Star Health Red Carpet Plan

Share on Social Networks

Share Link

Use permanent link to share in social mediaShare with a friend

Please login to send this document by email!

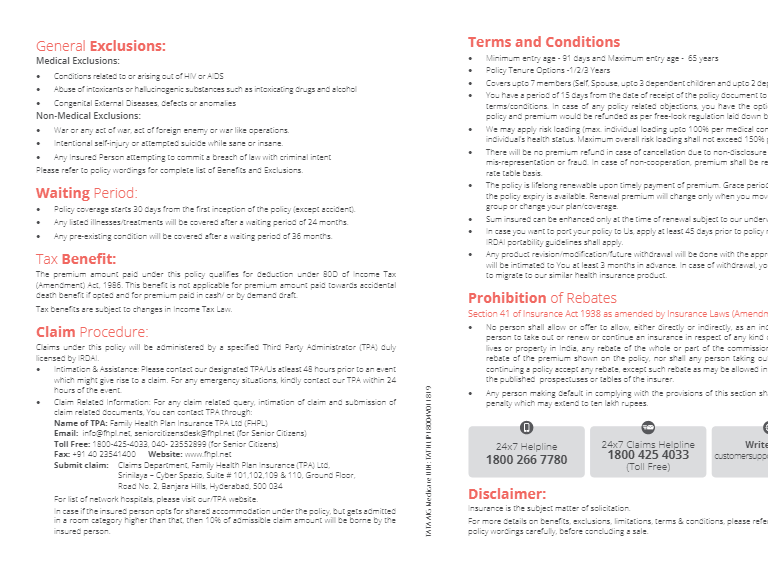

Embed in your website

7. Note: If the premium is paid Monthly , cancellation of policy will be on “No Refund Basis” Notwithstanding anything contained herein or otherwise, no refunds of premium shall be made in respect of Cancellation where, any claim has been admitted or has been lodged or any benefit has been availed by the insured person under the policy . ii. The Company may cancel the policy at any time on grounds of misrepresentation, non-disclosure of material facts, fraud by the insured person by giving 15 days written notice. There would be no refund of premium on cancellation on grounds of misrepresentation, non- disclosure of material facts or fraud v Automatic Expiry of the policy: The insurance under this policy with respect to each relevant insured person shall expire immediately upon death of the insured person or on expiry of the sum insured whichever shall first occur. v Disclosure to information norms: The policy shall become void and all premium paid thereon shall be forfeited to the Company , in the event of mis-representation, mis description or non- disclosure of any material fact by the policy holder . v Claims Procedure · n Call the 24 hour help-line for assista ce-1800 425 2255 / 1800 102 4477 · In case of planned hospitalization, inform 24 hours prior to admission in the hospital. · I n c a s e o f e m e r g e n c y h o s p i t a l i z a t i o n i n f o r m a t i o n t o b e g i v e n w i t h i n 2 4 h o u r s a f t e r h o s p i t a l i z a t i o n . · Cashless facility wherever possible in network hospital. · In non-network hospitals payment must be made up-front and then reimbursement will be ef fected on submission of documents v The Company: Star Health and Allied Insurance Co. Ltd., commenced its operations in 2006 as India's first Standalone Health Insurance provider . As an exclusive Health Insurer , the Company is providing sterling services in Health, Personal Accident & Overseas T ravel Insurance and is committed to setting international benchmarks in service and personal caring. v Star Advantages · No Third Party Administrator , direct in-house claims settlement · Faster and hassle – free claim settlement · Cashless hospitalization v T ax Benefits: Payment of premium by any mode other than cash for this insurance is eligible for relief under Section 80D of the Income T ax Act 1961. v Prohibition of rebates: (Section 41 of Insurance Act 1938): No person shall allow or of fer to allow , either directly or indirectly , as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy , nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakhs rupees. PREMIUM CHART (Excluding T ax) Amount in Rs. A , = Adult v Portability: The insured person will have the option to port the policy to other insurers by applying to such insurer to port the entire policy along with all the members of the family , if any , at least 45 days before, but not earlier than 60 days from the policy renewal date as per IRDAI guidelines related to portability . lf such person is presently covered and has been continuously covered without any lapses under any health insurance policy with an lndian General/Health insurer , the proposed insured person will get the accrued continuity benefits i n w a i t i n g p e r i o d s a s p e r I R D A I g u i d e l i n e s o n p o r t a b i l i t y . F o r d e t a i l s c o n t a c t “portability@starhealth.in” or call T elephone No +91-044-28288869. For Detailed Guidelines on portability , kindly refer the link https://www .irdai.gov .in/ADMINCMS/cms/frmGuidelines_Layout.aspx?page=PageNo3987 v Withdrawal of the policy i. In the likelihood of this product being withdrawn in future, the Company will intimate the insured person about the same 90 days prior to expiry of the policy ii. lnsured Person will have the option to migrate to similar health insurance product available with the Company at the time of renewal with all the accrued continuity benefits such as cumulative bonus, waiver of waiting period as per IRDAI guidelines, provided the policy has been maintained without a break v Instalment Premium Options: lf the insured person has opted for Payment of Premium on an instalment basis i.e. Half Y early , Quarterly or Monthly , as mentioned in the policy Schedule/Certificate of lnsurance, the following Conditions shall apply (notwithstanding any terms contrary elsewhere in the policy); i. Grace Period of 7 days would be given to pay the instalment premium due for the policy ii. During such grace period, coverage will not be available from the due date of instalment premium till the date of receipt of premium by Company iii. The insured person will get the accrued continuity benefit in respect of the "W aiting Periods", "Specific W aiting Periods" in the event of payment of premium within the stipulated grace Period iv . No interest will be charged lf the instalment premium is not paid on due date v. ln case of instalment premium due not received within the grace period, the policy will get cancelled vi. ln the event of a claim, all subsequent premium instalments shall immediately become due and payable vii The company has the right to recover and deduct all the pending installments from the claim amount due under the policy v Free Look Period: The Free Look Period shall be applicable on new individual health insurance policies and not on renewals or at the time of porting/migrating the policy . T h e i n s u r e d p e r s o n s h a l l b e a l l o w e d f r e e l o o k p e r i o d o f fi f t e e n d a y s f r o m d a t e o f r e c e i p t o f t h e p o l i c y d o c u m e n t t o r e v i e w t h e t e r m s a n d c o n d i t i o n s o f t h e p o l i c y , a n d t o r e t u r n t h e s a m e i f n o t a c c e p t a b l e . l f t h e i n s u r e d