2. WHY TRAVEL INSURANCE? An ideal holiday is a balance of planning and enjoyment. Travel Insurance plan plays a pivotal role in the success of your trip and can make your journey secure and stress free. The expenses incurred in a foreign land for availing medical/health care facilities are exorbitant. It has always been recommended to take preventive measure of insuring oneself when away from home. Many tourists travelling abroad for vacations often neglect opting for Travel Insurance assuming that unforeseen events such as natural calamities and social unrest would not take place. Unfortunately, in an individual’s capacity these events cannot be controlled. WHY TRAVEL INSURANCE OF ICICI LOMBARD ? ICICI Lombard provides a gamut of coverages and plans to suit every individual’s need. The various available plans of Travel Insurance of ICICI Lombard, covers travelers from the age of 3 months to 85 years, without any medical check-up for policy issuance. The policy covers not only your safety but also provide value added services for your family members back home.

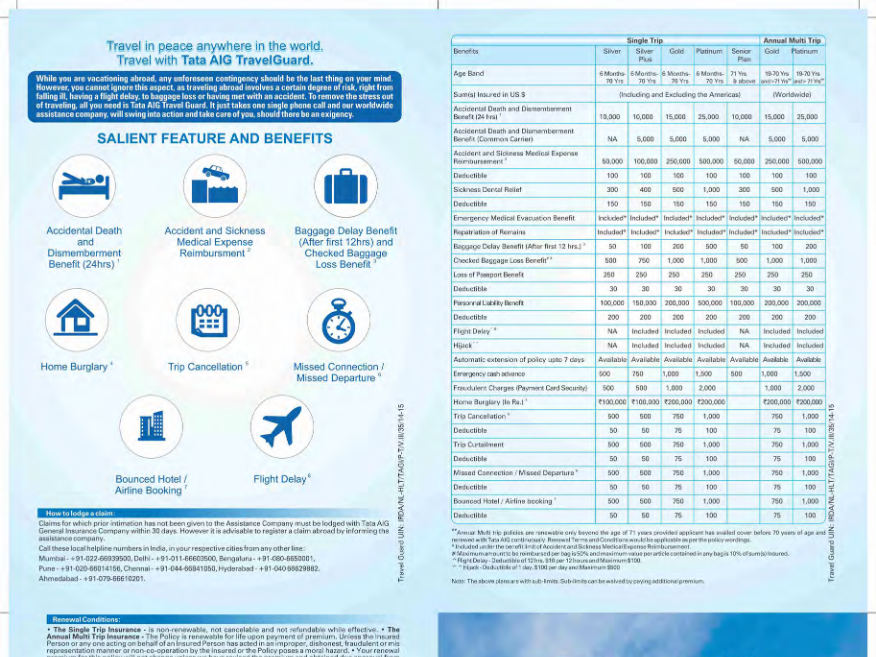

5. We have a range of travel insurance plans suitable for your requirements. They cover the medical eventualities including hospitalisation due to unexpected illness or injury and other medical benefits like daily allowance for hospitalisation and dental treatment. It also offers additional benefits like fire cover, burglary cover, compassionate visit & various other value added services. Repatriation of Remains (Included in medical Sum Insured) USD 7,500 USD 7,500 USD 7,500 NA Daily Allowance In Case of hospitalisation (franchise of 2 days) USD 50 per day (Max. 5 days) NA -NA Dental Treatment USD 300 USD 300 USD 300 USD 100 Total Loss of Checked-in Baggage USD 500 USD 500 - NA Delay of Checked-in Baggage USD 100 USD 100 - 6 hours Loss of Passport USD 300 USD 300 - USD 50 Personal Liability USD 100,000 USD 100,000 - 5% of actuals Personal Accident USD 15,000 USD 15,000 - NA Emergency Cash Advance USD 1,000 USD 1,000 - NA Trip Cancellation & Interruption USD 500 USD 500 - NA Hijack Distress Allowance USD 125 per day (Max. 7 days) USD 125 per day (Max. 7 days) - 12 hours USD 100 Medical Cover (includes medical evacuation cost)* USD 50,000 to USD 5,00,000 USD 50,000 to USD 500,000 USD 50,000 to USD 100,000 Platinum Plan** Gold Plan Silver Plan Deductible Benefits Missed Flight Connection USD 500 USD 500 - 3 hours Accidental Death (Common Carrier) USD 5,000 USD 5,000 - NA Fire Cover for Building INR 20,00,000 - - NA Fire Cover for Contents INR 10,00,000 - - NA Burglary Cover for Home Contents INR 1,00,000 - - NA Bounced Booking – Hotel / Airline USD 2,000 - - USD 250 Compassionate Visit USD 7,500 - - NA Emergency Hotel Extension USD 5,000 - - USD 250 Value Added Services Available - - NA Loss of Baggage and Personal Effects USD 2,000 - - USD 100 Return of Minor Child(ren) Travel cost at actuals not exceeding USD 7,500 --NA Trip Delay USD 500 USD 500 - 6 hours Political Risk and Catastrophe Evacuation USD 7,500 USD 7,500 -NA *Subject to sublimits, please refer to policy wordings for details • ** Only sublimit B is applicable • Available for w orldwide & excluding USA & Canada Please Note : Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered

