,699 66-70 15,822 16,897 10,402 25,121 18,050 12,274 23,792 17,536 28,491 21,933 15,076 32,513 24,263 17,620 47,282 39,994 33,069 More than 70 18,736 20,015 12,304 29,845 21,445 14,571 28,310 20,863 33,928 26,120 17,948 38,736 28,902 20,987 56,381 47,698 39,446 FAMILY SIZE: 6 MEMBER Sum Insured (in INR) 300000 500000 1000000 1500000 2000000 2500000 5000000 Age/ deduc - tible 200000 200000 300000 200000 300000 500000 300000 500000 300000 500000 1000000 300000 500000 1000000 300000 500000 1000000 21-25 6,544 7,011 4,345 10,389 7,490 5,127 9,839 7,283 11,767 9,087 6,289 13,419 10,054 7,343 19,518 16,543 13,717 26-30 6,803 7,286 4,515 10,789 7,775 5,321 10,212 7,556 12,211 9,427 6,521 13,924 10,429 7,613 20,246 17,155 14,221 31-35 6,958 7,451 4,616 11,027 7,946 5,436 10,434 7,719 12,475 9,630 6,659 14,225 10,653 7,774 20,680 17,521 14,521 36-40 7,360 7,877 4,880 11,647 8,389 5,737 11,013 8,143 13,164 10,158 7,020 15,008 11,235 8,194 21,808 18,471 15,302 41-45 7,691 8,242 5,092 12,283 8,853 6,049 11,666 8,629 13,972 10,788 7,458 15,949 11,942 8,715 23,234 19,694 16,331 46-50 9,147 9,788 6,047 14,531 10,461 7,139 13,766 10,170 16,474 12,705 8,766 18,794 14,057 10,241 27,338 23,151 19,174 51-55 11,345 12,114 7,488 17,880 12,852 8,762 16,872 12,448 20,165 15,530 10,692 22,985 17,169 12,481 33,358 28,213 23,329 56-60 12,687 13,546 8,365 20,018 14,386 9,801 18,901 13,940 22,597 17,400 11,973 25,763 19,238 13,980 37,402 31,631 26,152 61-65 14,988 15,998 9,870 23,660 16,997 11,570 22,344 16,471 26,721 20,568 14,141 30,469 22,741 16,514 44,238 37,405 30,916 66-70 16,526 17,647 10,873 26,190 18,818 12,802 24,782 18,268 29,663 22,836 15,699 33,841 25,258 18,344 49,189 41,603 34,397 More than 70 19,396 20,717 12,746 30,836 22,156 15,061 29,222 21,537 35,020 26,948 18,520 39,996 29,822 21,650 58,244 49,264 40,728

12. 12 CIN: U66010PN2000PLC015329, UIN: BAJHLIP20147V021920 Note: In case of policy issued on Floater Basis, age of the oldest member of the family will be considered for premium calculation. Premiums are exclusive of GST FAMILY SIZE: 1 MEMBER Sum Insured (in INR) 300000 500000 1000000 1500000 2000000 2500000 5000000 Age/ deduc - tible 200000 200000 300000 200000 300000 500000 300000 500000 300000 500000 1000000 300000 500000 1000000 300000 500000 1000000 Upto 20 1,783 1,916 1,184 2,869 2,072 1,418 2,734 2,026 3,278 2,536 1,758 3,745 2,809 2,055 5,466 4,640 3,854 21-25 2,170 2,315 1,441 3,370 2,423 1,658 3,157 2,332 3,759 2,895 1,998 4,275 3,197 2,326 6,178 5,222 4,316 26-30 2,397 2,556 1,590 3,720 2,673 1,828 3,483 2,571 4,148 3,193 2,201 4,717 3,526 2,563 6,816 5,759 4,757 31-35 2,533 2,700 1,679 3,929 2,822 1,930 3,678 2,714 4,380 3,371 2,322 4,981 3,722 2,705 7,196 6,079 5,021 36-40 2,885 3,074 1,910 4,472 3,211 2,193 4,185 3,086 4,983 3,834 2,638 5,667 4,232 3,073 8,185 6,912 5,705 41-45 2,982 3,195 1,968 4,779 3,442 2,346 4,547 3,359 5,452 4,206 2,902 6,227 4,657 3,394 9,079 7,694 6,377 46-50 3,952 4,229 2,601 6,325 4,551 3,097 6,013 4,438 7,210 5,558 3,828 8,235 6,153 4,477 12,002 10,165 8,417 51-55 5,129 5,485 3,371 8,200 5,896 4,009 7,792 5,746 9,344 7,198 4,951 10,672 7,968 5,792 15,550 13,163 10,893 56-60 6,305 6,739 4,139 10,075 7,241 4,919 9,571 7,054 11,477 8,838 6,074 13,108 9,782 7,105 19,095 16,159 13,368 61-65 7,902 8,443 5,183 12,619 9,067 6,156 11,985 8,830 14,372 11,064 7,599 16,415 12,245 8,889 23,908 20,227 16,728 66-70 9,088 9,708 5,958 14,509 10,422 7,074 13,778 10,149 16,522 12,716 8,731 18,870 14,073 10,213 27,482 23,248 19,223 More than 70 10,827 11,562 7,095 17,279 12,410 8,420 16,406 12,082 19,674 15,139 10,390 22,470 16,754 12,155 32,721 27,677 22,881 FAMILY SIZE: 2 MEMBER Sum Insured (in INR) 300000 500000 1000000 1500000 2000000 2500000 5000000 Age/ deduc - tible 200000 200000 300000 200000 300000 500000 300000 500000 300000 500000 1000000 300000 500000 1000000 300000 500000 1000000 21-25 3,469 3,701 2,303 5,387 3,873 2,651 5,047 3,728 6,009 4,629 3,194 6,834 5,111 3,719 9,877 8,349 6,900 26-30 3,832 4,087 2,542 5,947 4,274 2,923 5,569 4,111 6,631 5,105 3,519 7,542 5,637 4,098 10,897 9,208 7,606 31-35 4,049 4,317 2,684 6,282 4,512 3,085 5,881 4,340 7,002 5,390 3,713 7,964 5,950 4,324 11,505 9,720 8,027 36-40 4,613 4,915 3,053 7,150 5,133 3,506 6,691 4,934 7,967 6,129 4,218 9,061 6,766 4,912 13,087 11,051 9,122 41-45 4,768 5,107 3,146 7,641 5,503 3,751 7,269 5,371 8,716 6,725 4,640 9,956 7,446 5,426 14,516 12,301 10,195 46-50 6,319 6,761 4,159 10,112 7,276 4,952 9,613 7,095 11,527 8,886 6,120 13,166 9,837 7,158 19,189 16,251 13,457 51-55 8,200 8,768 5,389 13,110 9,427 6,409 12,458 9,187 14,939 11,508 7,916 17,062 12,739 9,259 24,860 21,044 17,416 56-60 10,081 10,775 6,618 16,107 11,577 7,865 15,301 11,278 18,348 14,130 9,711 20,956 15,639 11,360 30,528 25,834 21,373 61-65 12,634 13,498 8,287 20,175 14,495 9,842 19,161 14,117 22,978 17,688 12,149 26,243 19,576 14,211 38,223 32,339 26,745 66-70 14,530 15,520 9,526 23,196 16,663 11,310 22,027 16,225 26,415 20,330 13,958 30,169 22,500 16,329 43,937 37,168 30,734 More than 70 17,309 18,485 11,342 27,625 19,840 13,462 26,229 19,315 31,454 24,204 16,611 35,924 26,786 19,432 52,313 44,248 36,581