h a s n o t m a d e a n y c l a i m d u r i n g t h e F r e e L o o k P e r i o d , t h e i n s u r e d s h a l l b e e n t i t l e d t o ; i. a refund of the premium paid less any expenses incurred by the Company on medical examination of the insured person and the stamp duty charges or ii. where the risk has already commenced and the option of return of the policy is exercised by the insured person, a deduction towards the proportionate risk premium for period of cover or iii. where only a part of the insurance coverage has commenced, such proportionate premium commensurate with the insurance coverage during such period v C a n c e l l a t i o n : T h e p o l i c y h o l d e r m a y c a n c e l t h i s p o l i c y b y g i v i n g 1 5 d a y s w r i t t e n n o t i c e a n d i n s u c h a n e v e n t , t h e C o m p a n y s h a l l r e f u n d p r e m i u m f o r t h e u n e x p i r e d p o l i c y p e r i o d a s d e t a i l e d b e l o w ; 8 9 10 7 596.00 mm 210.00 mm 95.50 mm 95.50 mm 100.00 mm 100.00 mm 102.50 mm 102.50 mm Cancellation table applicable for Policy T erm 1 Y ear without instalment option Period on risk R a t e o f p r e m i u m t o b e r e t a i n e d Up to one month 2 2 . 5 % o f t h e p o l i c y p r e m i u m Exceeding one month up to 3 months 3 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 3 months up to 6 months 5 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 6 months up to 9 months 8 0 % o f t h e p o l i c y p r e m i u m Exceeding 9 months F u l l o f t h e p o l i c y p r e m i u m Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 25% of the policy premium Exceeding 3 months up to 6 months 37.5% of the policy premium Exceeding 6 months up to 9 months 47.5% of the policy premium Exceeding 9 months up to 12 months 57.5% of the policy premium Exceeding 12 months up to 15 months 67.5% of the policy premium Exceeding 15 months up to 18 months 80% of the policy premium Exceeding 18 months up to 21 months 90% of the policy premium Exceeding 21 months Full of the policy premium Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 22.5% of the policy premium Exceeding 3 months up to 6 months 30% of the policy premium Exceeding 6 months up to 9 months 37.5% of the policy premium Exceeding 9 months up to 12 months 42.5% of the policy premium Exceeding 12 months up to 15 months 50% of the policy premium Exceeding 15 months up to 18 months 57.5% of the policy premium Exceeding 18 months up to 21 months 65% of the policy premium Exceeding 21 months up to 24 months 72.5% of the policy premium Exceeding 24 months up to 27 months 80% of the policy premium Exceeding 27 months up to 30 months 85% of the policy premium Exceeding 30 months up to 33 months 92.5% of the policy premium Exceeding 33 months Full of the policy premium Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months up to 24 months 100% of the total premium received Exceeding 24 months up to 27 months 95% of the total premium received Exceeding 27 months up to 30 months 100% of the total premium received Exceeding 30 months up to 33 months 92.5% of the total premium received Exceeding 33 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months up to 24 months 100% of the total premium received Exceeding 24 months up to 25 months 97.5% of the total premium received Exceeding 25 months up to 27 months 100% of the total premium received Exceeding 27 months up to 28 months 97.5% of the total premium received Exceeding 28 months up to 30 months 100% of the total premium received Exceeding 30 months up to 31 months 95% of the total premium received Exceeding 31 months up to 33 months 100% of the total premium received Exceeding 33 months up to 34 months 95% of the total premium received Exceeding 34 months 100% of the total premium received Individual (1A) Policy T erm 1 year 2 years 3 years Sum Insured 1,00,000 4,450 8,589 12,482 2,00,000 8,456 16,320 23,719 3,00,000 12,900 24,897 36,185 4,00,000 15,501 29,917 43,480 5,00,000 18,000 34,740 50,490 7,50,000 21,000 40,530 58,905 10,00,000 22,500 43,425 63,1 13 15,00,000 29,205 56,366 81,920 20,00,000 32,710 63,130 91,752 25,00,000 35,985 69,451 1,00,938 Buy this Insurance Online at www .starhealth.in and avail discount 5% This discount is available for first purchase only Call T oll-free: 1800-425-2255 / 1800-102-4477, sms ST AR to 56677 Fax T oll Free No: 1800-425-5522 « Email : support@starhealth.in CIN : U66010TN2005PLC056649 « IRDAI Regn. No: 129 T h e i n f o r m a t i o n p r o v i d e d i n t h i s b r o c h u r e i s o n l y i n d i c a t i v e . F o r m o r e d e t a i l s o n t h e r i s k f a c t o r s , t e r m s a n d c o n d i t i o n s , p l e a s e r e a d t h e p o l i c y w o r d i n g s b e f o r e c o n c l u d i n g s a l e O r V i s i t o u r w e b s i t e w w w . s t a r h e a l t h . i n Senior Citizens Red Carpet Health Insurance Policy Unique Identication No.: SHAHLIP21265V042021 2A = Self + Spouse BRO / SCRC / V .9 / 2020 Senior Citizens Red Carpet Health Insurance Policy ST AR HEAL TH AND ALLIED INSURANCE CO L TD Regd. & Corporate Office: 1, New T ank Street, V alluvar Kottam High Road, Nungambakkam, Chennai - 600 034. “IRDAI OR ITS OFFICIALS DO NOT INVOL VE IN ACTIVITIES LIKE SALE OF ANY KIND OF INSURANCE OR FINANCIAL PRODUCTS NOR INVEST PREMIUMS. IRDAI DOES NOT ANNOUNCE ANY BONUS” PUBLIC RECEIVING SUCH PHONE CALLS ARE REQUESTED T O LODGE A POLICE COMPLAINT ALONG WITH DET AILS OF PHONE CALL AND NUMBER” Floater (2A) Policy T erm 1 year 2 years 3 years Sum Insured 10,00,000 38,250 73,823 1,07,291 15,00,000 49,650 95,825 1,39,268 20,00,000 55,610 1,07,327 1,55,986 25,00,000 61,175 1,18,068 1,71,596