6. Specially designed for senior citizens aged between 71 to 85 years under International Travel Insurance product with extensive coverages to provide protection across the globe. Deductibles Benefits Sum Insured Medical Cover (includes medical evacuation cost)* USD 25,000 to USD 50,000 USD 100 Repatriation of Remains (Included in medical Sum Insured) USD 7,500 NA Total Loss of Checked-in Baggage USD 500 NA Delay of Checked-in Baggage USD 100 6 hours Loss of Passport USD 300 USD 50 Personal Liability USD 100,000 5% of actual Personal Accident USD 2,500 NA Emergency Cash Advance USD 1,000 NA Trip Cancellation & Interruption USD 500 NA Missed Flight Connection USD 500 3 hours Trip Delay USD 500 6 hours Political Risk and Catastrophe Evacuation USD 7,500 NA Hijack Distress Allowance USD 125 per day (for max. 7 days) 12 hours * Subject to sublimits please refer policy wordings for details. Available for worldwide & excluding USA & Canada Please Note : Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered

7. This one year plan under International Travel Insurance product is specially designed for frequent fliers. We have three options of 30 days, 45 days & 60 days as maximum trip duration to choose from these comprehensive coverages. Deductibles Benefits Sum Insured Medical Cover (includes medical evacuation cost)* USD 1,00,000, USD 2,50,000 & USD 5,00,000 USD 100 Repatriation of Remains (included in medical Sum Insured) USD 7,500 NA Dental Treatment USD 300 USD 100 Total Loss of Checked-in Baggage USD 500 NA Delay of Checked-in Baggage USD 100 6 hours Loss of Passport USD 300 USD 50 Personal Liability USD 100,000 5% of actual Personal Accident USD 15,000 NA Emergency Cash Advance USD 1,000 NA Trip Cancellation & Interruption USD 500 NA Missed Flight Connection USD 500 3 hours USD 500 6 hours Political Risk and Catastrophe Evacuation USD 7,500 NA Accidental Death (Common Carrier) USD 5,000 Value Added Services Hijack Distress Allowance USD 125 per day (for max. 7 days) 12 hours *Subject to sublimits please refer policy wordings for details. Available for worldwide Please Note : Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered

8. This is a travel insurance plan exclusively designed under International Travel Insurance product to cater to the needs of the customers travelling to neighbouring countries. Along with the basic medical coverages it also provides special coverages like financial emergency assistance and personal liability. Deductibles Benefits Sum Insured Medical Cover (includes medical evacuation cost)* USD 25,000 USD 100 Repatriation of Remains (Included in medical Sum Insured) USD 7,500 NA Dental Treatment USD 300 USD 100 Total Loss of Checked-in Baggage USD 500 NA Delay of Checked-in Baggage USD 100 6 hours Loss of Passport USD 300 USD 50 Personal Liability USD 100,000 5% of actual Personal Accident USD 15,000 NA Emergency Cash Advance USD 1,000 NA Trip Cancellation & Interruption USD 500 NA Missed Flight Connection USD 500 3 hours Trip Delay USD 500 6 hours Political Risk and Catastrophe Evacuation USD 7,500 NA Accidental Death (Common Carrier) USD 5,000 NA Hijack Distress Allowance USD 125 per day (for max. 7 days) 12 hours * Subject to sublimits please refer policy wordings for details # Applicable only for the following neighbouring countries - Pakistan, Nepal, Bangladesh, Sri Lanka, Bhutan, Singapore, Hong Kong , China, Myanmar, Thailand, Philippines, Korea, Malaysia, Taiwan, Vietnam, Laos, Cambodia, UAE, Saudi Arabia, Kuwait, Qatar, Bahrain, Oman and Yemen Please Note : Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered

12. 014725MI Insurance is the subject matter of solicitation. Trade logo displayed above belongs to ICICI Bank Ltd. and Northbridge Financial Corporation and is used by ICICI Lombard GIC Ltd. under license. The advertisement contains only an indication of the cover offered. For complete details on risk factors, terms, conditions, coverages and exclusions, please read the sales brochure carefully before concluding a sale. ICICI Lombard General Insurance Company Limited. Registered Office: ICICI Lombard House, 414, Veer Savarkar Marg, Near Siddhivinayak Temple, Prabhadevi, Mumbai – 400 025. IRDA Reg. No. 115. Misc 129. Toll Free No. 1800 2666. Fax No 02261961323, CIN U67200MH2000PLC129408. Website: www.icicilombard.com. Email: customersupport@icicilombard.com UIN 014TJ2156II. Mailing Address Falck India Pvt. Ltd Upper Floor The Peach Tree, Block - C SushantLok - I, Sector - 43, Gurgaon, Haryana - 122015 (India) Medical & Travel Assistance USA & Canada Toll Free Number +18448711200 Rest of the World (Call Back Facility) +91 124 4498778 National Toll Free Number +18001025721 Fax Number +91 124 4006674 Email Address : icicilombard@falck.com

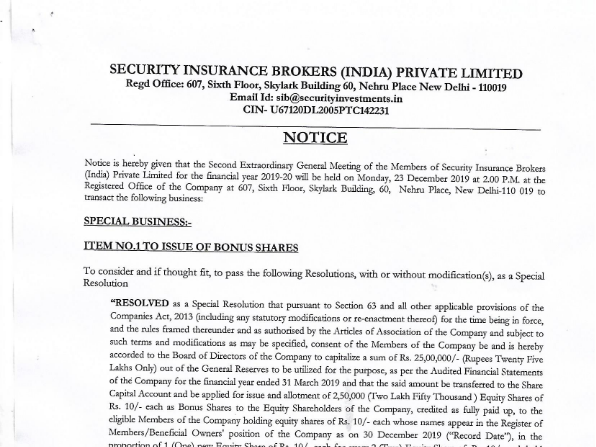

1.

