1. Optima Restore with Stay Active benefit. SHOR T W ALK S . BIG BENEFIT S . SA VE 2% SA VE 5% SA VE 8%

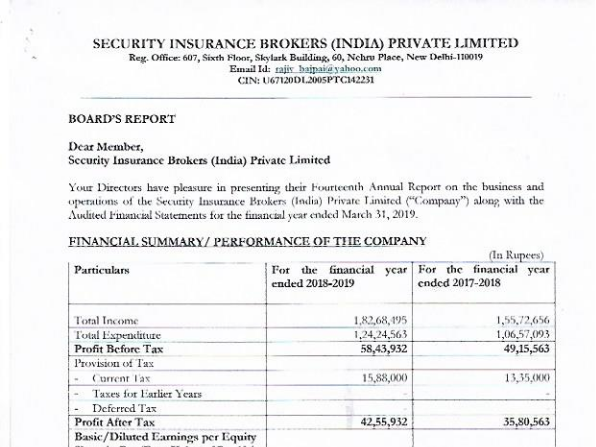

5. WALK MORE EARN MORE WALK FOR HEALTH Basic Sum Insured per Policy per Policy Year (Rs. in Lakh) 3.00 5.00 10.00 15.00 20.00, 25.00, 50.00 1a) In-patient Treatment Covered upto sum insured 1b) Pre-Hospitalization Covered upto 60 Days 1c) Post-Hospitalization Covered upto 180 Days 1d) Day Care Procedures All Day Care Treatments Covered 1e) Domiciliary Treatment Covered upto sum insured 1f) Organ Donor Covered upto sum insured 1g) Ambulance Cover Upto Rs. 2,000 / Hospitalisation 1h) Daily Cash for choosing Shared Accommodation Rs.800 / day, Maximum Rs.4,800 Rs.1000 / day, Maximum Rs.6,000 1i) E-Opinion in respect of a Critical Illness One opinion per policy year 1j) Emergency Air Ambulance Cover Not Covered Covered upto Rs. 2.5 Lacs per hospitalization and maximum upto sum insured in an year 2) Restore Benefit Equal to 100% of Basic Sum Insured 3) Multiplier Benefit Bonus of 50% of the Basic Sum Insured for every claim free year, maximum upto 100%.In case of claim, bonus will be reduced by 50% of the basic sum insured. However this reduction will not reduce the Sum Insured below the basic Sum Insured of the policy 4) Health Checkup Not Applicable Upto Rs. 2500 Upto Rs. 5000 Upto Rs. 8000 Upto Rs. 10,000 RESTORE FAMILY