1. Note: If the premium is paid Monthly , cancellation of policy will be on “No Refund Basis” Notwithstanding anything contained herein or otherwise, no refunds of premium shall be made in respect of Cancellation where, any claim has been admitted or has been lodged or any benefit has been availed by the insured person under the policy . ii. The Company may cancel the policy at any time on grounds of misrepresentation, non-disclosure of material facts, fraud by the insured person by giving 15 days written notice. There would be no refund of premium on cancellation on grounds of misrepresentation, non- disclosure of material facts or fraud v Automatic Expiry of the policy: The insurance under this policy with respect to each relevant insured person shall expire immediately upon death of the insured person or on expiry of the sum insured whichever shall first occur. v Disclosure to information norms: The policy shall become void and all premium paid thereon shall be forfeited to the Company , in the event of mis-representation, mis description or non- disclosure of any material fact by the policy holder . v Claims Procedure · n Call the 24 hour help-line for assista ce-1800 425 2255 / 1800 102 4477 · In case of planned hospitalization, inform 24 hours prior to admission in the hospital. · I n c a s e o f e m e r g e n c y h o s p i t a l i z a t i o n i n f o r m a t i o n t o b e g i v e n w i t h i n 2 4 h o u r s a f t e r h o s p i t a l i z a t i o n . · Cashless facility wherever possible in network hospital. · In non-network hospitals payment must be made up-front and then reimbursement will be ef fected on submission of documents v The Company: Star Health and Allied Insurance Co. Ltd., commenced its operations in 2006 as India's first Standalone Health Insurance provider . As an exclusive Health Insurer , the Company is providing sterling services in Health, Personal Accident & Overseas T ravel Insurance and is committed to setting international benchmarks in service and personal caring. v Star Advantages · No Third Party Administrator , direct in-house claims settlement · Faster and hassle – free claim settlement · Cashless hospitalization v T ax Benefits: Payment of premium by any mode other than cash for this insurance is eligible for relief under Section 80D of the Income T ax Act 1961. v Prohibition of rebates: (Section 41 of Insurance Act 1938): No person shall allow or of fer to allow , either directly or indirectly , as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy , nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakhs rupees. PREMIUM CHART (Excluding T ax) Amount in Rs. A , = Adult v Portability: The insured person will have the option to port the policy to other insurers by applying to such insurer to port the entire policy along with all the members of the family , if any , at least 45 days before, but not earlier than 60 days from the policy renewal date as per IRDAI guidelines related to portability . lf such person is presently covered and has been continuously covered without any lapses under any health insurance policy with an lndian General/Health insurer , the proposed insured person will get the accrued continuity benefits i n w a i t i n g p e r i o d s a s p e r I R D A I g u i d e l i n e s o n p o r t a b i l i t y . F o r d e t a i l s c o n t a c t “portability@starhealth.in” or call T elephone No +91-044-28288869. For Detailed Guidelines on portability , kindly refer the link https://www .irdai.gov .in/ADMINCMS/cms/frmGuidelines_Layout.aspx?page=PageNo3987 v Withdrawal of the policy i. In the likelihood of this product being withdrawn in future, the Company will intimate the insured person about the same 90 days prior to expiry of the policy ii. lnsured Person will have the option to migrate to similar health insurance product available with the Company at the time of renewal with all the accrued continuity benefits such as cumulative bonus, waiver of waiting period as per IRDAI guidelines, provided the policy has been maintained without a break v Instalment Premium Options: lf the insured person has opted for Payment of Premium on an instalment basis i.e. Half Y early , Quarterly or Monthly , as mentioned in the policy Schedule/Certificate of lnsurance, the following Conditions shall apply (notwithstanding any terms contrary elsewhere in the policy); i. Grace Period of 7 days would be given to pay the instalment premium due for the policy ii. During such grace period, coverage will not be available from the due date of instalment premium till the date of receipt of premium by Company iii. The insured person will get the accrued continuity benefit in respect of the "W aiting Periods", "Specific W aiting Periods" in the event of payment of premium within the stipulated grace Period iv . No interest will be charged lf the instalment premium is not paid on due date v. ln case of instalment premium due not received within the grace period, the policy will get cancelled vi. ln the event of a claim, all subsequent premium instalments shall immediately become due and payable vii The company has the right to recover and deduct all the pending installments from the claim amount due under the policy v Free Look Period: The Free Look Period shall be applicable on new individual health insurance policies and not on renewals or at the time of porting/migrating the policy . T h e i n s u r e d p e r s o n s h a l l b e a l l o w e d f r e e l o o k p e r i o d o f fi f t e e n d a y s f r o m d a t e o f r e c e i p t o f t h e p o l i c y d o c u m e n t t o r e v i e w t h e t e r m s a n d c o n d i t i o n s o f t h e p o l i c y , a n d t o r e t u r n t h e s a m e i f n o t a c c e p t a b l e . l f t h e i n s u r e d h a s n o t m a d e a n y c l a i m d u r i n g t h e F r e e L o o k P e r i o d , t h e i n s u r e d s h a l l b e e n t i t l e d t o ; i. a refund of the premium paid less any expenses incurred by the Company on medical examination of the insured person and the stamp duty charges or ii. where the risk has already commenced and the option of return of the policy is exercised by the insured person, a deduction towards the proportionate risk premium for period of cover or iii. where only a part of the insurance coverage has commenced, such proportionate premium commensurate with the insurance coverage during such period v C a n c e l l a t i o n : T h e p o l i c y h o l d e r m a y c a n c e l t h i s p o l i c y b y g i v i n g 1 5 d a y s w r i t t e n n o t i c e a n d i n s u c h a n e v e n t , t h e C o m p a n y s h a l l r e f u n d p r e m i u m f o r t h e u n e x p i r e d p o l i c y p e r i o d a s d e t a i l e d b e l o w ; 8 9 10 7 596.00 mm 210.00 mm 95.50 mm 95.50 mm 100.00 mm 100.00 mm 102.50 mm 102.50 mm Cancellation table applicable for Policy T erm 1 Y ear without instalment option Period on risk R a t e o f p r e m i u m t o b e r e t a i n e d Up to one month 2 2 . 