2. We understand living with diabetes can sometimes feel lonely and bitter but it does not have to be that way anymore. We’ve created a health insurance plan that not just covers your condition and complications, it also partners you in living with diabetes successfully. A health plan that truly understands diabetes.

3. Wellness program and personalized health coach to help you monitor and manage your health. Get coverage from Day One for all hospitalisation arising out of Diabetes and Hypertension. Stay healthy and earn reward points to avail reduced premiums. Active Wellness Program No waiting Period Rewards Uncomplicating Diabetes with

1. Let’s Uncomplicate Diabetes Get covered for type 1 & 2 diabetes from day 1 and uncomplicate your life with the Energy plan.

8. SMS ‘energy’ to 5676 7333 EMAIL: energy@hdfcergohealth.com Section 41 of Insurance Act 1938 as amended by Insurance Laws Amendment Act, 2015 (Prohibition of Rebates) • No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the prospectus or tables of the insurers. • Any person making default in complying with the provision of this section shall be liable for a penalty which may extend to ten lakh rupees IRDAI REGULATION NO 12: This policy is subject to regulation 12 of IRDAI (Protection of Policyholders’ Interests) Regulations, 2017. Note: Policy Term and Conditions & Premium rates are subject to change with prior approval from IRDAI DISCLAIMER › This is only a summary of the product features. The actual benefits available are as described in the policy, and will be subject to the policy terms, conditions and exclusions. Please seek the advice of your insurance advisor if you require any further information or clarification. We have been ‘Making India Health Confident’ with our innovative and award-winning health, personal accident, and travel insurance plans. Our insurance plans cater to individuals, families, and corporates with state-of-the-art infrastructure and uncomplicated services delivered by engaged employees. We also cater to large and small corporate groups with customized Group Health Insurance Plans. We have received several positive reviews and ratings for our health insurance plans and policies that have been ranked as the best plans in the health insurance industry by several of India’s most popular publications. We offer our products through a network of more than 150 offices, well-trained sales partners, and also directly through our call center, website and in-house sales force. Since our inception, our vision has always been to be a trusted leader in the health insurance sector by providing innovative solutions to the Indian population. Innovation has been in our DNA since inception. We were the first health insurance company to offer benefits like lifelong renewal, no sub-limits, maternity and multiplier benefits etc. The success of our innovative products made us the leader on several insurance product ranking tables and winning several accolades on both domestic and international level. ABOUT HDFC ERGO HDFC ERGO Health Insurance Limited (Formerly known as Apollo Munich Health Insurance Company Limited.) • Central Processing Centre: 2nd & 3rd Floor, iLABS Centre, Plot No. 404-405, Udyog Vihar, Phase-III, Gurugram-122016, Haryana • Corp. Off. 1st Floor, SCF-19, Sector-14, Gurugram-122001, Haryana • Registered Off. 101, First Floor, Inizio, Cardinal Gracious Road, Chakala, Opposite P & G Plaza, Andheri (East), Mumbai, Maharashtra 400069 India • Tel: +91-124-4584333 • Fax: +91-124-4584111 • Website: www.hdfcergohealth.com • Email: customerservice@hdfcergohealth.com • For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.•Tax laws are subject to change• IRDAI Registration Number - 131 • CIN: U66030MH2006PLC331263 • UIN: APOHLIPI8126V031718

4. Know the basics Synergising Wellness & Insurance The plan covers individuals in the age group of 18 to 65 years at entry, who are currently diagnosed with Type I Diabetes or Type II Diabetes or Pre-Diabetes (Impaired Fasting Glucose/ Impaired Glucose Tolerance) or Hypertension. Eligibility (who can be covered) The plan can be issued to an individual only and can be taken for the sum insureds of Rs. 2,00,000; 3,00,000; 5,00,000; 10,00,000; 15,00,000; 20,00,000; 25,00,000 and 50,00,000. Sum Insured (how much is covered) • Silver plan: cost for wellness tests is excluded a. Without Co-pay b. With 20% Co-pay* • Gold plan: cost for wellness tests is included a. Without Co-pay b. With 20% Co-pay* (* For more details please refer Policy Wordings.) Variants (my options) Know your plan better • Day one coverage for all hospitalisation arising out of Diabetes and Hypertension (No waiting period) • In-patient hospitalisation • Pre and post hospitalisation cover of 30 and 60 days respectively • 182 day care procedures • Emergency ambulance coverage • Organ donor expenses • Shared Accommodation benefit • HbA1C Checkup benefit Other Benefits: • Restore Benefit • Cumulative Bonus (Please refer policy wordings for detailed explanation) 1. The health coverage (best comprehensive cover)