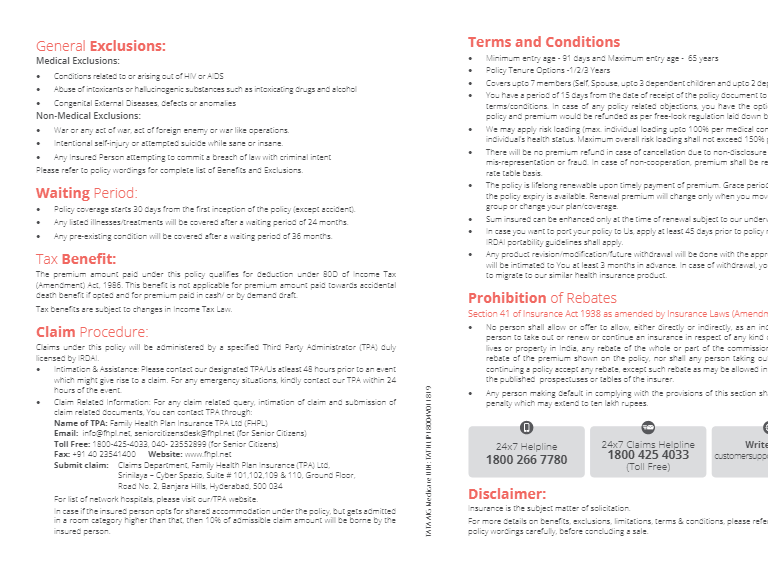

6. EVERY STEP COUNTS • Any treatment within first 30 days of cover except any accidental injury. • Any Pre-existing diseases/conditions will be covered after a waiting period of 3 years. • 2 years exclusion for specific diseases like cataract, hernia, hysterectomy, joint replacement etc. • Abuse of intoxicant or hallucinogenic substance like drugs and alcohol. • Pregnancy, dental treatment, external aids and appliances. • Hospitalization due to war or an act of war or due to nuclear, chemical or biological weapon and radiation of any kind. • Non-allopathic treatment, congenital external diseases, cosmetic surgery For complete exclusions please refer to the policy document. MAJOR EXCLUSIONS • Life-long Renewal: We offer life-long renewal regardless of your health status or previous claims made under your policy, unless the Insured Person or any one acting on behalf of an Insured Person acts in a dishonest or fraudulent manner or if there is any misrepresentation under or in relation to this policy or it poses a moral hazard. • Waiting Period: The waiting periods mentioned in the policy wording will get reduced by 1 year on every continuous renewal of your policy. • Renewal premium are subject to change with prior approval from IRDAI. Any change in benefits or premium (other than due to change in Age) will be done with the approval of the Insurance Regulatory and Development Authority and will be intimated at least 3 months in advance. In the likelihood of this policy being withdrawn in future, intimation will be sent to insured person about the same 3 months prior to expiry of the policy. Insured Person will have the option to migrate to similar indemnity health insurance policy available with us at the time of renewal with all the accrued continuity benefits such as Multiplier Benefit, waiver of waiting period etc; provided the policy has been maintained without a break as per portability/ migration guidelines issued by IRDAI. • Sum Insured Enhancement: Sum Insured can be enhanced only at the time of renewal subject to no claim having been lodged/paid under the Policy. If the insured increases the Sum Insured one grid up, no fresh medicals shall be required. In case where the Sum Insured increase is more than one grid up, the case shall be subject to medicals. In case of increase in the Sum Insured, waiting period will apply afresh for the amount by which the Sum Insured has been enhanced. However, the quantum of increase shall be at the discretion of the company. • Any Insured Person in the policy has the option to migrate to similar indemnity health insurance policy available with us at the time of renewal subject to underwriting with all the accrued continuity benefits such as Multiplier Benefit, waiver of waiting period etc; provided the policy has been maintained without a break as per portability/migration guidelines issued by IRDAI. TERMS OF RENEWAL: LIFE-LONG RENEWAL TAX BENEFIT

3. WALK FOR HEALTH RESTORE BENEFIT 2X HEALTH CHECK UP A Health Plan which restores your Sum Insured when you need it the most. Instant addition of 100% Basic Sum Insured on complete or partial utilization of Your existing Policy Sum Insured and Multiplier Benefit (if applicable) during the Policy Year. This total amount (Basic sum insured, Multiplier benefit and Restore sum insured) will be available to all Insured Persons for all claims under In-patient Benefit during the current Policy Year. Too good to be true, here’s how it will work: If you have a base Sum Insured of 5 lakhs, and you claim Rs.1,00,000 in the beginning of the year, we will restore the base Sum Insured of 5 lakhs to your remaining balance, i.e. you will now have Rs.9,00,000 which can be used for subsequent claims in the remaining policy year for all claims under In-patient Benefits. However, single claim in a Policy Year cannot exceed the sum of Basic Sum Insured and Multiplier Benefit (if any).

2. Introducing • Cares for You in illness • Rewards You for Staying Healthy Now with Stay Active benefit, simply walk your way to good health and earn upto 8% discount on your renewal premium. The more you walk, the healthier you and your family gets! Stay Active benefit comes along with the other Uncomplicated Benefits such as Auto restoration of sum insured if utilized during the year, 100% no claim bonus after 2 claim free years and much more! Optima Restore is a plan that: Optima Restore Health Insurance Plan

7. DISCLAIMER › This is only a summary of the product features. The actual benefits available are as described in the policy, and will be subject to the policy terms, conditions and exclusions. Please seek the advice of your insurance advisor if you require any further information or clarification. STATUTORY WARNING › Section 41 of Insurance Act 1938 as amended by Insurance Laws Amendment Act, 2015 (Prohibition of Rebates): No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a Policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurers. Any person making default in complying with the provision of this section shall be liable for a penalty which may extend to 10 lakh rupees. • Family Discount of 10% if 2 or more family members are covered under Optima Restore Individual Sum Insured Plan. (Discount is not applicable on the Critical Advantage Rider premium) • An additional 7.5% discount is offered on the premium if you choose a 2 year policy. DISCOUNTS • We will offer a discount at each renewal if the insured member achieves the average step count target on the mobile application provided by us. In an individual policy, the average step count would be calculated per adult member and in a floater policy it would be an average of all adult members covered. Dependent children covered either in individual or floater plan will not be considered for calculation of average steps. In individual policies the discount percentage (%) would be applied on premium applicable per insured member (Dependent Children are not eligible for this stay active discount in an individual policy) and in a floater policy it would be applied on premium applicable on policy. The discount provided would be as per the table below: Average Step Count Renewal Discount 5000 or below 0% 5001 to 8000 2% 8001 to 10000 5% Above 10000 8% The mobile app must be downloaded within 30 days of the policy risk start date to avail this benefit. The average step count completed by an Insured member would be tracked on this mobile application. We reserve the right to remove or reduce any count of steps if found to be achieved in unfair manner by manipulation. S TAY ACTIVE