5 % o f t h e p o l i c y p r e m i u m Exceeding one month up to 3 months 3 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 3 months up to 6 months 5 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 6 months up to 9 months 8 0 % o f t h e p o l i c y p r e m i u m Exceeding 9 months F u l l o f t h e p o l i c y p r e m i u m Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 25% of the policy premium Exceeding 3 months up to 6 months 37.5% of the policy premium Exceeding 6 months up to 9 months 47.5% of the policy premium Exceeding 9 months up to 12 months 57.5% of the policy premium Exceeding 12 months up to 15 months 67.5% of the policy premium Exceeding 15 months up to 18 months 80% of the policy premium Exceeding 18 months up to 21 months 90% of the policy premium Exceeding 21 months Full of the policy premium Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 22.5% of the policy premium Exceeding 3 months up to 6 months 30% of the policy premium Exceeding 6 months up to 9 months 37.5% of the policy premium Exceeding 9 months up to 12 months 42.5% of the policy premium Exceeding 12 months up to 15 months 50% of the policy premium Exceeding 15 months up to 18 months 57.5% of the policy premium Exceeding 18 months up to 21 months 65% of the policy premium Exceeding 21 months up to 24 months 72.5% of the policy premium Exceeding 24 months up to 27 months 80% of the policy premium Exceeding 27 months up to 30 months 85% of the policy premium Exceeding 30 months up to 33 months 92.5% of the policy premium Exceeding 33 months Full of the policy premium Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months up to 24 months 100% of the total premium received Exceeding 24 months up to 27 months 95% of the total premium received Exceeding 27 months up to 30 months 100% of the total premium received Exceeding 30 months up to 33 months 92.5% of the total premium received Exceeding 33 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months up to 24 months 100% of the total premium received Exceeding 24 months up to 25 months 97.5% of the total premium received Exceeding 25 months up to 27 months 100% of the total premium received Exceeding 27 months up to 28 months 97.5% of the total premium received Exceeding 28 months up to 30 months 100% of the total premium received Exceeding 30 months up to 31 months 95% of the total premium received Exceeding 31 months up to 33 months 100% of the total premium received Exceeding 33 months up to 34 months 95% of the total premium received Exceeding 34 months 100% of the total premium received Individual (1A) Policy T erm 1 year 2 years 3 years Sum Insured 1,00,000 4,450 8,589 12,482 2,00,000 8,456 16,320 23,719 3,00,000 12,900 24,897 36,185 4,00,000 15,501 29,917 43,480 5,00,000 18,000 34,740 50,490 7,50,000 21,000 40,530 58,905 10,00,000 22,500 43,425 63,1 13 15,00,000 29,205 56,366 81,920 20,00,000 32,710 63,130 91,752 25,00,000 35,985 69,451 1,00,938 Buy this Insurance Online at www .starhealth.in and avail discount 5% This discount is available for first purchase only Call T oll-free: 1800-425-2255 / 1800-102-4477, sms ST AR to 56677 Fax T oll Free No: 1800-425-5522 « Email : support@starhealth.in CIN : U66010TN2005PLC056649 « IRDAI Regn. No: 129 T h e i n f o r m a t i o n p r o v i d e d i n t h i s b r o c h u r e i s o n l y i n d i c a t i v e . F o r m o r e d e t a i l s o n t h e r i s k f a c t o r s , t e r m s a n d c o n d i t i o n s , p l e a s e r e a d t h e p o l i c y w o r d i n g s b e f o r e c o n c l u d i n g s a l e O r V i s i t o u r w e b s i t e w w w . s t a r h e a l t h . i n Senior Citizens Red Carpet Health Insurance Policy Unique Identication No.: SHAHLIP21265V042021 2A = Self + Spouse BRO / SCRC / V .9 / 2020 Senior Citizens Red Carpet Health Insurance Policy ST AR HEAL TH AND ALLIED INSURANCE CO L TD Regd. & Corporate Office: 1, New T ank Street, V alluvar Kottam High Road, Nungambakkam, Chennai - 600 034. “IRDAI OR ITS OFFICIALS DO NOT INVOL VE IN ACTIVITIES LIKE SALE OF ANY KIND OF INSURANCE OR FINANCIAL PRODUCTS NOR INVEST PREMIUMS. IRDAI DOES NOT ANNOUNCE ANY BONUS” PUBLIC RECEIVING SUCH PHONE CALLS ARE REQUESTED T O LODGE A POLICE COMPLAINT ALONG WITH DET AILS OF PHONE CALL AND NUMBER” Floater (2A) Policy T erm 1 year 2 years 3 years Sum Insured 10,00,000 38,250 73,823 1,07,291 15,00,000 49,650 95,825 1,39,268 20,00,000 55,610 1,07,327 1,55,986 25,00,000 61,175 1,18,068 1,71,596

5. Note: If the premium is paid Monthly , cancellation of policy will be on “No Refund Basis” Notwithstanding anything contained herein or otherwise, no refunds of premium shall be made in respect of Cancellation where, any claim has been admitted or has been lodged or any benefit has been availed by the insured person under the policy . ii. The Company may cancel the policy at any time on grounds of misrepresentation, non-disclosure of material facts, fraud by the insured person by giving 15 days written notice. There would be no refund of premium on cancellation on grounds of misrepresentation, non- disclosure of material facts or fraud v Automatic Expiry of the policy: The insurance under this policy with respect to each relevant insured person shall expire immediately upon death of the insured person or on expiry of the sum insured whichever shall first occur. v Disclosure to information norms: The