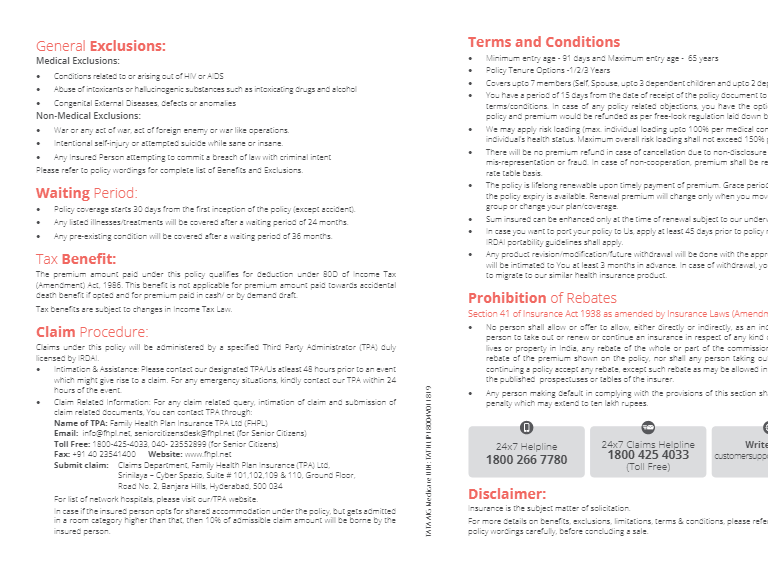

11. • Anaesthetist services - up to 25% of surgical treatment • Medical Practitioner’s visit fees - maximum USD 100 per day per visit up to 10 visits • Diagnostic and Radiology services - maximum USD 1,000 • Ambulance services** - maximum USD 500 • Miscellaneous expenses*** – maximum of USD 2,000 For the purpose of application of the above sub-limits : *Surgery : Includes Operation room charges, Surgeon fee and Implant charges **Ambulance Services: Includes Cost of transportation to hospital and Paramedic services ***Miscellaneous expenses: Includes but not limited to cost of medicines/ Pharmacy/ Drugs/ Supplies, nursing charges, External medical appliances as prescribed by a registered Medical Practitioner as necessary and essential as part of the treatment on actual, Bl ood storage & processing charges, other services which are not part of any other above given heads Exclusions: • Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered under the policy • Any claim relating to Hazardous Activities, unless specifically covered in the Policy • Any claim relating to events occurring before the commencement of the Trip covered hereunder and any time after the completion of the Trip at any port at the Country of Residence of the Insured mentioned hereunder For full list of exclusions please refer policy wordings at www.icicilombard.com Please Note : Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered

9. With International Travel Insurance of ICICI Lombard you are made to feel secure because your loved ones back home enjoy a bundle of concierge services when you are on the move. For the above mentioned services, the liability of the Company would always remain limited to providing assistance in terms of arranging the above mentioned services. All charges towards such services would be borne by the Insured Person. To avail above services please call: • USA & Canada Toll Free Number +18448711200 • National Toll Free Number +18001025721 • Fax: +91 124 4006674 Medical Concierge Services for dependents in India • Telephone Medical Information • Medical Service Provider Referral • Appointments with Local Doctors for Treatment • Home Nursing Care Assistance • Monitoring Assistance • Evacuation / Repatriation Services Automotive Assistance Services for dependents in India • Minor on the spot repair • Breakdown Services & Towing • Flat tyre service • Jumpstart • Gift / Flowers Delivery Assistance • Dining Referral and Reservation Assistance • Business Services • Special Events and Performance Assistance • Home Movers Assistance • Plumbing Assistance • Electrical Assistance • Pest Control Assistance • Home Cleaning Assistance • Electrical Gadget Repair Assistance Lifestyle Services for dependents in India • IRest Of The World (Call Back Facility) +91 124 4498778 in India only) • E-mail: icicilombard@falck.com Note N o t e : Applicable to selective plans under International Travel Insurance Please Note : Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered

10. Under International Travel Insurance product, at the request of the Insured, the Policy will be cancelled any time prior to the date of expiry mentioned in the Policy subject to the following conditions : • Cancellation shall be effected only in case of a no claim and /or before the expiry period of the cover is equal or more than 30 days • In case of Single Trip Policy: In the event of cancellation of the Policy, the Company in addition to retaining the premium on proportionate basis for the expired portion of the cover shall also retain a sum of ` 300 towards cancellation charges for the Policy before refunding the premium which the Insured is eligible under the Policy • For the cancellation clause for Multi-Trip policies, please refer to the Policy Wordings • No cancellation of this Policy will be allowed in case the Insured has reported a claim under any of the sections of this Policy prior to the date of notice of cancellation and such claim is either in the process of decision or stands admitted by the Insurer for any amount whatsoever • Disclosure to information norm : The policy shall be void and all premium paid hereon shall be forfeited to the company, in the event of misrepresentation, mis-description or non disclosure of any material Insured may cancel this Policy by giving us 15 days written notice and in such case company shall refund premium on short term basis for the unexpired Policy Period, provided no claim has been payable on insured’s behalf Terms of Renewal : • The Policy can be renewed under the then prevailing International Travel Insurance product or its nearest substitute (in case the product International Travel Insurance product is withdrawn by the Company) approved by IRDA • This policy shall ordinarily be renewable except on grounds of fraud, moral hazard or misrepresentation or non-cooperation by the insured • Renewal Premium - Premium payable on renewal and on subsequent continuation of cover are subject to change with prior approval from IRDA • The policy shall be renewed subject to the presence of the insured in Indian geographical location • Extension under the policy shall only be possible 30 days prior to the expiry of the policy period Limit of Covered Expenses : Sub-limit A : Limit for any one illness and/or injury The maximum liability of the Company applicable for any one Illness and / or Injury is USD 100,000 or Sum Insured, whichever is lesser Sub-limit B: Limits applicable for various types of medical expenses In case of persons aged 51 years and above, following limits are applicable for any one Illness and / or Injury : • Hospital Room and boarding- maximum USD 1,800 per day up to 30 days • Intensive care unit - maximum USD 3,250 per day up to 7 days • Surgery* - maximum up to USD 15,000