4. EVERY STEP COUNTS WALK MORE EARN MORE Basic Sum Insured per Insured Person per Policy Year (Rs. in Lakh) 3.00 5.00 10.00 15.00 20.00, 25.00, 50.00 1a) In-patient Treatment Covered upto sum insured 1b) Pre-Hospitalization Covered upto 60 Days 1c) Post-Hospitalization Covered upto 180 Days 1d) Day Care Procedures All Day Care Treatments Covered 1e) Domiciliary Treatment Covered upto sum insured 1f) Organ Donor Covered upto sum insured 1g) Ambulance Cover Upto Rs. 2,000 / Hospitalisation 1h) Daily Cash for choosing Shared Accommodation Rs.800 / day, Maximum Rs.4,800 Rs.1000 / day, Maximum Rs.6,000 1i) E-Opinion in respect of a Critical Illness One opinion per policy year 1j) Emergency Air Ambulance Cover Not Covered Covered upto Rs. 2.5 Lacs per hospitalization and maximum upto sum insured in an year 2) Restore Benefit Equal to 100% of Basic Sum Insured 3) Multiplier Benefit Bonus of 50% of the Basic Sum Insured for every claim free year, maximum upto 100%.In case of claim, bonus will be reduced by 50% of the basic sum insured. However this reduction will not reduce the Sum Insured below the basic Sum Insured of the policy 4) Health Checkup Not Applicable Upto Rs. 1500 Upto Rs. 2000 Upto Rs. 4000 Upto Rs. 5000 Modern treatment methods: Our customer deserves the best and the latest medical treatment. Now we cover modern treatment methods like robotic surgeries, stem cell therapy, oral chemotherapy etc. Refer Annexure I for modern treatment methods being covered (if taken as in-patient or domiciliary hospitalization or day care treatment basis) Extended coverage We would now be covering treatment of genetic disorders, injury or illness associated with hazardous activities, neurodegenerative disorders like parkinson, alzheimer, peritoneal dialysis. Refer Annexure II for conditions or treatments which will be covered now. Portability Optima Restore offers you easy portability so if you are insured under another Insurer’s health insurance policy you can transfer to HDFC ERGO Health Insurance Limited with all your accrued benefits after due allowances for waiting periods and enjoy all the unbelievable benefits of Optima Restore

8. REACH US HDFC ERGO Health Insurance Ltd. (Formerly known as Apollo Munich Health Insurance Company Limited.) • Central Processing Centre: 2nd & 3rd Floor, iLABS Centre, Plot No. 404- 405, Udyog Vihar, Phase-III, Gurugram-122016, Haryana Corp. Off: 1st Floor, SCF-19, Sector-14, Gurugram-122001, Haryana. Reg. Off: 101, First Floor, Inizio, Cardinal Gracious Road, Chakala, Opposite P & G Plaza, Andheri (East), Mumbai, Maharashtra 400069 India. Tel: +91-124-4584333 Fax: +91-124 - 4 5 8 4111 For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.• Tax laws are subject to change • IRDAI Registration Number - 131 • CIN: U66030MH2006PLC331263 • Optima Restore UIN : APOHLIP20106V051920 • SMS: 'restore' to 56767333 Secured online purchase at: www.hdfcergohealth.com Email: customerservice@hdfcergohealth.com • ARN: HDHI/MY AM/C 2020/025 ANNEXURE I:Modern Treatment Methods covered now S.No Additional Procedures covered 1 Oral chemotherapy 2 Stem cell therapy 3 Deep Brain stimulation 4 Uterine Artery Embolization & HIFU 5 Immunotherapy- Monoclonal Antibody to be given as injection 6 Stereotactic radio surgeries 7 Robotic surgeries 8 Intra vitreal injections 9 Bronchical Thermoplasty 10 Vaporisation of the prostrate (Green laser treatment or holmium laser treatment) 11 IONM - (Intra Operative Monitoring) Neuro 12 Balloon Sinuplasty ANNEXURE II: Conditions and Treatments covered now S.No. Additional treatments/conditions covered 1 Injury or illness due to participation in hazardous activities pursued for adventure purposes 2 Treatment for correction of eye sight due to refractive error beyond +/- 7.5 dioptres 3 Genetic diseases or disorders 4 Neurodegenerative disorders like Parkinson’s, Alzheimer’s 5 Any mental illness, stress or psychological disorders 6 Peritoneal dialysis 7 Expenses related to any admission primarily for enteral feedings 8 Obesity/Weight control treatment (if specified conditions are met) 9 Post Hospitalization expenses for Domiciliary treatment 10 Age Related Macular Degeneration (ARMD) 11 Expenses on Artificial life maintenance (including life support machine use) up to the vegetative state, irrespective of whether such treatment results in recovery of restoration of previous state of health or no t