policy shall become void and all premium paid thereon shall be forfeited to the Company , in the event of mis-representation, mis description or non- disclosure of any material fact by the policy holder . v Claims Procedure · n Call the 24 hour help-line for assista ce-1800 425 2255 / 1800 102 4477 · In case of planned hospitalization, inform 24 hours prior to admission in the hospital. · I n c a s e o f e m e r g e n c y h o s p i t a l i z a t i o n i n f o r m a t i o n t o b e g i v e n w i t h i n 2 4 h o u r s a f t e r h o s p i t a l i z a t i o n . · Cashless facility wherever possible in network hospital. · In non-network hospitals payment must be made up-front and then reimbursement will be ef fected on submission of documents v The Company: Star Health and Allied Insurance Co. Ltd., commenced its operations in 2006 as India's first Standalone Health Insurance provider . As an exclusive Health Insurer , the Company is providing sterling services in Health, Personal Accident & Overseas T ravel Insurance and is committed to setting international benchmarks in service and personal caring. v Star Advantages · No Third Party Administrator , direct in-house claims settlement · Faster and hassle – free claim settlement · Cashless hospitalization v T ax Benefits: Payment of premium by any mode other than cash for this insurance is eligible for relief under Section 80D of the Income T ax Act 1961. v Prohibition of rebates: (Section 41 of Insurance Act 1938): No person shall allow or of fer to allow , either directly or indirectly , as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy , nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakhs rupees. PREMIUM CHART (Excluding T ax) Amount in Rs. A , = Adult v Portability: The insured person will have the option to port the policy to other insurers by applying to such insurer to port the entire policy along with all the members of the family , if any , at least 45 days before, but not earlier than 60 days from the policy renewal date as per IRDAI guidelines related to portability . lf such person is presently covered and has been continuously covered without any lapses under any health insurance policy with an lndian General/Health insurer , the proposed insured person will get the accrued continuity benefits i n w a i t i n g p e r i o d s a s p e r I R D A I g u i d e l i n e s o n p o r t a b i l i t y . F o r d e t a i l s c o n t a c t “portability@starhealth.in” or call T elephone No +91-044-28288869. For Detailed Guidelines on portability , kindly refer the link https://www .irdai.gov .in/ADMINCMS/cms/frmGuidelines_Layout.aspx?page=PageNo3987 v Withdrawal of the policy i. In the likelihood of this product being withdrawn in future, the Company will intimate the insured person about the same 90 days prior to expiry of the policy ii. lnsured Person will have the option to migrate to similar health insurance product available with the Company at the time of renewal with all the accrued continuity benefits such as cumulative bonus, waiver of waiting period as per IRDAI guidelines, provided the policy has been maintained without a break v Instalment Premium Options: lf the insured person has opted for Payment of Premium on an instalment basis i.e. Half Y early , Quarterly or Monthly , as mentioned in the policy Schedule/Certificate of lnsurance, the following Conditions shall apply (notwithstanding any terms contrary elsewhere in the policy); i. Grace Period of 7 days would be given to pay the instalment premium due for the policy ii. During such grace period, coverage will not be available from the due date of instalment premium till the date of receipt of premium by Company iii. The insured person will get the accrued continuity benefit in respect of the "W aiting Periods", "Specific W aiting Periods" in the event of payment of premium within the stipulated grace Period iv . No interest will be charged lf the instalment premium is not paid on due date v. ln case of instalment premium due not received within the grace period, the policy will get cancelled vi. ln the event of a claim, all subsequent premium instalments shall immediately become due and payable vii The company has the right to recover and deduct all the pending installments from the claim amount due under the policy v Free Look Period: The Free Look Period shall be applicable on new individual health insurance policies and not on renewals or at the time of porting/migrating the policy . T h e i n s u r e d p e r s o n s h a l l b e a l l o w e d f r e e l o o k p e r i o d o f fi f t e e n d a y s f r o m d a t e o f r e c e i p t o f t h e p o l i c y d o c u m e n t t o r e v i e w t h e t e r m s a n d c o n d i t i o n s o f t h e p o l i c y , a n d t o r e t u r n t h e s a m e i f n o t a c c e p t a b l e . l f t h e i n s u r e d h a s n o t m a d e a n y c l a i m d u r i n g t h e F r e e L o o k P e r i o d , t h e i n s u r e d s h a l l b e e n t i t l e d t o ; i. a refund of the premium paid less any expenses incurred by the Company on medical examination of the insured person and the stamp duty charges or ii. where the risk has already commenced and the option of return of the policy is exercised by the insured person, a deduction towards the proportionate risk premium for period of cover or iii. where only a part of the insurance coverage has commenced, such proportionate premium commensurate with the insurance coverage during such period v C a n c e l l a t i o n : T h e p o l i c y h o l d e r m a y c a n c e l t h i s p o l i c y b y g i v i n g 1 5 d a y s w r i t t e n n o t i c e a n d i n s u c h a n e v e n t , t h e C o m p a n y s h a l l r e f u n d p r e m i u m f o r t h e u n e x p i r e d p o l i c y p e r i o d a s d e t a i l e d b e l o w ; 8 9 10 7 596.00 mm 210.00 mm 95.50 mm 95.50 mm 100.00 mm 100.00 mm 102.50 mm 102.50 mm Cancellation table applicable for Policy T erm 1 Y ear without instalment option Period on risk R a t e o f p r e m i u m t o b e r e t a i n e d Up to one month 2 2 . 