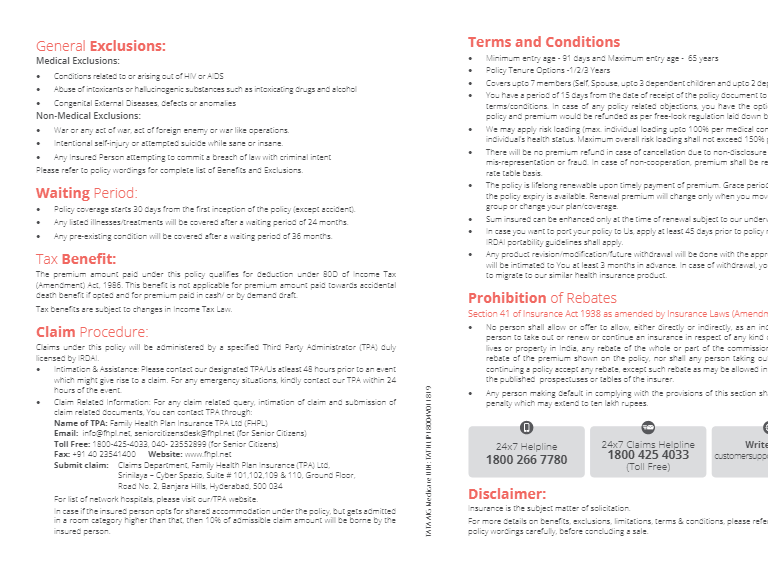

5. Based on the results of your medical tests and key health parameters such as BMI, BP, HbA1c and Cholesterol we offer you incentives for staying healthy. • Renewal premium discounts of up to 25% for management of health conditions. • Reimbursement up to 25% of renewal premium towards your medical expenses (like consultation charges, medicines and drugs, diagnostic expenses, dental expenses and other miscellaneous charges not covered under any medical insurance). 3. The reward points (reward for staying healthy) Wellness Tests: Two complete medical checks administered during the policy year. Wellness Test 1: HbA1c, Blood Pressure Monitoring, BMI Wellness Test 2: HbA1c, FBS, Total Cholesterol, Creatinine, HighDensity Lipoprotein (HDL), Low-Density Lipoprotein (LDL), Triglycerides (TG), Total Protein, Serum Albumin, Gamma- Glutamyltransferase (GGT), Serum Glutamic Oxaloacetic Transaminase (SGOT), Serum Glutamic Pyruvic Transaminase (SGPT), Billirubin, Total Cholesterol: HDL Cholesterol, ECG, Blood Pressure Monitoring, BMI, Doctor Consultation. Please note: For Gold Plan we offer wellness test on cashless basis if undergone at our network centers. However, in case you choose to undergo tests at a non-network (but approved) center we will reimburse a sum of up to Rs. 2000/- only at the end of policy year. If your go for non-approved center, we will not be able to reimburse the amount or provide you reward points. Wellness Support: • Access to a personalized wellness WEB PORTAL that tracks your medical values from various tests, stores all your medical records, helps you monitor your condition and provides you special offers for health products that you may need. • Personalized highly trained HEALTH COACH to guide, remind and create your personal diet and fitness plans. • MONTHLY NEWSLETTERS to provide you with important information on healthcare and management. • Access to a CENTRALIZED HELPLINE to answer any queries that you may have. 2. The wellness program (designed to manage your health) • Any pre-existing condition (other than diabetes or hypertension) will be covered after a waiting period of 2 years. • Expenses arising from HIV or AIDS and related diseases. • External Congenital diseases, mental disorder or insanity, cosmetic surgery and weight control treatments. • Abuse of intoxicant or hallucinogenic substances like intoxicating drugs and alcohol. • Hospitalization due to war or an act of war or due to a nuclear, chemical or biological weapon and radiation of any kind. • Pregnancy, dental treatment, external aids and appliances. • 2 years waiting period for specific diseases like cataract, hernia, joint replacement surgeries, surgery of hydrocele etc. • Items of personal comfort and convenience. • Experimental, investigative and unproven treatment devices and pharmacological regimens Please refer to the Policy Wording for the complete list of exclusions. Exclusions