3. All about Travel Insurance policy of ICICI Lombard Salient Features: • Comprehensive plans with extensive coverages • Coverage available upto 360 days( Original policy for 180 days and extension for additional 180 days) • No medical test required upto 85 years age • Value added services for dependents in India • Pay per day : Slab rate for first 7 days only, then pay per day basis Medical covers : • Medical Cover with medical evacuation costs Sum Insured from $50,000 to $5,00,000 • Repatriation of remains Covers repatriating the remains back as well as local burial or cremation in the country where the death shall occur • Daily Allowance in case of hospitalisation* Covered in case of hospitalisation for more than 2 days • Dental Treatment Covers cost of treatment to natural teeth in case of injury • Personal Accident Compensation paid in case of accidental - death or permanent total/partial disability • Personal Liability Compensation for legal liability incurred by the insured for involuntarily causing bodily injury or property damage to third parties • Accidental Death( Common Carrier) Compensation paid in case of death or permanent total/partial disability while travelling in common carrier Non-medical covers • Total Loss of Checked-in Baggage Reimbursement for the loss suffered due to permanent loss of checked-in baggage whilst in custody of the Common Carrier • Political Risk & Catastrophe Evacuation Company will pay the cost of Insured’s return to the Country of Residence or the nearest place of safety, in case insured needs to immediately evacuate the country • Compassionate Visit Payment of traveling and lodging & boarding expenses for a family member or relative in case of Insured’s hospitalisation for more than 5 days * Applicable to selective plans under International Travel Insurance

4. • Delay of Checked-in Baggage Allowance for the incidental expenses incurred due to a delay of checked-in baggage for more than 6 hours • Loss of Passport Reimbursement of expenses incurred in obtaining an emergency certificate to prosecute journey to resident country as well as cost incurred towards the prescribed application fee for a duplicate passport • Trip Cancellation & Interruption Reimbursement of the non-refundable prepaid payments, for the trip being cancelled or interrupted due to medical problems, acts of terrorism or natural disasters • Trip Delay Reimbursement of additional expenses incurred if trip is delayed for more than 6 hours • Bounced Booking Reimbursement of additional expenses incurred due to bounced booking of an airline or hotel, solely at the instance of the common carrier and accomodation provider respectively • Emergency Cash Advance Emergency cash allowance given in case of accidental loss of all or almost all travel funds • Emergency Hotel extension Payment of the actual additional expenses for lodging and boarding incurred in case the insured trip is delayed due to natural calamities, act of terrorism or medical emergencies • Loss of Baggage & Personal Effects Reimbursement for loss incurred due to loss of Checked In Baggage or personal effects outside the airport • Missed (Flight) Connections Reimbursement of the extra expenses incurred due to a missing a connecting flight, due to aircraft delay of more than 3 hours • Hijack Distress Allowance Compensation payable in case of hijack of air or sea common carrier, for more than 12 hrs while on your trip abroad • Return of Minor Child(ren) Compensation of the cost of economic class air ticket for the unattended minor child in the foreign land • Home Insurance ( Fire cover for Building and Contents, Burgulary Cover for Contents) Compensation to the losses incur due to damage to your home or its contents from fire and allied perils or any loss of home contents on account of burglary, whilst on your trip abroad • Value Added Services* *The liability of the Company would always remain limited to providing assistance in terms of arranging the above mentioned ser vices. All charges towards such services would be borne by the Insured Person. Please Note : Any claim due to or arising out of pre-existing medical condition/ailment whether declared or undeclared is not covered