5 % o f t h e p o l i c y p r e m i u m Exceeding one month up to 3 months 3 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 3 months up to 6 months 5 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 6 months up to 9 months 8 0 % o f t h e p o l i c y p r e m i u m Exceeding 9 months F u l l o f t h e p o l i c y p r e m i u m Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 25% of the policy premium Exceeding 3 months up to 6 months 37.5% of the policy premium Exceeding 6 months up to 9 months 47.5% of the policy premium Exceeding 9 months up to 12 months 57.5% of the policy premium Exceeding 12 months up to 15 months 67.5% of the policy premium Exceeding 15 months up to 18 months 80% of the policy premium Exceeding 18 months up to 21 months 90% of the policy premium Exceeding 21 months Full of the policy premium Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 22.5% of the policy premium Exceeding 3 months up to 6 months 30% of the policy premium Exceeding 6 months up to 9 months 37.5% of the policy premium Exceeding 9 months up to 12 months 42.5% of the policy premium Exceeding 12 months up to 15 months 50% of the policy premium Exceeding 15 months up to 18 months 57.5% of the policy premium Exceeding 18 months up to 21 months 65% of the policy premium Exceeding 21 months up to 24 months 72.5% of the policy premium Exceeding 24 months up to 27 months 80% of the policy premium Exceeding 27 months up to 30 months 85% of the policy premium Exceeding 30 months up to 33 months 92.5% of the policy premium Exceeding 33 months Full of the policy premium Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months up to 24 months 100% of the total premium received Exceeding 24 months up to 27 months 95% of the total premium received Exceeding 27 months up to 30 months 100% of the total premium received Exceeding 30 months up to 33 months 92.5% of the total premium received Exceeding 33 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months up to 24 months 100% of the total premium received Exceeding 24 months up to 25 months 97.5% of the total premium received Exceeding 25 months up to 27 months 100% of the total premium received Exceeding 27 months up to 28 months 97.5% of the total premium received Exceeding 28 months up to 30 months 100% of the total premium received Exceeding 30 months up to 31 months 95% of the total premium received Exceeding 31 months up to 33 months 100% of the total premium received Exceeding 33 months up to 34 months 95% of the total premium received Exceeding 34 months 100% of the total premium received Individual (1A) Policy T erm 1 year 2 years 3 years Sum Insured 1,00,000 4,450 8,589 12,482 2,00,000 8,456 16,320 23,719 3,00,000 12,900 24,897 36,185 4,00,000 15,501 29,917 43,480 5,00,000 18,000 34,740 50,490 7,50,000 21,000 40,530 58,905 10,00,000 22,500 43,425 63,1 13 15,00,000 29,205 56,366 81,920 20,00,000 32,710 63,130 91,752 25,00,000 35,985 69,451 1,00,938 Buy this Insurance Online at www .starhealth.in and avail discount 5% This discount is available for first purchase only Call T oll-free: 1800-425-2255 / 1800-102-4477, sms ST AR to 56677 Fax T oll Free No: 1800-425-5522 « Email : support@starhealth.in CIN : U66010TN2005PLC056649 « IRDAI Regn. No: 129 T h e i n f o r m a t i o n p r o v i d e d i n t h i s b r o c h u r e i s o n l y i n d i c a t i v e . F o r m o r e d e t a i l s o n t h e r i s k f a c t o r s , t e r m s a n d c o n d i t i o n s , p l e a s e r e a d t h e p o l i c y w o r d i n g s b e f o r e c o n c l u d i n g s a l e O r V i s i t o u r w e b s i t e w w w . s t a r h e a l t h . i n Senior Citizens Red Carpet Health Insurance Policy Unique Identication No.: SHAHLIP21265V042021 2A = Self + Spouse BRO / SCRC / V .9 / 2020 Senior Citizens Red Carpet Health Insurance Policy ST AR HEAL TH AND ALLIED INSURANCE CO L TD Regd. & Corporate Office: 1, New T ank Street, V alluvar Kottam High Road, Nungambakkam, Chennai - 600 034. “IRDAI OR ITS OFFICIALS DO NOT INVOL VE IN ACTIVITIES LIKE SALE OF ANY KIND OF INSURANCE OR FINANCIAL PRODUCTS NOR INVEST PREMIUMS. IRDAI DOES NOT ANNOUNCE ANY BONUS” PUBLIC RECEIVING SUCH PHONE CALLS ARE REQUESTED T O LODGE A POLICE COMPLAINT ALONG WITH DET AILS OF PHONE CALL AND NUMBER” Floater (2A) Policy T erm 1 year 2 years 3 years Sum Insured 10,00,000 38,250 73,823 1,07,291 15,00,000 49,650 95,825 1,39,268 20,00,000 55,610 1,07,327 1,55,986 25,00,000 61,175 1,18,068 1,71,596

6. Note: If the premium is paid Monthly , cancellation of policy will be on “No Refund Basis” Notwithstanding anything contained herein or otherwise, no refunds of premium shall be made in respect of Cancellation where, any claim has been admitted or has been lodged or any benefit has been availed by the insured person under the policy . ii. The Company may cancel the policy at any time on grounds of misrepresentation, non-disclosure of material facts, fraud by the insured person by giving 15 days written notice. There would be no refund of premium on cancellation on grounds of misrepresentation, non- disclosure of material facts or fraud v Automatic Expiry of the policy: The insurance under this policy with respect to each relevant insured person shall expire immediately upon death of the insured person or on expiry of the sum insured whichever shall first occur. v Disclosure to information norms: The policy shall become void and all premium paid thereon shall be forfeited to the Company , in the event of mis-representation, mis description or non- disclosure of any material fact by the policy holder . v Claims Procedure · n Call the 24 hour help-line for assista ce-1800 425 2255 / 1800 102 4477 · In case of planned hospitalization, inform 24 hours prior to admission in the hospital. · I n c a s e o f e m e r g e n c y h o s p i t a l i z a t i o n i n f o r m a t i o n t o b e g i v e n w i t h i n 2 4 h o u r s a f t e r h o s p i t a l i z a t i o n . · Cashless