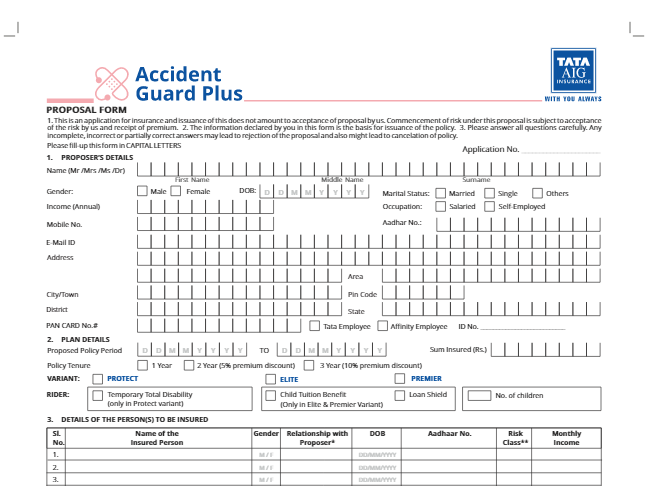

7. Buying Procedure • Fill the application form stating your personal information and health profile. Ensure that the information given in the form is complete and accurate. • Handover the application form and the premium amount in your preferred mode of payment along with necessary documents to the company representative. • Pre policy check will be organized, at a network center near you on cashless basis. In case your proposal is declined the cost of pre policy check will be deducted from the refundable premium. • Based on the details, we may accept or revise our offer to give you an optimal plan as per your profile. This will be done with your consent. In case we do not accept your policy we will inform you with a proper reason. In case of acceptance, the final policy document and kit will be sent to you. Terms of Renewal Life-long coverage: We offer life-long renewal unless the insured person or one acting on behalf of an insured person has acted in an improper, dishonest or fraudulent manner. Grace Period: A grace period of 30 days for renewing the policy is provided under this policy. Waiting Period: The waiting periods mentioned in the policy wording will get reduced by 1 year on every continuous renewal of your Energy insurance Policy. Renewal Premium: Renewal premium other than due to change in age are subject to change with prior approval from IRDAI. Free look cancellation: We offer a period of 15 days from the date of receipt of the Policy document to review the terms and conditions of this Policy. If case of any objections, you have the option of cancel the Policy and you shall be refunded the premium paid by you after adjusting the amounts spent on any medical check-up, stamp duty charges and proportionate risk premium. Tax benefit - 80D: The premium amount paid under this policy qualifies for deduction U/S 80D of the Income Tax Act (Tax benefits are subject to changes in Tax Laws). Sum Insured Enhancement: Sum insured can be enhanced only at the time of renewal; subject to no claim having been lodged/ paid under the policy. If you increase the sum insured by one grid, no fresh medical tests shall be required. In cases where the sum insured increase is more than one grid, the case shall be subject to medical test. In case of increase in the sum insured, waiting period will apply afresh for the amount by which the sum insured has been enhanced. However the quantum of increase shall be at the discretion of the company. Portability: Any insured person in the policy has the option to migrate to a similar indemnity health insurance policy available with us at the time of renewal; subject to underwriting with all the accrued continuity benefits such as cumulative bonus, waiver of waiting period etc. provided the policy has been maintained without a break as per the portability guidelines issued by IRDAI. Regulatory norms: In the likelihood of this policy being withdrawn in future, intimation will be sent to the insured person 3 months prior to expiry of the policy. Insured person will have the option to migrate to similar indemnity health insurance policy available with us at the time of renewal with all the accrued continuity benefits such as cumulative bonus, waiver of waiting period etc. provided the policy has been maintained without a break as per portability guidelines issued by IRDAI. 20% Copayment Applicable Age (in Yrs) 2 Lacs 3 Lacs 5 Lacs 10 Lacs 15 Lacs 20 Lacs 25 Lacs 50 Lacs 18-35 9,597 10,632 12,785 14,590 16,495 18,858 20,041 24,338 36-45 10,521 11,645 14,897 17,174 19,592 22,592 24,092 29,547 46-50 13,486 14,860 18,633 21,751 25,078 29,206 31,270 38,775 51-55 15,339 17,279 22,637 26,652 30,952 36,289 38,957 48,658 56-60 18,383 20,678 25,726 30,426 35,475 41,742 44,875 56,269 61-65 23,406 27,007 34,495 41,162 48,344 57,256 61,711 77,915 66-70 29,708 34,680 45,025 54,046 63,787 75,874 81,919 103,895 71-75 34,448 40,655 53,691 64,637 76,482 91,179 98,528 125,250 76-80 43,296 51,352 68,393 82,612 98,026 117,153 126,716 161,491 >80 51,430 61,178 81,983 99,217 117,928 141,148 152,757 194,974