facility wherever possible in network hospital. · In non-network hospitals payment must be made up-front and then reimbursement will be ef fected on submission of documents v The Company: Star Health and Allied Insurance Co. Ltd., commenced its operations in 2006 as India's first Standalone Health Insurance provider . As an exclusive Health Insurer , the Company is providing sterling services in Health, Personal Accident & Overseas T ravel Insurance and is committed to setting international benchmarks in service and personal caring. v Star Advantages · No Third Party Administrator , direct in-house claims settlement · Faster and hassle – free claim settlement · Cashless hospitalization v T ax Benefits: Payment of premium by any mode other than cash for this insurance is eligible for relief under Section 80D of the Income T ax Act 1961. v Prohibition of rebates: (Section 41 of Insurance Act 1938): No person shall allow or of fer to allow , either directly or indirectly , as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy , nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakhs rupees. PREMIUM CHART (Excluding T ax) Amount in Rs. A , = Adult v Portability: The insured person will have the option to port the policy to other insurers by applying to such insurer to port the entire policy along with all the members of the family , if any , at least 45 days before, but not earlier than 60 days from the policy renewal date as per IRDAI guidelines related to portability . lf such person is presently covered and has been continuously covered without any lapses under any health insurance policy with an lndian General/Health insurer , the proposed insured person will get the accrued continuity benefits i n w a i t i n g p e r i o d s a s p e r I R D A I g u i d e l i n e s o n p o r t a b i l i t y . F o r d e t a i l s c o n t a c t “portability@starhealth.in” or call T elephone No +91-044-28288869. For Detailed Guidelines on portability , kindly refer the link https://www .irdai.gov .in/ADMINCMS/cms/frmGuidelines_Layout.aspx?page=PageNo3987 v Withdrawal of the policy i. In the likelihood of this product being withdrawn in future, the Company will intimate the insured person about the same 90 days prior to expiry of the policy ii. lnsured Person will have the option to migrate to similar health insurance product available with the Company at the time of renewal with all the accrued continuity benefits such as cumulative bonus, waiver of waiting period as per IRDAI guidelines, provided the policy has been maintained without a break v Instalment Premium Options: lf the insured person has opted for Payment of Premium on an instalment basis i.e. Half Y early , Quarterly or Monthly , as mentioned in the policy Schedule/Certificate of lnsurance, the following Conditions shall apply (notwithstanding any terms contrary elsewhere in the policy); i. Grace Period of 7 days would be given to pay the instalment premium due for the policy ii. During such grace period, coverage will not be available from the due date of instalment premium till the date of receipt of premium by Company iii. The insured person will get the accrued continuity benefit in respect of the "W aiting Periods", "Specific W aiting Periods" in the event of payment of premium within the stipulated grace Period iv . No interest will be charged lf the instalment premium is not paid on due date v. ln case of instalment premium due not received within the grace period, the policy will get cancelled vi. ln the event of a claim, all subsequent premium instalments shall immediately become due and payable vii The company has the right to recover and deduct all the pending installments from the claim amount due under the policy v Free Look Period: The Free Look Period shall be applicable on new individual health insurance policies and not on renewals or at the time of porting/migrating the policy . T h e i n s u r e d p e r s o n s h a l l b e a l l o w e d f r e e l o o k p e r i o d o f fi f t e e n d a y s f r o m d a t e o f r e c e i p t o f t h e p o l i c y d o c u m e n t t o r e v i e w t h e t e r m s a n d c o n d i t i o n s o f t h e p o l i c y , a n d t o r e t u r n t h e s a m e i f n o t a c c e p t a b l e . l f t h e i n s u r e d h a s n o t m a d e a n y c l a i m d u r i n g t h e F r e e L o o k P e r i o d , t h e i n s u r e d s h a l l b e e n t i t l e d t o ; i. a refund of the premium paid less any expenses incurred by the Company on medical examination of the insured person and the stamp duty charges or ii. where the risk has already commenced and the option of return of the policy is exercised by the insured person, a deduction towards the proportionate risk premium for period of cover or iii. where only a part of the insurance coverage has commenced, such proportionate premium commensurate with the insurance coverage during such period v C a n c e l l a t i o n : T h e p o l i c y h o l d e r m a y c a n c e l t h i s p o l i c y b y g i v i n g 1 5 d a y s w r i t t e n n o t i c e a n d i n s u c h a n e v e n t , t h e C o m p a n y s h a l l r e f u n d p r e m i u m f o r t h e u n e x p i r e d p o l i c y p e r i o d a s d e t a i l e d b e l o w ; 8 9 10 7 596.00 mm 210.00 mm 95.50 mm 95.50 mm 100.00 mm 100.00 mm 102.50 mm 102.50 mm Cancellation table applicable for Policy T erm 1 Y ear without instalment option Period on risk R a t e o f p r e m i u m t o b e r e t a i n e d Up to one month 2 2 . 5 % o f t h e p o l i c y p r e m i u m Exceeding one month up to 3 months 3 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 3 months up to 6 months 5 7 . 5 % o f t h e p o l i c y p r e m i u m Exceeding 6 months up to 9 months 8 0 % o f t h e p o l i c y p r e m i u m Exceeding 9 months F u l l o f t h e p o l i c y p r e m i u m Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 1 Y ear with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 25% of the policy premium Exceeding 3 months up to 6 months 37.5% of the policy premium Exceeding 6 months up to 9 months 47.5% of the policy premium Exceeding 9 months up to 12 months 57.5% of the policy premium Exceeding 12 months up to 15 months 67.5% of the policy premium Exceeding 15 months up to 18 months 80% of the policy premium Exceeding 18 months up to 21 months 90% of the policy premium Exceeding 21 months Full of the policy premium Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months 100% of the total premium received Cancellation table applicable for Policy T erm 2 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears without instalment option Period on risk Rate of premium to be retained Up to one month 17.5% of the policy premium Exceeding one month up to 3 months 22.5% of the policy premium Exceeding 3 months up to 6 months 30% of the policy premium Exceeding 6 months up to 9 months 37.5% of the policy premium Exceeding 9 months up to 12 months 42.5% of the policy premium Exceeding 12 months up to 15 months 50% of the policy premium Exceeding 15 months up to 18 months 57.5% of the policy premium Exceeding 18 months up to 21 months 65% of the policy premium Exceeding 21 months up to 24 months 72.5% of the policy premium Exceeding 24 months up to 27 months 80% of the policy premium Exceeding 27 months up to 30 months 85% of the policy premium Exceeding 30 months up to 33 months 92.5% of the policy premium Exceeding 33 months Full of the policy premium Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Half-yearly premium payment frequency Period on risk Rate of premium to be retained Up to one month 45% of the total premium received Exceeding one month up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 65% of the total premium received Exceeding 7 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 15 months 90% of the total premium received Exceeding 15 months up to 18 months 100% of the total premium received Exceeding 18 months up to 21 months 90% of the total premium received Exceeding 21 months up to 24 months 100% of the total premium received Exceeding 24 months up to 27 months 95% of the total premium received Exceeding 27 months up to 30 months 100% of the total premium received Exceeding 30 months up to 33 months 92.5% of the total premium received Exceeding 33 months 100% of the total premium received Cancellation table applicable for Policy T erm 3 Y ears with instalment option of Quarterly premium payment frequency Period on risk Rate of premium to be retained Up to one month 87.5% of the total premium received Exceeding one month up to 3 months 100% of the total premium received Exceeding 3 months up to 4 months 87.5% of the total premium received Exceeding 4 months up to 6 months 100% of the total premium received Exceeding 6 months up to 7 months 85% of the total premium received Exceeding 7 months up to 9 months 100% of the total premium received Exceeding 9 months up to 10 months 85% of the total premium received Exceeding 10 months up to 12 months 100% of the total premium received Exceeding 12 months up to 13 months 97.5% of the total premium received Exceeding 13 months up to 15 months 100% of the total premium received Exceeding 15 months up to 16 months 95% of the total premium received Exceeding 16 months up to 18 months 100% of the total premium received Exceeding 18 months up to 19 months 95% of the total premium received Exceeding 19 months up to 21 months 100% of the total premium received Exceeding 21 months up to 22 months 92.5% of the total premium received Exceeding 22 months up to 24 months 100% of the total premium received Exceeding 24 months up to 25 months 97.5% of the total premium received Exceeding 25 months up to 27 months 100% of the total premium received Exceeding 27 months up to 28 months 97.5% of the total premium received Exceeding 28 months up to 30 months 100% of the total premium received Exceeding 30 months up to 31 months 95% of the total premium received Exceeding 31 months up to 33 months 100% of the total premium received Exceeding 33 months up to 34 months 95% of the total premium received Exceeding 34 months 100% of the total premium received Individual (1A) Policy T erm 1 year 2 years 3 years Sum Insured 1,00,000 4,450 8,589 12,482 2,00,000 8,456 16,320 23,719 3,00,000 12,900 24,897 36,185 4,00,000 15,501 29,917 43,480 5,00,000 18,000 34,740 50,490 7,50,000 21,000 40,530 58,905 10,00,000 22,500 43,425 63,1 13 15,00,000 29,205 56,366 81,920 20,00,000 32,710 63,130 91,752 25,00,000 35,985 69,451 1,00,938 Buy this Insurance Online at www .starhealth.in and avail discount 5% This discount is available for first purchase only Call T oll-free: 1800-425-2255 / 1800-102-4477, sms ST AR to 56677 Fax T oll Free No: 1800-425-5522 « Email : support@starhealth.in CIN : U66010TN2005PLC056649 « IRDAI Regn. No: 129 T h e i n f o r m a t i o n p r o v i d e d i n t h i s b r o c h u r e i s o n l y i n d i c a t i v e . F o r m o r e d e t a i l s o n t h e r i s k f a c t o r s , t e r m s a n d c o n d i t i o n s , p l e a s e r e a d t h e p o l i c y w o r d i n g s b e f o r e c o n c l u d i n g s a l e O r V i s i t o u r w e b s i t e w w w . s t a r h e a l t h . i n Senior Citizens Red Carpet Health Insurance Policy Unique Identication No.: SHAHLIP21265V042021 2A = Self + Spouse BRO / SCRC / V .9 / 2020 Senior Citizens Red Carpet Health Insurance Policy ST AR HEAL TH AND ALLIED INSURANCE CO L TD Regd. & Corporate Office: 1, New T ank Street, V alluvar Kottam High Road, Nungambakkam, Chennai - 600 034. “IRDAI OR ITS OFFICIALS DO NOT INVOL VE IN ACTIVITIES LIKE SALE OF ANY KIND OF INSURANCE OR FINANCIAL PRODUCTS NOR INVEST PREMIUMS. IRDAI DOES NOT ANNOUNCE ANY BONUS” PUBLIC RECEIVING SUCH PHONE CALLS ARE REQUESTED T O LODGE A POLICE COMPLAINT ALONG WITH DET AILS OF PHONE CALL AND NUMBER” Floater (2A) Policy T erm 1 year 2 years 3 years Sum Insured 10,00,000 38,250 73,823 1,07,291 15,00,000 49,650 95,825 1,39,268 20,00,000 55,610 1,07,327 1,55,986 25,00,000 61,175 1,18,068 1,71,596