6. Know your premium (Premium Exclusive of GST) 20% Copayment Applicable Age (in Yrs) 2 Lacs 3 Lacs 5 Lacs 10 Lacs 15 Lacs 20 Lacs 25 Lacs 50 Lacs 18-35 4,597 5,632 7,785 9,590 11,495 13,858 15,041 19,338 36-45 5,521 6,645 9,897 12,174 14,592 17,592 19,092 24,547 46-50 8,486 9,860 13,633 16,751 20,078 24,206 26,270 33,775 51-55 10,339 12,279 17,637 21,652 25,952 31,289 33,957 43,658 56-60 13,383 15,678 20,726 25,426 30,475 36,742 39,875 51,269 61-65 18,406 22,007 29,495 36,162 43,344 52,256 56,711 72,915 66-70 24,708 29,680 40,025 49,046 58,787 70,874 76,919 98,895 71-75 29,448 35,655 48,691 59,637 71,482 86,179 93,528 120,250 76-80 38,296 46,352 63,393 77,612 93,026 112,153 121,716 156,491 >80 46,430 56,178 76,983 94,217 112,928 136,148 147,757 189,974 No Copayment Applicable Age (in Yrs) 2 Lacs 3 Lacs 5 Lacs 10 Lacs 15 Lacs 20 Lacs 25 Lacs 50 Lacs 18-35 5,642 6,973 9,697 11,980 14,360 17,312 18,789 24,157 36-45 6,733 8,195 12,305 15,200 18,220 21,965 23,838 30,648 46-50 10,302 12,123 16,923 20,906 25,057 30,210 32,785 42,152 51-55 12,510 15,062 21,867 27,012 32,376 39,034 42,363 54,465 56-60 16,150 19,194 25,670 31,711 38,008 45,823 49,731 63,941 61-65 22,163 26,898 36,497 45,085 54,039 65,150 70,704 90,906 66-70 29,695 36,229 49,487 61,132 73,274 88,340 95,874 123,266 71-75 35,334 43,468 60,159 74,316 89,076 107,391 116,549 149,848 76-80 45,886 56,448 78,273 96,692 115,896 139,725 151,639 194,964 >80 55,559 68,349 94,997 117,353 140,660 169,581 184,041 236,625 Silver Plan No Copayment Applicable Age (in Yrs) 2 Lacs 3 Lacs 5 Lacs 10 Lacs 15 Lacs 20 Lacs 25 Lacs 50 Lacs 18-35 10,642 11,973 14,697 16,980 19,360 22,312 23,789 29,157 36-45 11,733 13,195 17,305 20,200 23,220 26,965 28,838 35,648 46-50 15,302 17,123 21,923 25,906 30,057 35,210 37,785 47,152 51-55 17,510 20,062 26,867 32,012 37,376 44,034 47,363 59,465 56-60 21,150 24,194 30,670 36,711 43,008 50,823 54,731 68,941 61-65 27,163 31,898 41,497 50,085 59,039 70,150 75,704 95,906 66-70 34,695 41,229 54,487 66,132 78,274 93,340 100,874 128,266 71-75 40,334 48,468 65,159 79,316 94,076 112,391 121,549 154,848 76-80 50,886 61,448 83,273 101,692 120,896 144,725 156,639 199,964 >80 60,559 73,349 99,997 122,353 145,660 174,581 189,041 241,625 Gold Plan